Home health agencies in the U.S. face a significant challenge with denied claims, especially under Medicare. A denied claim means the payer (like Medicare) refuses payment for services, which can disrupt cash flow and patient care.

An acceptable denial rate in home health is typically around 3% – anything higher signals problems in the billing process. Understanding why home health billing denials occur is the first step in preventing them.

This article examines the top reasons for home health denials (with a focus on Medicare), explains common Medicare denial codes, and offers professional strategies for preventing and appealing denied claims.

Top Reasons for Denied Claims in Home Health

When a home health claim is denied, it’s usually for one (or more) of a few common reasons. Below are the top reasons Medicare home health claims get denied, along with why they happen:

Medicare Eligibility Issues

Medicare has strict eligibility criteria for home health services. If a patient doesn’t meet “homebound” requirements or truly need intermittent skilled care, Medicare will deny the claim.

For example, claims are denied if documentation shows the patient was not actually homebound (e.g. the patient was noted to leave home frequently without considerable effort).

Failing to meet the intermittent care requirement can also trigger denials providing more nursing care hours than Medicare’s limits (generally more than 28–35 hours per week) or attempting daily long-term care without a clear end date violates Medicare’s coverage criteria.

In short, if the services are not medically necessary or the patient isn’t eligible for home health under Medicare’s rules, the claim will be denied. In fact, “skilled nursing services were not medically necessary” is consistently the #1 denial reason found in Medicare reviews

Documentation Errors

Incomplete or incorrect documentation is another major cause of home health denials. Medicare requires a valid physician certification and plan of care for every home health episode. If any required document is missing, unsigned, or invalid, payment will be refused.

In one recent analysis, 20% of denied home health claims were because the initial physician certification or plan of care was missing, incomplete, or invalid, causing the subsequent episode to be denied

Common documentation errors include:

1- A plan of care with no physician signature

2- signatures without dates,

3- Other omissions in required forms.

Even a seemingly minor paperwork detail can lead to denial. for instance, if the physician’s signature is not dated or is illegible, the certification is considered untimely/invalid and Medicare will deny the claim.

Home health agencies must ensure all documentation (orders, certifications, visit notes, etc.) is thorough, accurate, and meets Medicare’s requirements to avoid these denials.

Face-to-Face Encounter Issues

Face-to-face (F2F) encounter documentation is a notorious trouble spot in home health billing. It’s no secret that face-to-face documentation is one of the top reasons Medicare denies home health claims

Medicare requires that a qualified provider (usually the certifying physician or certain non-physician practitioners) meet the patient in person and document the encounter related to the need for home health.

This encounter must occur within 90 days before the start of care or 30 days after. If the F2F encounter isn’t properly documented and timed, the home health claim will be denied as an invalid certification.

Common F2F errors include failing to obtain any face-to-face note, obtaining it outside the required timeframe, or having an unrelated encounter note. Medicare will flag the claim because “the physician certification was invalid since the required face-to-face encounter was missing/incomplete/untimely.”

In many cases, agencies mistakenly submit only a F2F attestation form without the actual clinical progress note from the encounter, which is not sufficient and leads to denial. To avoid F2F-related denials, home health providers must ensure a timely, relevant face-to-face visit is performed and that the detailed encounter note (not just a form) is included in the documentation.

Incorrect Coding (CPT/HCPCS Errors)

Using the wrong billing codes or data on a claim is another frequent reason for denials or rejections. Every home health claim must have codes (diagnosis codes, procedure codes, etc.) that accurately reflect the patient’s condition and the services provided. Incorrect coding.

For example, if the diagnosis code on the claim doesn’t match the patient’s medical record, or if an invalid HCPCS/CPT code is used, can cause the claim to be rejected by the Medicare claims system or denied upon review.

Coding errors include mismatches in procedure codes, omitted modifiers, or the use of codes that are not covered for home health services. In home health, this might involve the HIPPS code or revenue codes derived from OASIS and diagnosis data.

Coding mistakes often result in automatic claim rejections (which prevent the claim from processing) or denials for medical necessity if the codes don’t align with coverage criteria. The bottom line: accuracy in coding is vital.

Timely Filing Issues

Medicare (and other payers) enforce strict, timely filing deadlines. If a home health claim is submitted late, beyond the allowed time window, it will be automatically denied, regardless of how valid the services were.

Medicare’s rule is that home health claims must be submitted within 12 months (1 calendar year) of the date of service. For example, if you provided care starting July 1, 2024, the claim needs to reach Medicare by July 1, 2025.

Missing this deadline results in an irreversible denial (unless a very limited exception applies). Many other insurers have even shorter deadlines (90 or 180 days). In practice, agencies sometimes miss filing deadlines due to internal delays or if a claim was returned for corrections and not resubmitted in time.

Late submissions are a preventable cause of lost revenue. One industry study found roughly 7% of claims get denied for timely filing lapses across healthcare.

In Medicare’s case, any claim filed after the one-year mark will be denied with no payment made. Home health providers must track billing dates closely (and also ensure required prior submissions like the Notice of Admission are timely) to avoid this pitfall.

Medicare Denial Codes and What They Mean

When Medicare denies a home health claim, it assigns a specific denial reason code that appears on the remittance advice or review letter. These codes can look like combinations of numbers and letters (e.g. 5HC01, 5FF2F, 56900, etc.), and each corresponds to a particular reason that the claim was not payable.

Knowing the common Medicare denial codes is helpful for agencies to interpret denial notices quickly and take appropriate action. Below are some of the frequent home health Medicare denial codes and their meanings:

-

5HN18 – “Skilled nursing services were not medically necessary.” This code indicates Medicare believes the patient did not need the skilled nursing care provided (i.e. services fell outside the medical necessity criteria). It often relates to cases where documentation failed to support the need for skilled nursing or the patient’s condition didn’t warrant it.

-

5HC09 – “The initial certification was missing/incomplete/invalid; therefore, the recertification episode is denied.” This code means that a required physician certification or plan of care for the start of care was not properly in place, so a subsequent episode (recertification period) isn’t payable. Essentially, if the foundational paperwork for the first episode is invalid, Medicare will deny payment for later episodes.

-

5HC01 – “The physician certification was invalid since the required face-to-face encounter was missing/incomplete/untimely.” This code (or in some Medicare regions, a similar code 5FF2F for face-to-face) points to a face-to-face encounter issue. It means the claim was denied because the mandated face-to-face visit with the patient either didn’t happen within the allowed timeframe, wasn’t documented properly, or wasn’t done by an eligible provider. When you see 5HC01 or 5FF2F, it’s a F2F documentation failure.

-

5HY01 – This code indicates “the documentation submitted did not show that the therapy services were reasonable and necessary and at a level of complexity requiring a therapist. In other words, Medicare denied the claim because it determined that therapy visits (physical, occupational, or speech therapy) were not justified by the patient’s condition or could have been performed by non-therapist caregivers. This is a medical necessity denial for therapy services.

-

56900 – This code means “requested medical records were not received within the 45-day time limit; unable to determine medical necessity… claim denied.”. Medicare (or a Medicare reviewer) had asked the agency for additional documentation (an Additional Documentation Request, ADR) to review the claim, but the agency did not submit the records in time. As a result, the claim gets denied by default. The instruction for 56900 denials is usually to send the medical records (if still within 120 days of the denial) rather than resubmitting the claim.

These are just a few examples of Medicare home health denial codes. Medicare Administrative Contractors (MACs) publish full lists of denial reason codes and their definitions.

By understanding codes like these, agencies can quickly grasp why a claim was denied and address the specific issue (whether it’s a documentation problem, missing paperwork, etc.).

For instance, a 5HC01 denial clearly tells you to fix the face-to-face documentation, whereas a 5HN18 denial signals you need to bolster the medical necessity evidence for nursing care. In short, denial codes are a roadmap to the corrective action needed.

How to Fix or Prevent Home Health Billing Denials

It’s often said that “an ounce of prevention is worth a pound of cure” in medicine. That holds true for home health denials: the best strategy is to prevent denials before they happen, rather than simply reacting to them after the fact. Industry research suggests that up to 90% of claim denials are preventable with the right processes in place.

By focusing on front-end prevention and robust billing practices, home health agencies can dramatically reduce their denial rates. Below are key strategies to fix issues that cause denials and prevent future billing denials:

Conduct Regular Internal Audits and Quality Checks

Implement rigorous internal audits of your billing and documentation processes to ensure accuracy and compliance. Before claims are submitted, they should be reviewed (either by a dedicated team or through a checklist process) to catch errors.

A best practice is to conduct pre-billing audits systematically, verifying that each claim has all required documentation (signed and dated plan of care, face-to-face note, etc.), correct codes, and meets coverage criteria.

This proactive approach helps “catch and reduce errors that could lead to claim denials.” Focus especially on the most common problem areas: eligibility, documentation completeness, and coding.

For example, audit a sample of charts to ensure the homebound status is well documented and the physician’s orders are properly signed. Internal audits can also examine patterns of past denials to identify weak spots.

If you find, say, repeated face-to-face documentation lapses, you can correct that process before more claims are denied. In addition, ensure your intake and insurance verification process is solid. Many denials originate from the intake stage (e.g. wrong insurance information, missing prior authorization).

Verify Medicare eligibility and any secondary insurance details at admission to avoid surprises later. In summary, a culture of “denial prevention rather than just correction” is key.

By thoroughly reviewing claims for errors and omissions prior to submission, agencies can prevent a majority of avoidable denials.

Leverage Billing Software and Pre-Submission Checks

Modern billing software and claim-scrubbing tools are invaluable for denial prevention. Many home health agencies use electronic health record (EHR) systems or billing software that can flag issues before claims go out.

These systems perform automated checks (edits) on claims for common errors – for example, they can catch an invalid ICD-10 diagnosis code, a missing OASIS assessment date, or an expired certification.

Claims scrubbers in particular will “proactively identify errors or discrepancies in claims before submission”, checking for coding accuracy, formatting mistakes, missing info, and other issues.

Implementing such software can stop faulty claims “in their tracks” so they are corrected rather than denied. Ensure your software is up-to-date with the latest Medicare rules (such as any new codes or billing requirements).

Additionally, use system alerts for timely filing for instance, a dashboard that shows approaching deadlines or flags claims that haven’t been sent within the allowable window. Automation can also aid in denial management on the back end: top agencies utilize technology to track and categorize denials in real-time.

This helps quickly identify denial trends (e.g. if multiple claims are denied for the same reason, the system highlights it).

In short, take advantage of technology to reduce human error. By scrubbing claims and utilizing built-in billing edits, agencies can achieve a higher “clean claim” rate, meaning more claims are accepted on the first submission. Fewer errors upfront equals fewer denials down the line.

Invest in Staff Training and Education

Even the best processes and software will falter if staff are not well-trained. Continuous staff training is essential to keep your team compliant with Medicare’s ever-changing rules.

Make sure your billing specialists, coders, and clinicians understand the latest home health regulations (e.g. what the face-to-face note must include, how to document homebound status, new PDGM coding guidelines, etc.).

Regular training on coding and documentation requirements has been shown to reduce errors.

For example, train clinicians on the importance of detailed documentation that supports medical necessity, and train coders on using the correct codes and modifiers for home health services. When guidelines or codes update annually, hold refresher sessions.

Additionally, encourage an internal culture where staff double-check their work and understand the impact of mistakes. Something as simple as a missing physician's signature can cost the agency thousands of dollars, so staff should never view it as just “paperwork.” Emphasize accuracy at every step.

It may help to share denial data with the team: for instance, if more than half of the denied claims get overturned on appeal. It shows the team that thorough documentation could have secured payment in the first place.

Likewise, highlight that nearly 90% of denials are avoidable– a statistic that underscores how much their diligence matters. In summary, well-trained personnel are your first line of defense against denials.

Investing in training (and re-training) will pay off with fewer billing mistakes, fewer denials, and faster reimbursements.

(Another tip: establish a dedicated denial management team or at least a point-person who is responsible for monitoring denials and coordinating appeals. Top-performing denial management services often have a team focused on unpaid claims, which leads to quicker resolution and feedback to fix root causes.

How to Appeal a Denied Claim

Despite best efforts at prevention, some claims will still be denied by Medicare or other payers. The good news is that a denial is not the end of the road home health agencies have the right to appeal Medicare claim denials and often succeed in overturning them (many denied claims that are properly appealed do get paid on review.

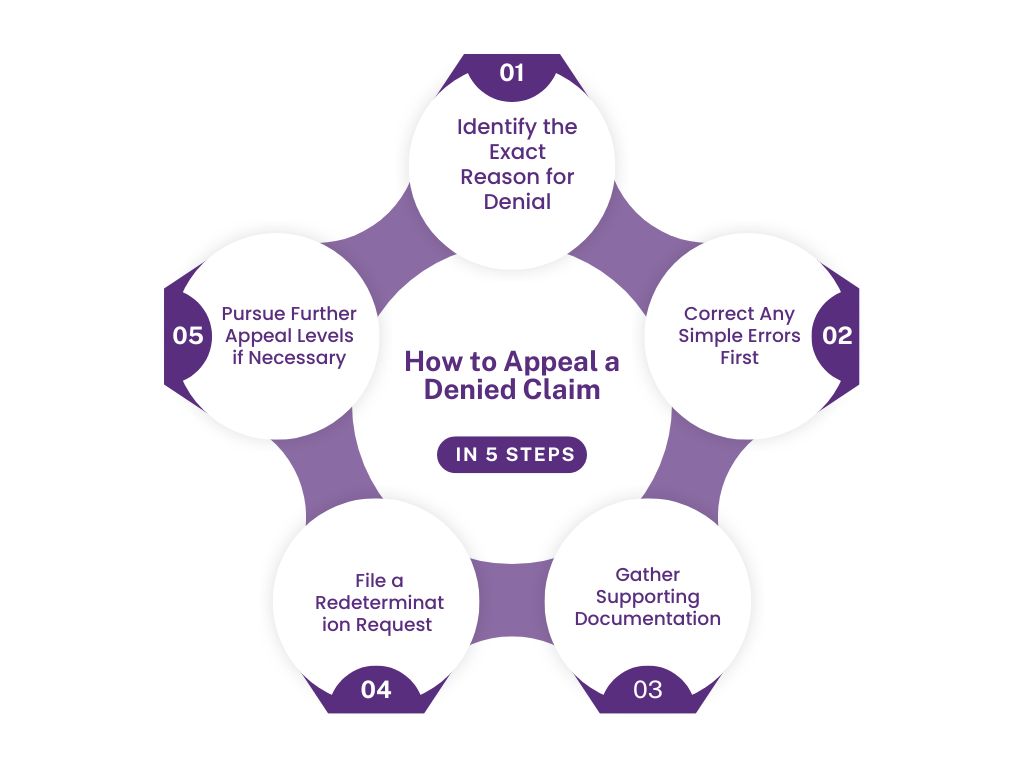

The key is to handle appeals promptly and follow Medicare’s procedures carefully. Here is a step-by-step guide on how to appeal a denied home health claim:

1- Identify the Exact Reason for Denial

As soon as you receive the denial (via remittance advice or a denial letter), determine why the claim was denied. Look at the denial code and description on the Medicare Remittance Advice (or the explanation from the MAC).

Understanding the reason is crucial – for example, was it denied due to being “not medically necessary,” “missing documentation,” or “untimely filing,” etc. Also verify whether it was a true denial or a rejection. (A rejected claim means it never entered the payer’s system due to errors – these usually have to be corrected and resubmitted, not formally appealed.

A denied claim is one that the payer processed but refused to pay.) Knowing this difference will guide your next steps.

Tip: Confusing a rejection with a denial is a common mistake. Remember that rejections require correction/resubmission, whereas denials can be formally appealed.

2- Correct Any Simple Errors First

If your review finds an obvious error that caused the denial (for instance, the claim had a typo in the patient’s ID, or you accidentally billed the wrong payer), correct those errors immediately.

Some denials can be resolved without a formal appeal by fixing the error and resubmitting the claim (this is typically the case for claim rejections or certain correctable denials). However, do not just resubmit a denied claim unchanged. Medicare’s system will likely deny it again as a duplicate. Ensure you address the denial reason.

For example, if the denial was due to missing documentation, gather that document; if due to coding, fix the coding. Medicare has a process called reopening for certain minor errors or omissions on a claim, which you can use within 1 year of the denial to correct the claim without a full appeal in some cases. Check with your MAC when this is applicable. In all other cases, you will proceed to a formal appeal.

3- Gather Supporting Documentation:

Successful appeals depend on evidence. Collect all relevant records to support why the claim should be paid. This may include the patient’s medical records, doctor’s orders, therapy notes, the corrected plan of care, or any document that addresses the denial reason.

For example, if the claim was denied for lack of medical necessity, obtain a detailed physician letter explaining why the care was needed. If it was denied due to a missing face-to-face note, ensure you have the completed face-to-face encounter documentation.

Basically, prepare a packet of information that will demonstrate to Medicare that the service met coverage criteria or that you have corrected the initial problem.

4- File a Redetermination Request (First-Level Appeal):

The first formal appeal in Medicare’s process is called a redetermination. You (the provider) must submit a redetermination request in writing to your Medicare Administrative Contractor (MAC) within 120 days of the date on the denial notice (the Remittance Advice).

It’s best not to wait –sooner is better (and if you want to preserve the option for escalation, you should file within 120 days). Most MACs have a specific form (e.g., CMS-20027) or an online portal for redeterminations, but a letter is also acceptable if it contains all necessary information.

In your appeal request, clearly state the claim details (patient, dates of service, Medicare number, etc.), the denial code/reason, and then provide a concise argument as to why the denial was incorrect. Attach the supporting documentation you gathered.

For example, you might write: “We are requesting a redetermination for claim X denied under code 5HC01 (face-to-face not met). Attached is the physician’s progress note from 2/15/2025 which documents the required face-to-face encounter, meeting Medicare’s criteria.

Therefore, the certification is valid and the claim should be paid.” The more clearly you can demonstrate that you’ve met the rules, the better. The MAC’s redetermination department will review your appeal and usually issue a decision within 60 days. Remember to keep copies of everything you submit and proof of when you sent it.

5- Pursue Further Appeal Levels if Necessary:

If the redetermination decision comes back unfavorably (i.e. the MAC upholds the denial) and you firmly believe the claim is payable, you can escalate the appeal. Medicare offers a total of five levels of appeal.

The second level is a Reconsideration by a Qualified Independent Contractor (QIC). You have 180 days from the redetermination decision to request a reconsideration. This involves sending your case to an independent reviewer (QIC), who will essentially resubmit your documentation along with the MAC’s denial notice and any additional evidence or explanation.

The QIC decision typically comes within 60 days. If the QIC also denies the claim, the third level is an Administrative Law Judge (ALJ) hearing. You must request an ALJ hearing within 60 days of the QIC denial, and the contested amount must be at least a set threshold ($190 in 2025.

In an ALJ hearing, you can present your case (often via phone or video) to a judge who will independently evaluate the facts. If that fails, the fourth level is the Medicare Appeals Council, and the fifth level is judicial review in federal court (for high-dollar cases).

Most home health claim disputes are resolved before reaching these last stages. In fact, many are resolved at reconsideration or ALJ if you have a strong case. Each level has its own rules and deadlines, so be sure to follow the instructions given in the decision letters. Throughout the process, continue to compile evidence and clearly explain how the claim meets Medicare criteria. It can be time-consuming, but given that a significant portion of appealed claims are eventually overturned in favor of providers, the effort can yield reimbursement.

6- Follow Up and Track Your Appeals:

Once you’ve filed an appeal, mark your calendar and keep an eye out for the response. If you don’t hear back within the expected timeframe (e.g., 60 days for a redetermination), you can contact the MAC to check status.

Always document communications and retain copies of any additional info you send. It’s wise to maintain a denials/appeals log for your agency, so nothing falls through the cracks. This log should include the date you appealed, the level, the amount at stake, and the outcome.

Effective denial management means being persistent if new information or clarification is requested by reviewers, respond promptly.

By following these steps, home health agencies can maximize their chances of success when appealing denials. Remember that denial appeals require diligence: meet the deadlines, present a compelling case with evidence, and don’t be afraid to escalate if you genuinely believe Medicare’s denial is mistaken.

As Medicare’s own guidance notes, a redetermination is essentially asking the MAC to take a second look with all the facts; it’s your opportunity to show why the claim does meet the rules.

Many agencies find that with well-prepared appeals, they can recoup payment even for initially denied claims, converting lost revenue back into cash flow.

Conclusion

Denied claims in home health can have serious repercussions, from lost revenue and cash flow problems to additional administrative workload and even compliance risks. However, as we’ve discussed, there are clear ways to minimize and manage home health denials.

By understanding the top denial reasons (including Medicare eligibility, documentation, face-to-face requirements, coding, and timely filing issues) and addressing them proactively, agencies can avoid many pitfalls that lead to denials.

Equally important is having a robust plan for denial follow-up and appeals. When Medicare does deny a claim, don’t view it as the final word – it’s often just the start of a structured process to demonstrate compliance.

Home health agencies do not have to navigate these challenges alone. If your organization is struggling with frequent denials or complex Medicare billing requirements, consider reaching out for professional home health care billing services. Engaging an expert in home health billing or a revenue cycle consultant can provide an objective audit of your processes and pinpoint areas for improvement.

ABOUT AUTHOR

John Wick

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.