You send off a patient's claim to their insurance company, expecting everything to go smoothly. They review it, and soon enough, you get paid. Simple, right?

If only it were that straightforward! Any experienced medical biller knows there's a lot more happening behind the scenes. It's not just about submitting a claim—it's about understanding the ins and outs of the claim adjudication process. The little details can make a big difference in whether you get paid promptly or face delays. Let's explore what really happens after you submit that claim.

What is Claim Adjudication?

Claim adjudication is the insurance company's review process for the claims you submit. When you send in a claim for services provided to a patient, the insurer doesn't just automatically pay it. Instead, they take a close look to decide whether to approve it, deny it, or request more information.

Think of it like this: the insurance company is double-checking that everything adds up. They're confirming that the patient's policy covers the services, that the claim was filed correctly, and that all the necessary details are included. This process ensures that payments are accurate and fair for everyone involved.

What Are the Three Types of Claims Adjudication in Medical Billing?

When you submit a claim to an insurance payer, it goes through the adjudication process, which determines how—or if—the claim will be paid. Understanding the three main types of claim adjudication outcomes can help you better navigate this process:

1- Approved Claims

This is the best-case scenario. The insurance company reviews your claim and decides to pay it in full according to the patient's policy benefits. This happens when:

-

All the information on the claim is accurate and complete.

-

The services provided are covered under the patient's insurance plan.

-

There are no discrepancies or red flags that require further investigation.

2- Denied Claims

A denied claim means the insurance payer has decided not to pay for the services billed. Common reasons for denial include:

-

Incorrect or incomplete information (like wrong patient details or coding errors).

-

Services not covered under the patient's insurance plan.

-

Lack of necessary pre-authorizations or referrals.

3- Adjusted or Partially Paid Claims

In some cases, the insurance company may agree to pay the claim but not the full amount you billed. Reasons for adjustments can include:

-

Patient's deductible or co-insurance amounts.

-

Services that exceed usual and customary fee limits.

-

Contractual agreements that reduce payment rates.

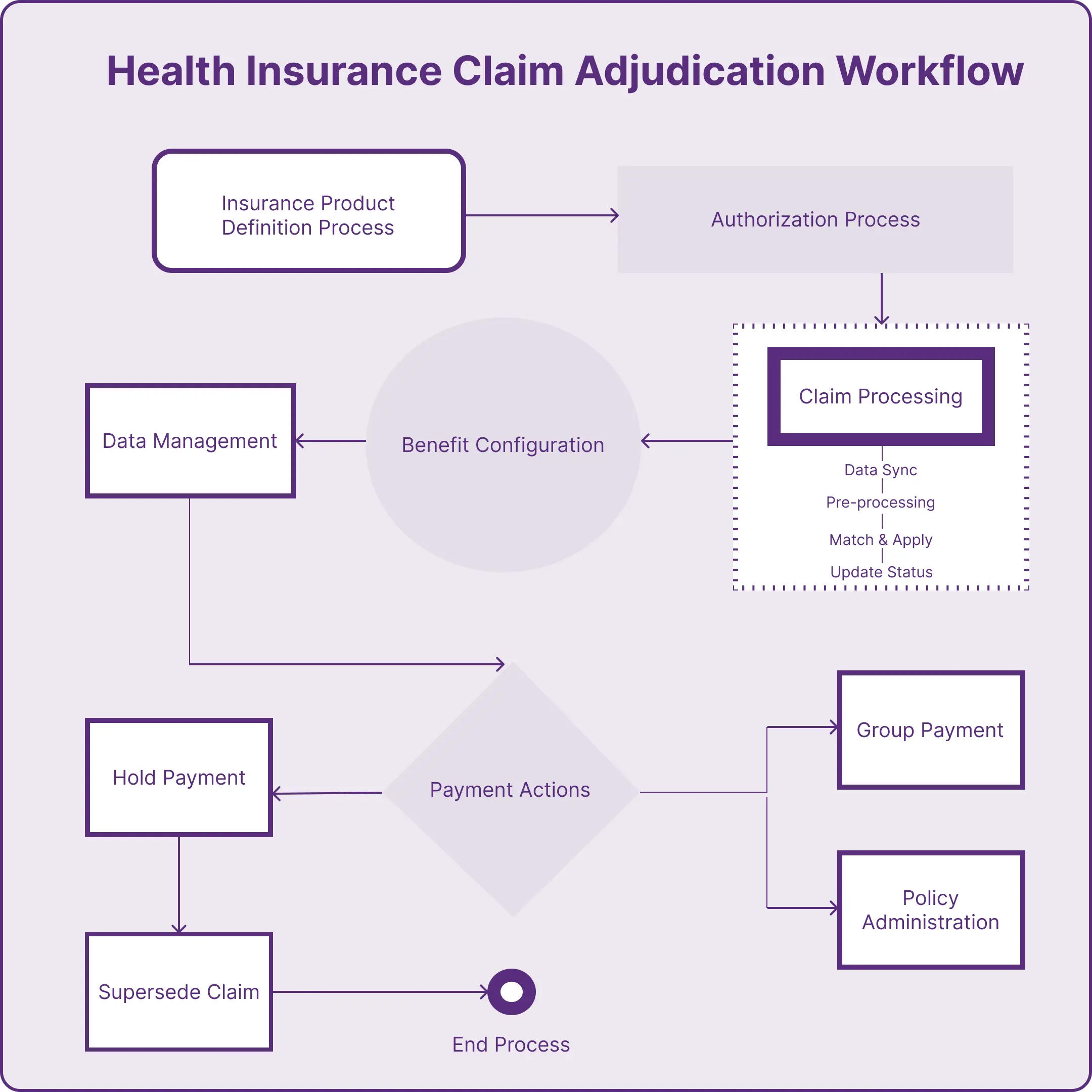

Claim Adjudication Process

Now, let's uncover the science behind the claim adjudication process. To make it easy, we'll walk through the steps that most insurance companies follow when processing a claim.

Step 1: Initial Processing Review

The first checkpoint is the initial processing review. Surprisingly, many claims get denied right here due to simple errors or missing information. During this step, the insurance payer verifies basic details such as:

-

Patient's Name: Is it spelled correctly and does it match their records?

-

Subscriber Identification Number: Is the ID accurate and valid?

-

Service Codes: Are the procedure codes correct?

-

Dates of Service: Do the dates match the time the services were provided?

-

Diagnosis Codes: Are the diagnosis codes accurate and relevant?

-

Patient's Gender: Does it match the information on file?

If any of these elements are incorrect or incomplete, the claim gets sent back with a "denied" status. While you can fix and resubmit denied claims, doing so consumes valuable time and resources. That's why it's crucial to double-check all information before submission.

Step 2: Automated Review

If your claim passes the initial review, it moves on to the automated review. Here, the insurer's system digs a bit deeper to ensure the claim aligns with their policies. They check for:

-

Patient Eligibility: Was the patient covered under the policy on the service date?

-

Pre-certifications or Authorizations: Are they present and valid for the services rendered?

-

Duplicate Claims: Has this claim been submitted before?

-

Timely Filing: Was the claim submitted within the allowed time frame?

-

Valid Codes: Are the diagnosis and procedure codes current and valid?

-

Medical Necessity: Do the services meet the criteria for medical necessity?

Failing this step can also lead to denials or delays, so it's important to ensure all these aspects are in order.

Step 3: Manual Review

If everything looks good so far, the claim moves to the manual review. This is where a trained claim examiner—and sometimes a nurse or physician—takes a closer look. They may request additional medical records, especially for:

-

Unlisted Procedures: Services that aren't common and require more context.

-

Medical Necessity Confirmation: Ensuring that the services provided were necessary for the patient's health.

This step acts as a safeguard to catch any issues that automated systems might miss.

Step 4: Payment Determination

After the reviews, the insurance company makes a decision on the claim. There are typically three outcomes:

-

Paid: The claim is approved, and you'll receive payment according to the patient's policy benefits.

-

Reduced: The insurer decides the billed service level is higher than necessary and adjusts the payment accordingly—this is often called "downcoding."

-

Denied: The claim is not reimbursable due to specific reasons identified during the review process.

Understanding these outcomes helps you anticipate the next steps and manage your practice's finances effectively.

Step 5: Receiving Payment

Finally, if the claim is approved or adjusted, you'll receive what's known as a Remittance Advice (RA) or Explanation of Payment (EOP). It's not just about the money; this document provides detailed explanations for:

-

Payment Amounts: How much the insurer paid.

-

Reductions or Adjustments: Reasons for any payment reductions.

-

Patient Responsibility: Any amounts the patient needs to cover.

-

Denials or Uncovered Charges: Explanations for services not covered.

Key data points included are:

-

Payer Paid Amount

-

Approved Amount

-

Allowed Amount

-

Patient Responsibility Amount

-

Covered Amount

-

Discount Amount

-

Adjudication Date

These details are crucial for your records and for billing the patient accurately for any remaining balances.

Final Words

While you might not be directly involved in the claim adjudication process, understanding how it works can be incredibly beneficial. Knowing the journey your claims take after submission gives you insights into potential delays or issues that might arise. This knowledge equips you to provide more accurate information upfront, which can help streamline the process and improve the likelihood of timely reimbursements.

ABOUT AUTHOR

John Whick

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.