Healthcare providers are commonly encountering the CO 24 denial code in their claim submissions to Medicare & Medicaid these days. This denial code represents a contractual obligation adjustment, & it's often used to indicate a rejection of a claim due to specific coverage situations.

While the core objective of healthcare providers is to deliver excellent patient care, the administrative aspect involving insurance claim submissions and reimbursements also plays a vital role in maintaining the operations of a healthcare organization.

Hence, a robust understanding of the intricacies involved with denial codes, including the CO-24 denial code, is essential. This knowledge empowers providers to address these denials effectively and recover the reimbursements they're entitled to, maintaining the sustainability of their practice.

To help providers understand the code, this blog post explains the basics of denial code co-24 and the best way to resolve it. We will get an insight into what CO24 denial is and what are medicare and Medicaid policies for this denial.

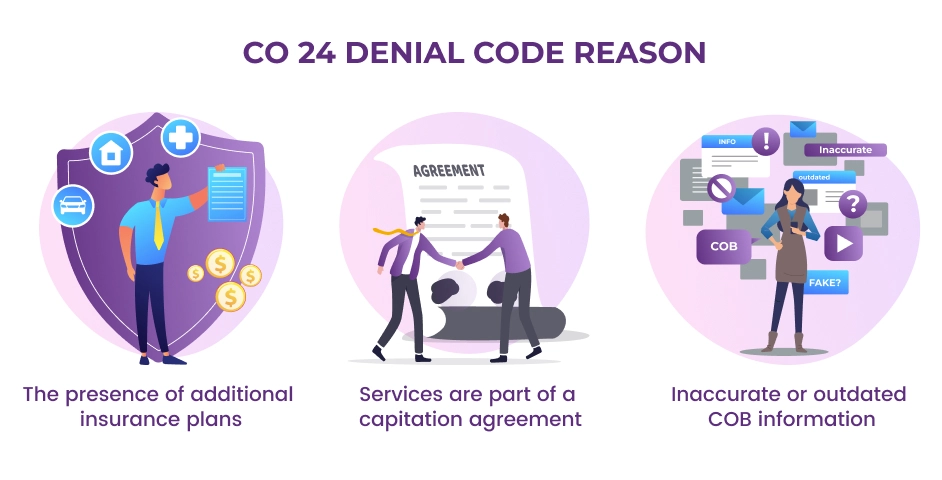

CO 24 Denial Code Reason

C0 24 denial code is also known as charges covered under a Capitation Agreement/Managed Care Plan. Most healthcare providers are unaware of the co 24 denial code reason and often struggle to know the reason behind it.

The clear and foremost CO24 denial code reason is when Medicare records indicate that the provided healthcare services should be billed to a managed care health plan, rather than directly to Medicare. In such instances, Medicare will reject the claim, marking it with the CO 24 denial code.

when a patient has multiple insurance plans, including secondary and tertiary insurance, the CO 24 denial code may appear. This situation underscores the significant role of Coordination of Benefits (COB) in identifying the payer responsible for healthcare expenses.

The most frequently observed reasons behind the CO 24 denial code include:

The presence of additional insurance plans: When a patient is insured with both Medicare or Medicaid and another plan, this can trigger the CO 24 denial code.

Services are part of a capitation agreement: If the services provided fall within the scope of a capitation agreement with another health plan, this can also result in the CO 24 denial.

Inaccurate or outdated COB information: If a patient has not updated their Coordination of Benefits (COB) information with their primary insurance provider, this may cause the CO 24 denial code to be applied to claims.

Understanding these common reasons is pivotal to ensure a smooth billing process. Healthcare providers need to be diligent in gathering and updating patient insurance information, and appropriately coordinating the billing process. This reduces the risk of denials, accelerates the reimbursement cycle, and allows healthcare providers to maintain focus on their primary goal: delivering quality patient care.

CO 24 Denial Code Description

The CO 24 denial code is used to indicate that the claim made has been denied due to the patient's insurance coverage under a capitation agreement or a managed care plan.

A capitation agreement is a contract between a health insurance company or managed care organization (MCO) and a healthcare provider, such as a doctor's office or hospital. Under a capitation agreement, the MCO pays the provider a fixed fee per patient per month, regardless of how many services the patient receives.

In specific circumstances, this denial code occurs when claims are incorrectly submitted. For instance, when a patient is insured under a Medicare Advantage plan (also known as Medicare Part C), and instead of directing the claim to Part C, it is sent to Original Medicare, this results in a CO 24 denial code.

It's important to understand that the CO 24 denial code can apply to a broad range of services provided by healthcare professionals. This includes, but is not limited to, inpatient hospital stays, outpatient care, laboratory tests, and a wide array of other medical services.

CO 24 Medicare Denial

A CO 24 Medicare denial often occurs when there is a discrepancy between the insurance plan under which a healthcare provider bills for services and the actual plan coverage of the patient.

Medicare Advantage plans are an alternative to Original Medicare and are offered by private insurance companies approved by Medicare. These plans often provide all of the coverage of Original Medicare Part A (Hospital Insurance) and Part B (Medical Insurance), and frequently offer additional benefits such as vision, dental, and even prescription drug coverage. When a patient has a Medicare Advantage plan, it essentially replaces their Original Medicare coverage.

One exception to this, however, is hospice care. Even when a patient has a Medicare Advantage plan, Original Medicare will still cover hospice services. Apart from this exception, all other claims for patients with Medicare Advantage plans should be billed to the private insurer that administers the patient's Part C coverage, not to Original Medicare.

If a healthcare provider incorrectly bills Original Medicare for a service that should be billed to a Medicare Advantage plan, this can result in a CO 24 Medicare denial Code. This denial means that the claim was denied because the charges are covered under a capitation agreement or managed care plan - in this case, the Medicare Advantage plan.

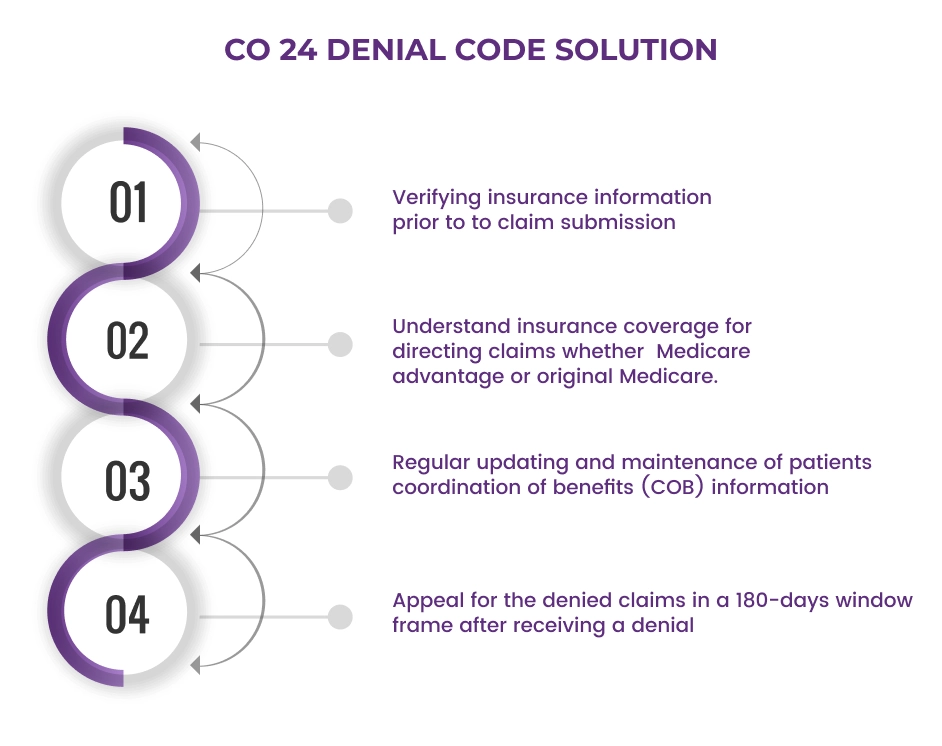

CO 24 Denial Code Solutions

Addressing and resolving the CO 24 denial code can be made easier by following certain crucial steps.

-

Firstly, insurance information must be thoroughly verified prior to claim submission. This involves a careful review of all insurance plans under which a patient is covered. This could include secondary and tertiary insurance, along with Medicare or Medicaid coverage, if applicable.

-

Understanding the specifics of a patient's insurance coverage is also vital. Knowing where to direct the claims, whether it be to a Medicare Advantage plan or Original Medicare, will help avoid denial codes like CO 24.

-

Another key component of the CO 24 denial code solution involves maintaining up-to-date Coordination of Benefits (COB) information. This should be carefully filed with the patient's primary insurance provider, detailing any additional coverage and all members included in the policy.

-

Lastly, it's essential to know the process for appealing denied claims. Providers usually have a 180-day window after receiving a denial to file an appeal, during which they can present additional information to substantiate their original claim. Knowing how to navigate this appeal process can play a critical role in resolving CO 24 denial code issues, ensuring that the healthcare provider can continue to deliver quality patient care without unnecessary financial burdens.

Denial Code and Action

Dealing with denial codes, including the CO 24 denial code, requires a firm grasp of the relevant actions to take in response. The goal is to ensure that healthcare providers can quickly and effectively address these issues, minimizing disruption to the billing process and helping to maintain a steady revenue stream.

Identification: The first action step is identifying the denial code accurately. Understanding what each code, like CO 24, represents, is critical to address the denial.

Verification: Once the denial code has been identified, verify the patient's insurance details. For a CO 24 denial code, you should confirm whether the patient is part of a capitation agreement or a managed care plan, such as a Medicare Advantage plan.

Claim review: It's necessary to review the claim that has been denied. Look for any errors in the claim details or any mismatches with the patient's insurance plan.

Coordination of Benefits (COB): Ensuring that the patient's COB details are accurate and up-to-date is a crucial step. If the patient has multiple insurance plans, the COB information will help determine the payer order.Claim resubmission or appeal: After addressing the issue that led to the denial, the next action would be to resubmit the claim or file an appeal. For appeals, remember that additional documentation may be required to support the claim.

Preventive measures: To prevent future denials, it's important to implement measures such as regular insurance verification and claim audits. Training staff on common denial codes and the correct steps to address them can also be beneficial.

Final Words

In summary, mastering Medicare and Medicaid claim denials, such as the CO 24 code, is key to a healthcare practice’s financial viability. While patient care is the main priority, administrative processes also hold importance. Precise insurance verification, understanding patient coverage, and efficient billing can prevent claim denials. a solid understanding of the denial codes and the respective corrective measures can facilitate swift resolutions.

If you are struggling and feeling confused about what to do when you run into a CO 24 Denial Code it is better to seek help from a professional medical billing company, with our expertise and guidance, we will work with you to minimize CO-24 denials and ensure that your claims are processed accurately.

ABOUT AUTHOR

Paul Demo

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.