Hospice and Medicare coverage is one of those topics that many people don’t think about until they need to, and by then, the questions are overwhelming. “How long will Medicare cover hospice care?” is probably at the top of your list. And let’s face it, when you’re navigating end-of-life care for a loved one, the last thing you want to worry about is deciphering insurance policies.

The truth is, Medicare’s hospice benefits are designed to support families during one of life’s toughest moments—but there’s a catch (or at least it feels that way). You might wonder if Medicare will cover hospice care for as long as your loved one needs it or if there’s a hidden clock ticking down on those benefits. Let’s unravel the confusion together.

How do Hospice Benefits Work For Medicare Beneficiaries?

Hospice benefits under Medicare are designed to provide compassionate, comprehensive care for individuals facing a terminal illness. The goal is to prioritize comfort, dignity, and quality of life, both for the patient and their family.

Eligibility for Hospice Benefits

To qualify for Medicare-covered hospice care, beneficiaries must meet these criteria:

-

Doctor Certification: A physician must certify that the patient has a terminal illness with a life expectancy of six months or less, assuming the illness follows its usual course.

-

Choosing Comfort Care Over Curative Treatment: Hospice focuses on managing symptoms and improving comfort rather than curing the illness. Beneficiaries must agree to forgo curative treatments related to their terminal condition.

-

Medicare Part A Enrollment: Hospice care is covered under Medicare Part A, so the patient must be enrolled.

What Medicare Covers

Medicare’s hospice benefits are extensive and aim to address both medical and emotional needs. Covered services include:

-

Pain Management and Symptom Control: Medications, therapies, and equipment to ensure comfort.

-

Nursing Services: Regular visits from hospice nurses to monitor and manage care.

-

Home Health Aides: Assistance with personal care like bathing and dressing.

-

Social Services: Support from social workers to help navigate emotional and practical concerns.

-

Spiritual Counseling: Chaplain services for patients and families seeking guidance or comfort.

-

Bereavement Support: Counseling for family members for up to 13 months after the patient’s passing.

-

Respite Care: Temporary inpatient care to give family caregivers a break

How Long Will Medicare Pay For Hospice Care

Medicare’s hospice care benefits are structured to provide coverage for as long as it’s medically necessary, without a strict cap on duration—as long as certain conditions are met. Here’s how it works:

Initial Certification Period

Medicare provides hospice coverage starting with an initial certification period of six months (or 90 days + 90 days). To qualify:

-

A physician must certify that the patient has a terminal illness with a life expectancy of six months or less.

-

The patient must agree to receive palliative care, focusing on comfort and symptom management rather than curative treatments.

Unlimited Renewals

If the patient’s condition continues to meet the hospice eligibility criteria, Medicare allows for unlimited 60-day benefit periods after the initial six months. Each new period requires recertification by a hospice doctor or medical director.

Key Factors for Continued Coverage

-

The patient remains terminally ill, as determined by a doctor.

-

Hospice care focuses on comfort rather than cure.

As long as these requirements are met, Medicare will continue to cover hospice care indefinitely.

What Happens if the Patient’s Condition Improves?

If a patient’s condition stabilizes or improves, hospice benefits may no longer be necessary. In this case:

-

The patient can be discharged from hospice.

-

They can re-enter hospice care later if their condition worsens and they meet the criteria again.

What Does Medicare Cover During Hospice?

Under Medicare’s hospice benefit, most costs related to the terminal illness are covered, including:

-

Medical equipment (e.g., wheelchairs, hospital beds)

-

Pain relief and symptom management medications

-

Hospice team services (nursing, counseling, spiritual care)

-

Short-term inpatient care and respite care for family support

Are There Any Time Limits?

There’s no definitive "end date" to hospice coverage as long as the medical team certifies that the patient remains eligible. This means that patients may receive hospice care for months or even years if needed, provided the required documentation is in place.

Phases of Hospice Care and Medicare Coverage

Medicare’s hospice care is structured into different phases based on the patient’s needs, with specific cost coverage and durations for each level. Here's how the care phases align with the cost and coverage details:

1. Routine Home Care

-

Cost Covered:

-

Day 1 to 60: Up to $207 per day.

-

Day 61 and after: Up to $163 per day.

-

-

Days Covered: Ongoing, as long as the patient is certified as eligible.

Routine home care is the foundational level of hospice care, designed for patients who can be managed at home with regular visits from the hospice team. This includes care such as symptom management, personal care assistance, and emotional support.

2. Continuous Home Care

-

Cost Covered: Up to $1,492 per day.

-

Days Covered: Provided during periods of patient crisis, requiring 8 to 24 hours of care per day.

This level of care is for patients experiencing a medical crisis that requires intensive symptom management at home. Medicare covers these services on a short-term basis to stabilize the patient.

3. General Inpatient Care (GIP)

-

Cost Covered: Up to $1,068 per day.

-

Days Covered: Short-term care for managing severe symptoms, typically during periods of patient crisis.

General inpatient care is offered in a hospital, hospice facility, or skilled nursing facility for patients whose symptoms can’t be managed at home. This phase is often used for advanced symptom relief such as complex pain management or breathing difficulties.

4. Inpatient Respite Care for Caregivers

-

Cost Covered: Up to $473 per day.

-

Days Covered: Short periods, typically up to five consecutive days.

Respite care is a temporary inpatient service to give family caregivers a much-needed break while ensuring the patient receives full hospice support. This care is usually provided in a hospice or skilled nursing facility.

How These Costs and Phases Interact

Patients can transition between these levels of care based on their needs. Medicare ensures that coverage aligns with the intensity of care required, so patients receive the right support at every phase. Understanding these coverage limits helps families navigate the financial aspects of hospice care with clarity and confidence.

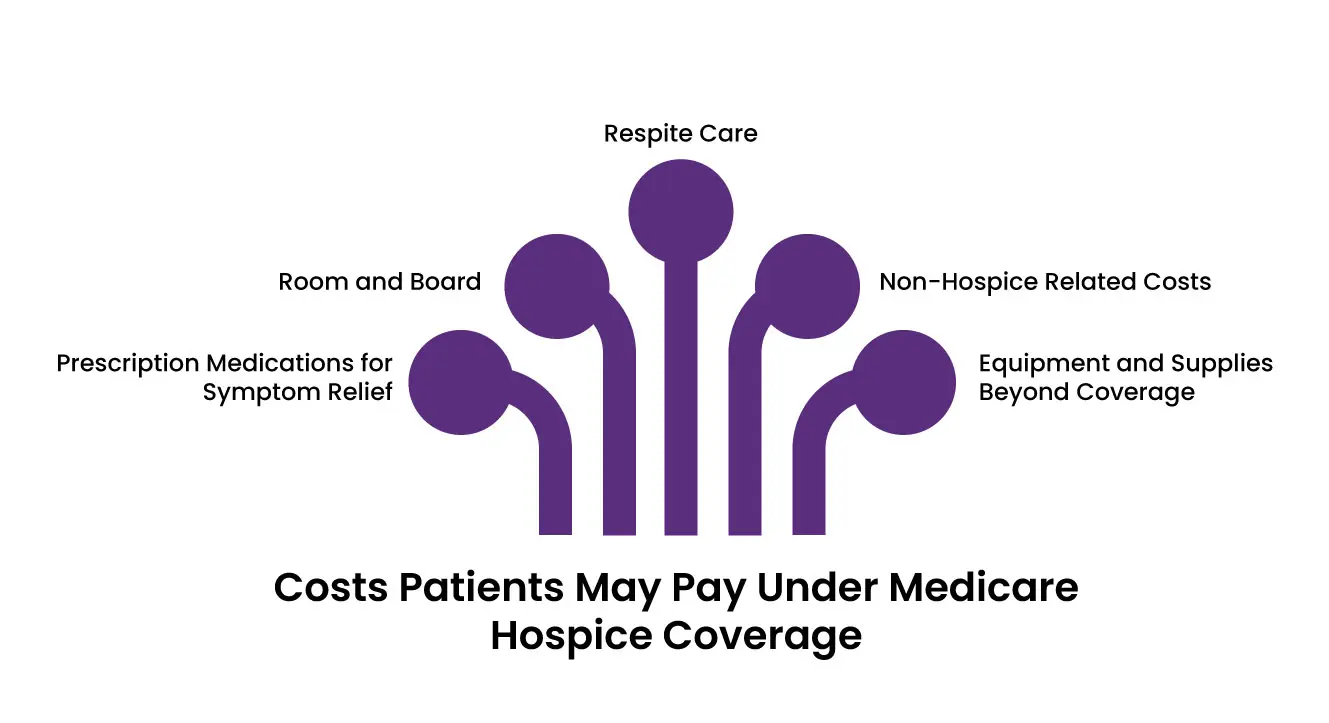

Costs Patients May Pay Under Medicare Hospice Coverage

Prescription Medications for Symptom Relief and Pain Management:

Patients may pay up to $5 per prescription for medications related to their hospice care.

These are typically for medications that alleviate symptoms like pain, nausea, or anxiety.

Room and Board:

Medicare does not cover room and board unless the patient is in an approved inpatient hospice facility or receiving respite care.

If the patient resides in a nursing home or assisted living facility, the family may be responsible for paying room and board fees.

Respite Care:

Families may pay 5% of the Medicare-approved amount for respite care, which is temporary inpatient care designed to give caregivers a break.

For example, if Medicare pays $473 per day for respite care, the patient’s family would owe about $24 per day.

Non-Hospice Related Costs:

Medicare only covers care directly related to the terminal illness. For unrelated treatments, standard Medicare Part A and Part B costs (e.g., deductibles, coinsurance) apply.

For example, if the patient needs treatment for a broken bone that’s unrelated to their terminal condition, those costs would not fall under the hospice benefit.

Equipment and Supplies Beyond Coverage:

While Medicare provides medical equipment like hospital beds and wheelchairs, additional equipment not covered by Medicare may need to be rented or purchased out-of-pocket.

Examples of What Patients Don’t Pay:

-

Hospice team services (nurses, aides, social workers).

-

Counseling (spiritual or emotional support).

-

Medical supplies like bandages or catheters.

-

Durable medical equipment related to the terminal illness (hospital beds, oxygen machines).

-

Bereavement counseling for family members.

Medicaid or Private Insurance Supplementation

For those with Medicaid or private insurance, these programs may cover costs not covered by Medicare, such as room and board in certain facilities. Families should check their specific insurance policies to confirm coverage.

How Long Will Medicare Pay for Palliative Care?

Medicare does not place a strict time limit on palliative care, as it is not tied to a specific duration like hospice care. Instead, Medicare covers palliative care services as long as they are deemed medically necessary and meet the program’s guidelines.

Final Words

When it comes to hospice and palliative care, Medicare is here to give families the peace of mind they deserve. Whether your loved one needs care at home or in a facility, Medicare ensures that they receive the support they need, from symptom management to emotional counseling.

What’s more, these benefits last as long as they’re medically necessary, so you’ll never have to feel rushed or unsupported. With these resources at your disposal, you can focus on providing love and care to your family members while letting Medicare handle the rest.

ABOUT AUTHOR

Pedro Collins

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.