Healthcare providers handle a massive volume of claims every day, and a surprising number get denied due to errors. These mistakes can range from incorrect diagnosis codes to mismatched patient information. This is where clearinghouses step in to save the day.

Clearinghouses are the unsung heroes of the medical billing world. They act as a vital link between healthcare providers and insurance payers. Their role is crucial in ensuring that claims are submitted correctly and efficiently, reducing the risk of denials and payment delays.

Let's take a closer look at what clearinghouses do and why they're so important for the smooth operation of healthcare billing.

What is a Healthcare Clearinghouse?

Simply put, a clearinghouse is a middleman between healthcare providers (like doctors and hospitals) and insurance companies. They act as a translator, taking the claim information from the provider and converting it into a format that the insurance company understands. But they do much more than just translate:

Error checking: Clearinghouses scrub claims for errors before they're sent to the insurance company, helping to dramatically reduce denials.

Streamlining: They make it easy for providers to send claims electronically to multiple insurance companies at once, saving time and resources.

Status updates: Clearinghouses track claims and provide updates to providers, so they know when a claim is paid or if there are any issues.

How Does A Clearing House In Medical Billing Work?

Providers should make sure that they send claims to a clearinghouse before submitting them directly to insurance companies. This is where the real magic begins. The clearinghouse for medical claims acts as a quality control expert, meticulously reviewing and refining each claim before it reaches the insurance company.

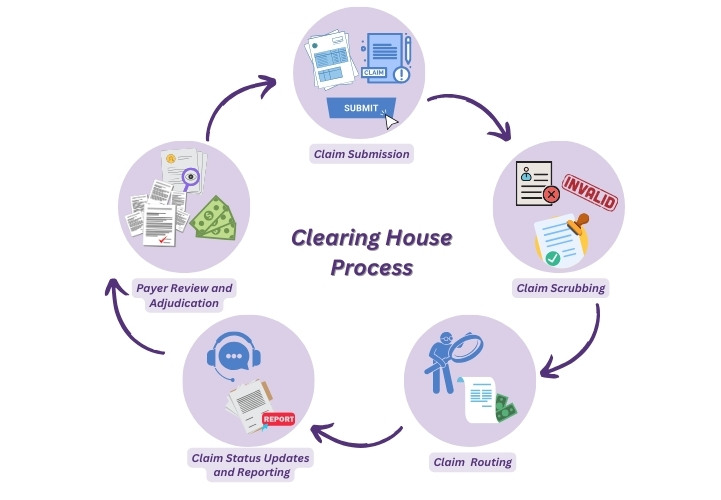

Let's break down the key steps involved in the clearinghouse workflow:

1- Claim Submission

The journey of a claim begins when a healthcare provider delivers services to a patient. This could be anything from a routine check-up to a complex surgical procedure. This claim, often in a standardized format like the ANSI X12 837, contains crucial details such as:

-

Patient demographics: Name, address, date of birth, insurance information

-

Diagnosis codes: The specific medical condition(s) treated

-

Procedure codes: The services performed (e.g., office visit, surgery)

-

Charges: The cost of each service

Instead of sending this claim directly to the insurance company, the provider transmits it electronically to a clearinghouse. This is where the clearinghouse's expertise comes into play.

2- Claim Scrubbing

Once the clearinghouse receives a claim, it doesn't simply forward it to the insurance company. Instead, it performs a crucial step called "claim scrubbing." This is where the clearinghouse meticulously checks the claim for errors and inconsistencies. This could include:

-

Missing or invalid information: Ensuring all required fields are filled out correctly.

-

Incorrect coding: Verifying that diagnosis and procedure codes match the services provided and comply with payer guidelines.

-

Duplicate claims: Identifying and eliminating duplicate submissions.

-

Eligibility verification: Confirming that the patient is covered by the specified insurance plan.

Claim scrubbing is essential because even minor errors can lead to claim denials or delays in payment. By catching and correcting these errors before the claim reaches the insurance company, the clearinghouse greatly increases the chances of a clean claim that gets processed quickly and accurately.

3- Claim Routing

Once a claim is scrubbed and free of errors, the clearinghouse takes on the role of a digital postman. It determines the appropriate insurance payer for the claim based on the patient's insurance information. This involves:

-

Identifying the correct payer: Clearinghouses have extensive databases of insurance companies and their specific requirements. They match the patient's insurance details with the correct payer to ensure the claim is sent to the right destination.

-

Formatting the claim: Each insurance payer might have a slightly different format or electronic data interchange (EDI) standard for claims. The clearinghouse translates the claim into the specific format required by the payer, ensuring seamless processing.

-

Secure transmission: Clearinghouses use secure electronic channels to transmit claims to insurance companies, protecting sensitive patient data from unauthorized access.

By accurately routing the claim to the correct payer in the right format, the clearinghouse expedites the claims process and reduces the risk of rejections due to incorrect submission.

4- Claim Status Updates and Reporting

Clearinghous don't just send off claims and forget about them. They actively track the status of each claim, keeping the healthcare provider informed every step of the way. This includes:

-

Acknowledgement: Notifying the provider that the claim has been received by the payer.

-

Processing updates: Providing status updates on the claim's progress, such as whether it's under review or requires additional information.

-

Payment information: Relaying payment details once the claim is processed, including the amount paid and any adjustments made.

-

Denial management: If a claim is denied, the clearinghouse helps identify the reason for denial and assists the provider in resubmitting the claim with the necessary corrections.

5- Payer Review and Adjudication

Once the insurance company receives the claim from the clearinghouse, it's time for payer review and adjudication. This is where the insurance company assesses the claim to determine coverage and payment.

-

Review of Claim Details: The payer carefully reviews the claim, checking for accuracy and completeness. They verify the patient's eligibility for coverage, ensuring that the services provided are medically necessary and fall within the scope of the patient's insurance plan.

-

Application of Benefits: If the claim meets the criteria, the payer applies the patient's benefits to determine the amount of coverage. This involves calculating deductibles, copayments, and coinsurance amounts, as outlined in the patient's insurance policy.

-

Claim Adjudication: Based on the review and benefits application, the payer makes a decision on the claim. This decision can be one of the following:

-

Payment: The claim is approved, and the payer remits payment to the provider, often through the clearinghouse.

-

Denial: The claim is rejected due to reasons like ineligible services, incorrect coding, or missing information.

-

Partial payment: The claim is partially paid, and the remaining balance may be the patient's responsibility or require further review.

-

This step is crucial as it determines whether the provider receives payment for the services rendered. If there are any issues, the payer will communicate with the clearinghouse, which in turn informs the provider.

Common Reasons for Clearing House Rejection In Medical Billing?

Missing or invalid information: Think of this as a typo on your claim. It could be a misspelled name, incorrect insurance ID, wrong date of service, or missing information like a diagnosis code.

Incorrect coding: This is when the codes used to describe the diagnosis or procedure don't match or are outdated.

Eligibility issues: The patient might not be covered by the insurance plan for the service provided, or their policy might have expired.

Duplicate claims: Sometimes, a claim gets accidentally submitted twice.

Choosing the Right Insurance Clearinghouse

Selecting the right clearinghouse is a crucial decision for healthcare providers, as it can significantly impact your billing efficiency and revenue cycle management. With so many options available, it's important to consider several factors before making your choice.

Key considerations when choosing a clearinghouse:

-

Cost and Pricing Structure: Clearinghouses typically charge either a per-claim fee or a monthly subscription. Evaluate your claim volume and budget to determine which pricing model works best for your practice. Be sure to ask about any additional fees for setup, training, or specific services.

-

Payer Network: Ensure that the clearinghouse has connections to all the insurance payers you work with. A wider payer network means fewer claim rejections due to incorrect routing.

-

Error Detection and Scrubbing Capabilities: Look for a clearinghouse with robust error-checking features. This can include checking for coding errors, missing information, and duplicate claims. A good clearinghouse should help you reduce claim rejections and speed up payment.

-

Customer Support: Reliable customer support is crucial. Choose a clearinghouse that offers responsive customer service, ideally with multiple channels for support (phone, email, online chat). Consider their reputation and track record in providing timely assistance to resolve any issues.

-

Reporting and Analytics: A clearinghouse with comprehensive reporting features can provide valuable insights into your claims processing. Look for features like claim status tracking, rejection analysis, and financial reporting to help you monitor your revenue cycle and identify areas for improvement.

-

Security and Compliance: Ensure that the clearinghouse adheres to HIPAA regulations and implements robust security measures to protect sensitive patient data. This is crucial to maintain patient privacy and comply with industry standards.

-

Technology and Integrations: Consider whether the clearinghouse's technology integrates seamlessly with your existing practice management or electronic health record (EHR) system. This can streamline your workflow and reduce manual data entry.

-

User-Friendliness: The clearinghouse's interface should be intuitive and easy to use. A user-friendly system can save your staff time and reduce frustration.

By carefully evaluating these factors, you can choose a clearinghouse that aligns with your specific needs and helps you optimize your medical billing process.

Why is HMS USA A reliable Option for Clearinghouse Services?

HMS USA stands out as a reliable choice for clearinghouse services for several reasons. First and foremost, their extensive experience in the healthcare industry provides them with a deep understanding of the complex billing landscape. This expertise translates into efficient claim processing and reduced denial rates.

HMS USA's robust technology infrastructure ensures a seamless experience for healthcare providers. Their advanced software is designed to detect and correct errors, streamline claim submission, and provide real-time status updates. This not only saves time and resources but also minimizes the risk of costly delays or rejections.

Furthermore, HMS USA prioritizes security and compliance, adhering to stringent industry standards to safeguard patient data. Their commitment to data integrity ensures that sensitive information remains confidential and protected.

ABOUT AUTHOR

John Wick

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.