Did you know the CO 50 denial code ranks as the sixth most frequent reason for Medicare denials? If you've come across this code, you're not alone—it’s a common hurdle in medical billing.

The CO-50 denial indicates that Medicare has determined the service billed as non-covered, which essentially means it's not considered medically necessary for the patient’s treatment under their current coverage.

In this post, we'll dive into the specifics of the CO 50 denial code—what triggers it, how to respond when it appears, and strategies to minimize its impact on your billing cycle.

By understanding the nuances of this denial, you can take proactive steps to reduce its occurrence and keep your revenue cycle on track. Let’s look closer at how you can stay ahead of the CO 50 denial and ensure your claims don’t fall through the cracks.

What Does Medical Necessity Mean in CO 50 Denial Code?

In the context of the CO 50 denial code, medical necessity refers to whether a healthcare service, procedure, or treatment is deemed essential and appropriate for diagnosing or treating a patient’s medical condition, according to Medicare guidelines. When a service is considered medically necessary, it means that the care provided aligns with accepted medical standards for the patient’s diagnosis, illness, or injury.

For a claim to be approved under Medicare, the service must meet specific criteria that justify its need for the patient’s health condition. If Medicare determines that the service does not meet their standards for medical necessity, it issues the CO 50 denial code, indicating that the service is non-covered under the patient's plan. This could occur for several reasons, including:

-

The service being routine or preventive when Medicare only covers treatments for acute or diagnosed conditions.

-

The procedure being experimental or not widely accepted in the medical community.

-

The service falling outside th

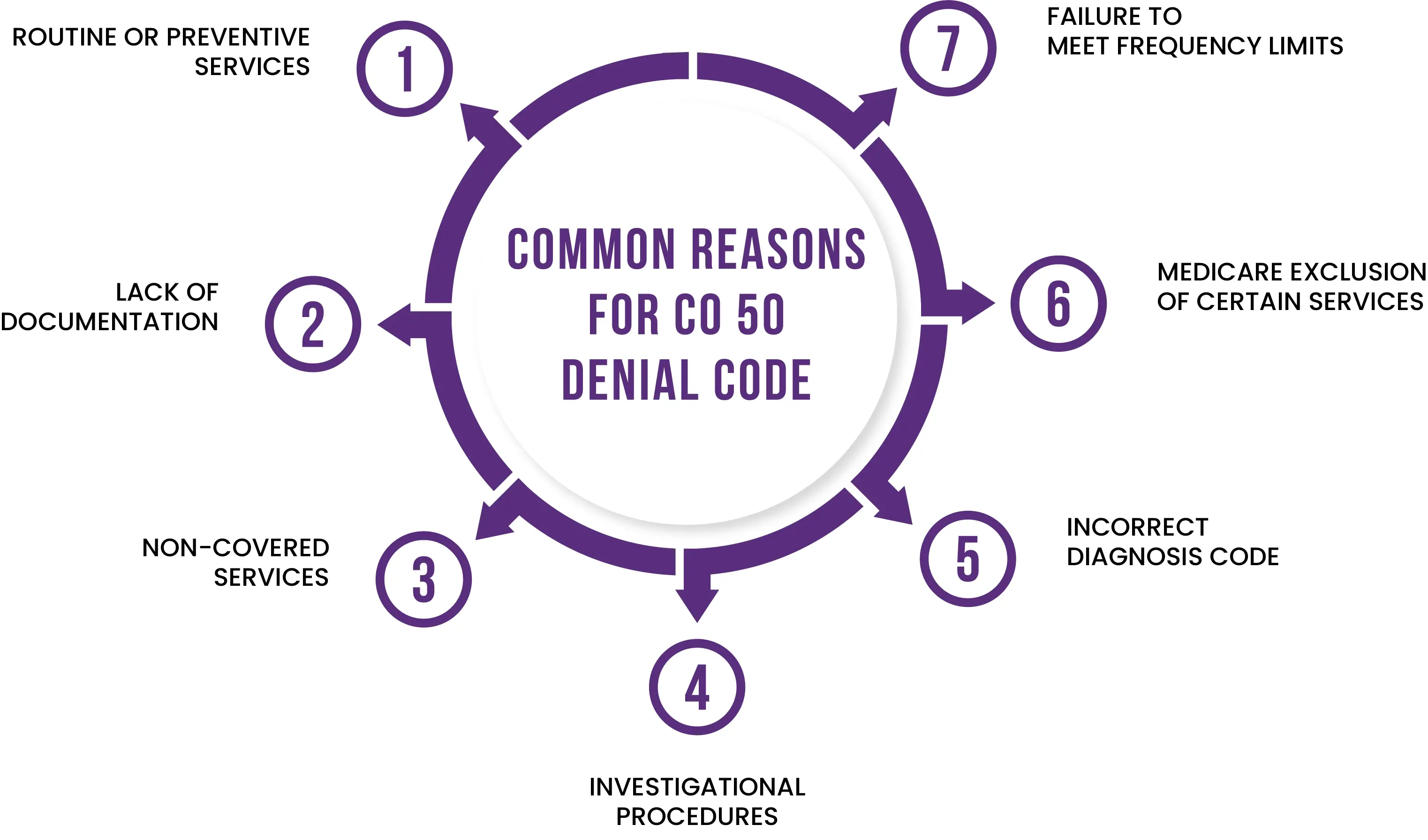

Common Reasons for CO 50 Denial Code

There are several common reasons for receiving a CO 50 denial code. Each of these causes stems from Medicare’s determination that the service billed is non-covered, often linked to questions around medical necessity.

1. Routine or Preventive Services

Medicare typically covers services that are deemed necessary for the diagnosis or treatment of an illness or injury. Routine or preventive care—such as annual check-ups, screenings, or certain vaccinations—may not be covered unless they are explicitly listed under Medicare’s preventive services.

2. Lack of Documentation Supporting Medical Necessity

One of the most common reasons for this denial is the failure to provide sufficient documentation to support the medical necessity of the service. Even if a service is medically necessary from the provider's perspective, Medicare requires detailed documentation to justify the claim.

3. Non-Covered Services

Some services are simply not covered by Medicare, regardless of their necessity for the patient. These may include cosmetic procedures, experimental treatments, or certain elective surgeries. Billing for services outside the Medicare coverage guidelines will result in a CO 50 denial.

4. Experimental or Investigational Procedures

Medicare does not cover procedures or treatments that are considered experimental or investigational. These services may not be widely accepted within the medical community or may not have sufficient evidence to support their efficacy.

5. Incorrect Diagnosis Code

Using an incorrect or unspecific diagnosis code can trigger a CO 50 denial. If the diagnosis code submitted with the claim does not clearly demonstrate the medical necessity of the service, Medicare may deny it as non-covered.

6. Medicare Exclusion of Certain Services

Certain services are explicitly excluded from Medicare coverage, such as routine dental care, hearing aids, and eye exams for glasses. Submitting claims for these types of services will result in a CO 50 denial since they are not part of Medicare's covered benefits.

7. Failure to Meet Frequency Limits

Medicare often imposes limits on the frequency of certain services. For example, Medicare may only cover specific tests or screenings once every 12 months. If a provider bills for a service more frequently than allowed, Medicare may deny the claim under CO 50, indicating that the service is not necessary based on the timing of the previous service.

What Should Be Action Plan to Get Over this Denial Code?

To overcome the CO 50 denial code, it's essential to have a structured action plan in place. Here’s an effective step-by-step approach to handle and resolve this denial:

Check the Remittance Advice

-

If the remittance advice includes the MA130 message, this indicates that there was missing information that needs to be corrected before the claim can be processed. In such cases, correct the claim and rebill it to Medicare.

Submit a Redetermination Request

A redetermination request should be submitted. This process involves appealing the denial with all the necessary supporting documentation. Ensure that you:

-

Include complete and relevant medical records.

-

Attach any additional evidence that supports the medical necessity of the service provided.

Review Local Coverage Determinations (LCD) and Policy Articles

-

Before submitting a Redetermination, carefully review the applicable Local Coverage Determinations (LCDs), LCD policy articles, and documentation checklists. These resources will help ensure that the services being billed meet Medicare’s coverage guidelines. Aligning your documentation with these policies can strengthen your appeal and increase the likelihood of claim approval.

Submit Complete Documentation

-

When submitting your Redetermination request, ensure that all supporting documentation is included. This should fully demonstrate that the service provided was medically necessary and falls within Medicare’s coverage criteria.

Strategies to Avoid Medicare CO 50 Denial Code

To minimize the risk of Medicare CO 50 denials, implementing proactive strategies is essential. Here are some key strategies to help avoid these denials:

1. Verify Coverage and Eligibility Before Service

-

Always check the patient’s Medicare coverage and eligibility before providing services. This includes verifying that the service you are billing for is covered under the patient’s Medicare plan. Regular eligibility checks can prevent submitting claims for non-covered services.

2. Ensure Medical Necessity Documentation

-

Clearly document the medical necessity of each service provided. Medicare requires thorough documentation to justify why a service is needed. Ensure that clinical notes, patient history, diagnosis, and treatment rationale are all properly recorded to support the claim.

3. Review and Follow Local Coverage Determinations (LCDs)

-

Familiarize yourself with the Local Coverage Determinations (LCDs) and National Coverage Determinations (NCDs) for the services you provide. LCDs outline the specific conditions under which Medicare will cover a service. By ensuring your services meet these requirements, you can reduce the chance of a CO 50 denial.

4. Use Correct Diagnosis and Procedure Codes

-

One of the most common causes of CO 50 denials is incorrect or incomplete coding. Make sure you use precise and up-to-date ICD-10, CPT, and HCPCS codes that align with the diagnosis and treatment. Incorrect codes can cause Medicare to consider the service unnecessary and deny the claim.

5. Educate and Train Billing Staff

-

Ensure that your billing and coding staff are well-trained and up-to-date on Medicare guidelines and coding practices. Regular training sessions can help them stay current with changes in regulations, preventing common errors that lead to denials.

6. Pre-Authorization and Prior Approval

-

For certain procedures or services that may be considered high-risk for denial, it’s important to seek pre-authorization from Medicare when applicable. Obtaining prior approval for these services can safeguard against denials and ensure you have the necessary documentation from the start.

7. Use the Medicare Self-Service Portal

-

Utilize the Noridian Medicare Portal for quick self-service reopenings or adjustments. This tool allows you to fix minor errors, such as incorrect diagnosis codes, without needing to go through the full appeal process. This helps avoid denial altogether in many cases.

8. Implement a Claim Review Process

-

Establish a pre-submission review process for all Medicare claims. Having a designated team or individual review claims for accuracy, documentation, and coding before submission can reduce the likelihood of denials.

9. Communicate With Providers

-

Maintain clear communication between billing staff and healthcare providers to ensure that all necessary documentation and notes are recorded accurately and promptly. Providers must understand the importance of documenting medical necessity to avoid denials.

10. Monitor Denial Trends

-

Regularly review and analyze your denial trends. If CO 50 denials are a recurring issue, identify the root causes and address those specific areas, whether it’s coding errors, lack of documentation, or specific services that frequently result in denials.

Words By Author

In conclusion, CO 50 denials can be a significant challenge for healthcare providers, but with the right strategies, they are manageable. By verifying coverage, documenting medical necessity, using accurate coding, and staying up-to-date on Medicare guidelines, you can greatly reduce the risk of these denials. Remember, proactive steps in your billing process can save you time and improve your cash flow.

If you're looking to streamline your billing operations and minimize CO 50 denials, HMS USA LLC is here to help. Our expert team can take the burden off your shoulders, ensuring accurate billing, denial management, and faster claim approvals. Contact HMS USA LLC today and let us help you optimize your revenue cycle and keep your claims on track!

ABOUT AUTHOR

Khabib Makhachev

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.