Just imagine you visit a hospital for a medical procedure, carefully choosing an in-network facility to keep your costs manageable. However, weeks later, you’re hit with an unexpected bill for hundreds or even thousands of dollars.

Why? It turns out that while the hospital itself was in-network, one of the specialists who treated you, such as an anesthesiologist or radiologist, was not. This is a classic example of balance billing.

In this guide, we’ll break down the ins and outs of balance billing, from understanding how it works to exploring the legal and ethical considerations surrounding it. Whether you’re a healthcare consumer or a provider, we’ll arm you with the knowledge you need to make informed decisions and avoid surprises.

What is Balance Billing in Healthcare?

Balance billing, also known as surprise billing, occurs when a healthcare provider bills a patient for the difference between what the provider charges for a service and what the patient’s insurance company agrees to pay. This typically happens in situations where the provider is considered out-of-network for the patient’s insurance plan.

When you see an in-network provider, your insurance has a pre-negotiated rate with the provider, and you’re only responsible for co-pays, deductibles, or coinsurance as specified by your plan.

However, if you visit an out-of-network provider, there’s no such agreement. The provider may charge you for the remaining balance after your insurance pays its share. This remaining amount is the balance bill.

Common Scenarios Leading to Balance Billing

Balance billing often happens unintentionally to patients who assume their care is fully covered. Some typical scenarios include:

-

Emergency Care: In emergencies, patients may not have the luxury of choosing an in-network provider or hospital. After the care is provided, they may find out that some—or all—of the services were rendered by out-of-network providers.

-

Specialized Services: Even if you go to an in-network hospital, certain specialists, like anesthesiologists, radiologists, or surgical assistants, might be out-of-network. Their services can result in balanced bills.

-

Ambulance Services: Both air and ground ambulance providers are often out-of-network, leaving patients with hefty balance bills.

Is Balance Billing Legal or Not?

The legality of balance billing depends on several factors, including the type of care provided, the location of the patient, and the specific healthcare laws in place. In some cases, balance billing is prohibited, while in others, it is permitted but subject to certain regulations. Let’s break it down:

When is Balance Billing Legal?

Balance billing is often legal in situations where:

-

Out-of-Network Services: A patient knowingly chooses to receive care from an out-of-network provider. If the provider clearly informs the patient of their out-of-network status and potential costs, balance billing may be permitted.

-

No Legal Protections Exist: In areas or for types of care where no laws explicitly ban balance billing, providers can charge patients the remaining balance after insurance reimbursement.

-

Elective Services: When patients opt for elective or non-emergency procedures with an out-of-network provider, they may be subject to balance billing if they agree to the terms beforehand.

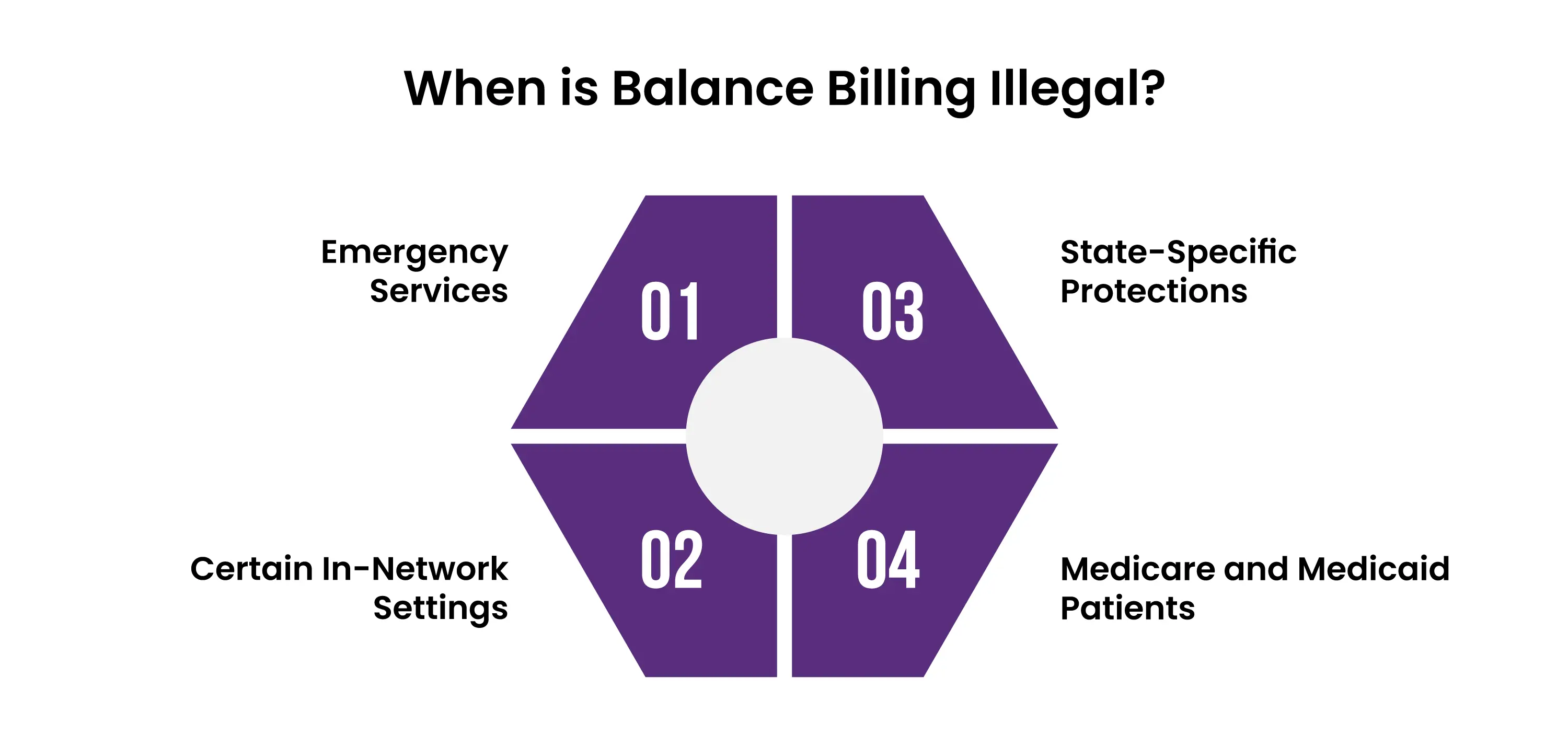

When is Balance Billing Illegal?

Balance billing is illegal in many instances, particularly when legal protections are in place to shield patients from unexpected costs. These include:

Emergency Services:

Under the No Surprises Act in the U.S., providers cannot balance bill patients for emergency care, even if the facility or provider is out-of-network. Emergency care must be billed at in-network rates, as patients have no control over provider selection in such situations.

Certain In-Network Settings:

The No Surprises Act also protects patients from balance billing when they receive care from out-of-network providers at in-network facilities, such as anesthesiologists or radiologists. Patients cannot be charged more than the in-network rate for these services.

State-Specific Protections:

Many U.S. states have enacted laws prohibiting balance billing for specific types of care, like emergency services or when patients have limited provider choices. For example, California and New York have strong consumer protections against balance billing in healthcare.

Medicare and Medicaid Patients:

Providers who accept Medicare or Medicaid are prohibited from balance billing patients. They must accept the reimbursement rates set by these government programs as full payment.

Penalties for Illegal Balance Billing

If a provider engages in illegal balance billing, they can face:

-

Fines and penalties imposed by regulatory authorities.

-

Legal action by patients or consumer protection agencies.

-

Reputational damage and potential exclusion from insurance networks or government programs.

How Patients Can Protect Themselves

To avoid illegal balance billing:

-

Understand Your Rights: Familiarize yourself with federal and state laws, such as the No Surprises Act, and know when balance billing is prohibited.

-

Ask for an Estimate: Before receiving care, ask for a detailed cost estimate and verify whether the provider is in-network.

-

Review Your Bill: Check for errors and unexpected charges. If you believe you’ve been balance billed illegally, report it to your insurance company or a regulatory agency.

State-Level Balance Billing Protections

As of recent years, 33 states have implemented laws providing some level of consumer protection against surprise billing. Among these, 18 states have established comprehensive safeguards that:

-

Extend Protections: Apply to both emergency department services and in-network hospital settings.

-

Broad Applicability: Cover all types of insurance plans, including Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs).

-

Consumer Financial Protection: Hold consumers harmless from costs exceeding their in-network cost-sharing amounts and prohibit providers from balance billing.

-

Dispute Resolution Mechanisms: Establish state-specific standards or processes for resolving payment disputes between providers and insurers.

These comprehensive protections ensure that patients are not financially penalized for receiving out-of-network care in situations beyond their control.

Examples of State Approaches

-

California: Prohibits balance billing for emergency services and requires that patients only pay their in-network cost-sharing amounts.

-

New York: Employs an independent dispute resolution process to settle payment disagreements between providers and insurers, shielding patients from surprise bills.

-

Texas: Enforces a mediation system for certain out-of-network bills, allowing providers and insurers to negotiate payments without involving the patient.

Interaction with Federal Law

The federal No Surprises Act, effective from January 2022, complements state laws by providing baseline protections against surprise billing nationwide. In areas where state laws offer stronger or additional protections, those state laws take precedence. For instance, while the federal law addresses surprise bills from air ambulance services, it does not cover ground ambulance services—an area some states have chosen to regulate independently.

Ongoing Legislative Developments

State legislatures continue to refine and expand balance billing protections. Recent trends include:

-

Expanding Scope: Including protections for additional services, such as ground ambulance transportation.

-

Enhancing Transparency: Mandating that providers offer clear information about network status and potential charges before delivering services.

-

Strengthening Enforcement: Implementing stricter penalties for providers who violate balance billing prohibitions.

For the most current information on state-specific balance billing laws, resources like the National Conference of State Legislatures (NCSL) provide detailed analyses and updates.

Understanding the nuances of both federal and state balance billing laws is crucial for consumers and healthcare providers alike. Staying informed about these regulations can help prevent unexpected medical bills and ensure compliance with current legal standards.

What To Do If You Receive a Surprise Bill?

Receiving an unexpected medical bill, also known as a surprise bill, can be stressful and confusing. However, there are practical steps you can take to address the issue effectively.

1. Understand the Bill

Review the Details: Carefully examine the bill to understand what services were provided and why you were charged. Look for:

-

Provider names

-

Dates of service

-

Itemized charges

Check Your Insurance Explanation of Benefits (EOB): This document explains how your insurance processed the claim. Compare it with the bill to identify discrepancies.

2. Verify Network Status

Confirm Provider Network Status: Determine if the provider or facility was in-network or out-of-network for your insurance plan. If you were treated by an out-of-network provider at an in-network facility, balance billing protections may apply.

Contact Your Insurance Company: Ask for clarification about the charges and whether they align with your coverage.

3. Know Your Rights

Understand Legal Protections: Familiarize yourself with federal laws like the No Surprises Act, which protects patients from balance billing in certain emergency and non-emergency scenarios.

Check State Laws: Some states have additional protections against surprise billing. Research the specific regulations in your state.

4. Dispute the Bill

If you believe the bill is incorrect or unfair:

- Contact the Provider: Call the provider’s billing department and ask for a detailed explanation of the charges. Request corrections if you find errors.

- File a Dispute with Your Insurance: If the charges appear to violate your insurance agreement, initiate a formal dispute process with your insurance company.

- Negotiate the Bill: Providers may be willing to reduce the amount owed or arrange a payment plan if you explain your financial situation.

5. Utilize Dispute Resolution Mechanisms

For bills covered by the No Surprises Act:

Use the Federal Dispute Process: You can initiate the federal independent dispute resolution process to settle disputes between insurers and providers without involving the patient.

State-Level Processes: If your state has its own dispute resolution program, use it to address surprise billing issue

6. Seek Assistance

Contact Consumer Assistance Programs: Many states have programs to help patients navigate surprise bills. They can provide guidance, advocate on your behalf, and help you file complaints.

Consult a Medical Billing Advocate: These professionals specialize in analyzing medical bills and negotiating with providers to reduce costs.

7. File a Complaint if Necessary

If the provider or insurer violates federal or state protections:

Report to Regulatory Authorities: File a complaint with your state’s insurance department or the federal government.

Seek Legal Help: If necessary, consult an attorney specializing in healthcare billing issues.

Words By Author

Dealing with balance billing can be daunting, but knowledge is your greatest tool. By understanding your rights, staying within your insurance network, and confirming coverage for services, you can significantly reduce the risk of unexpected medical bills. Laws like the No Surprises Act are there to protect you, ensuring fairness in situations where you might otherwise feel vulnerable.

For providers, fostering transparency and helping patients navigate these complexities is equally important. Together, patients, providers, and insurers can work toward a healthcare system that prioritizes clarity and financial fairness, leaving surprises only where they belong—out of your medical bills.

ABOUT AUTHOR

Pedro Collins

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.