As a healthcare providers have you ever felt like you're speaking a different language when it comes to medical billing? Insurance companies seem to have their own set of rules, and sometimes it feels like they're playing a game of 'Denial or No Denial' with your claims.

You submit a claim, only to have it denied for some obscure reason you've never heard of before. One of the most common culprits? The CO 197 denial code. If you're tired of this denial code crashing your party like an uninvited guest, don't worry, you're not the only one who wants to kick it out. Today, we're going to explore why this code is so pesky, and how you can avoid it like a pro.

What is CO 197 Denial Code?

When a healthcare provider submits a claim for a service, the insurance company or payer may require prior authorization or precertification before the service can be provided. If the provider fails to obtain the necessary authorization or notification before providing the service, the claim may be denied with the CO 197 denial code.

What is Pre-Authorization & Why You Need to obtain it?

Pre-authorization, also known as pre-certification, is the process by which a healthcare provider obtains approval from a patient's insurance company or payer before providing a service or procedure. This approval ensures that the service is medically necessary and appropriate for the patient's condition, and that it will be covered by the insurance plan.

Obtaining pre-authorization is essential for healthcare providers because it helps to ensure that claims are reimbursed and that patients receive the care they need. Without pre-authorization, healthcare providers run the risk of having their claims denied or delayed, which can impact their revenue and patient satisfaction.

Pre-authorization requirements can vary depending on the patient's insurance plan and the service being provided. Some insurance plans require pre-authorization for all services, while others only require it for certain procedures or treatments. It's important for healthcare providers to understand the pre-authorization requirements for each patient's insurance plan and to obtain the necessary approvals before providing the service.

How is preauthorization obtained?

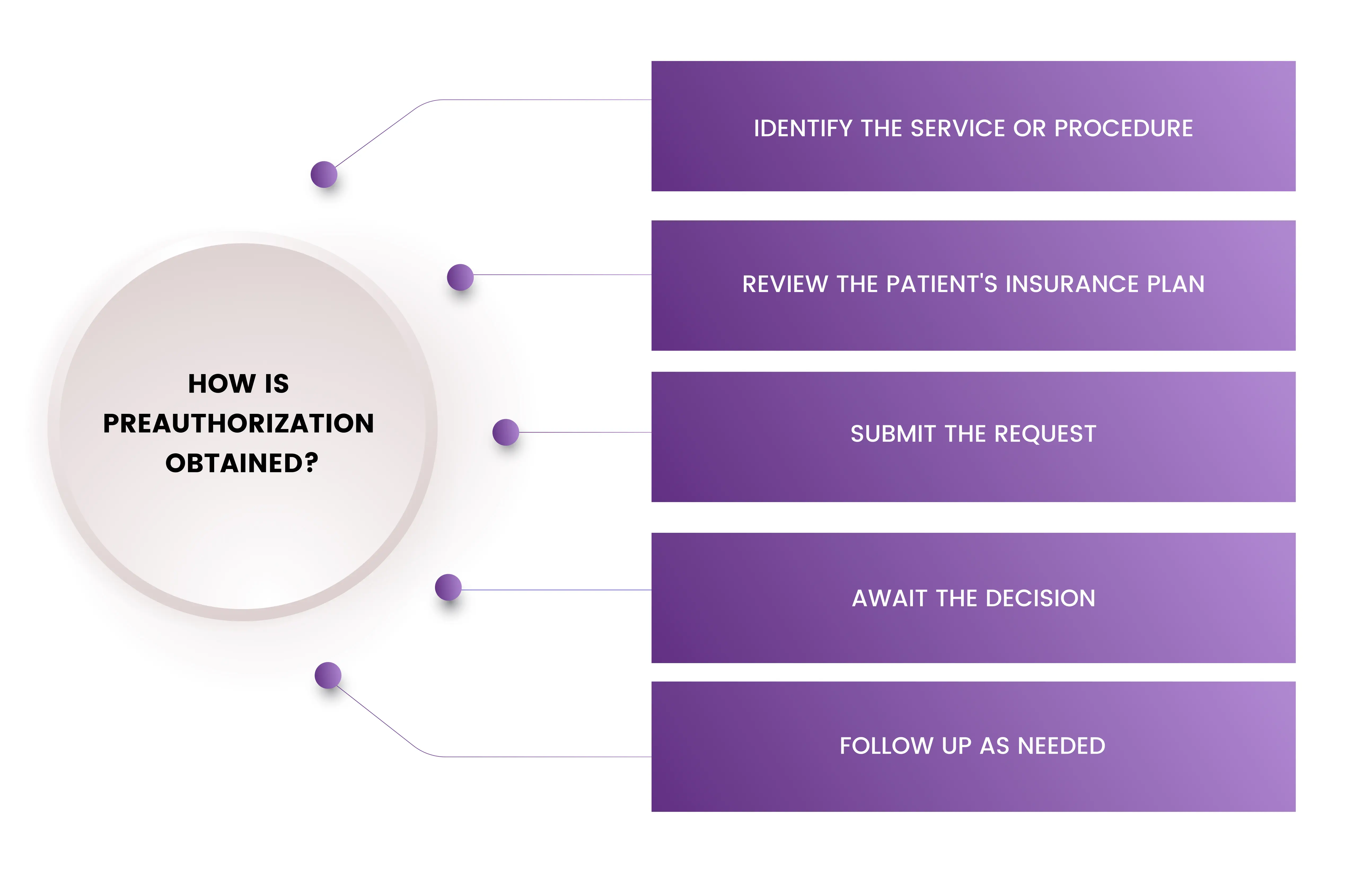

Pre-authorization is typically obtained through the following process:

Identify the service or procedure: The healthcare provider should identify the specific service or procedure that requires pre-authorization.

Review the patient's insurance plan: The healthcare provider should review the patient's insurance plan to determine the pre-authorization requirements for the service or procedure. This information is typically available in the insurance plan's policy documents or on the insurer's website.

Submit the request: The healthcare provider should submit a pre-authorization request to the patient's insurance company or payer. This request should include information about the patient's condition, the proposed service or procedure, and any supporting documentation (such as medical records or test results).

Await the decision: The insurance company or payer will review the pre-authorization request and make a decision. This decision will be communicated to the healthcare provider in writing, and will indicate whether the service or procedure has been approved or denied.

Follow up as needed: If the pre-authorization request is denied, the healthcare provider may need to follow up with the insurance company or payer to provide additional information or to appeal the decision.

Some additional tips to keep in mind when obtaining pre-authorization include:

- Begin the process as early as possible to allow for any necessary follow-up or appeals.

- Ensure that all necessary information is included in the pre-authorization request, including the patient's medical history and any supporting documentation.

- Follow the insurance company or payer's guidelines for submitting pre-authorization requests.

- Keep track of pre-authorization requirements for each patient's insurance plan to avoid denials or delays in the future.

What should a provider do when he gets encountered with a CO 197 denial?

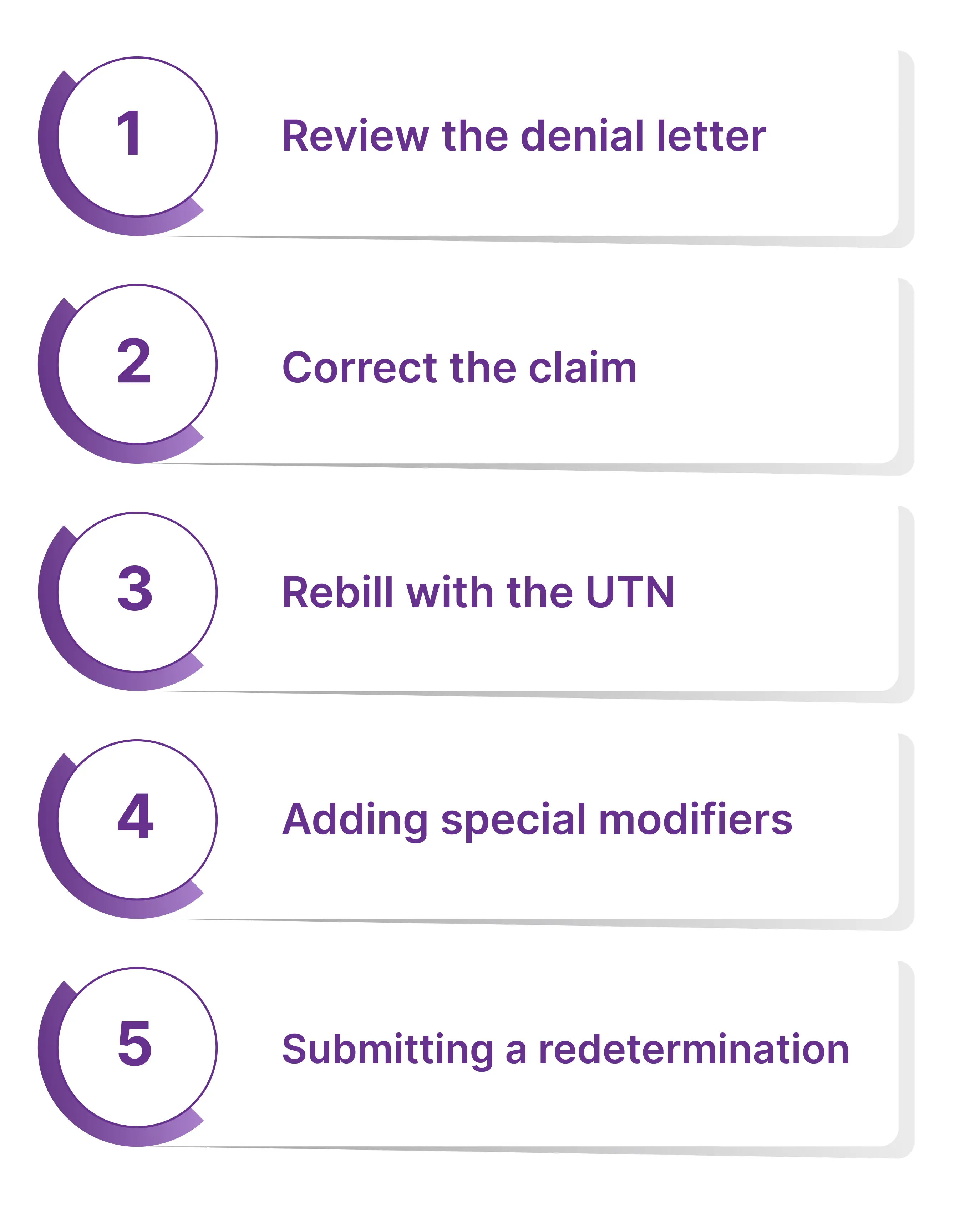

When a provider encounters a CO 197 denial code, it is important to take prompt action to address the issue and resubmit the claim. The following steps can be taken to correct the claim and avoid further delays or denials:

Review the denial letter

Carefully examine the CO 197 denial letter to understand the reason for the denial and any additional documentation or information that may be required to resubmit the claim.

Correct the claim

If there were any errors or omissions in the original claim, make the necessary corrections and resubmit the claim with all the relevant supporting documentation.

Rebill with the UTN

If pre-authorization was obtained and a Unique Tracking Number (UTN) was provided in the affirmative decision letter, be sure to include the UTN in the appropriate field when rebilling the claim. This may include adding the UTN to Item 23 on the CMS-1500 claim form or in the appropriate loop and segment if billing electronically.

Adding special modifiers

In certain cases, when prior authorization is bypassed, insurers may require the addition of special modifiers to the claim. It is important to review the insurer's documentation and modifier requirements to ensure that the correct modifiers are included in the claim.

Submitting a redetermination

If the patient did not meet coverage criteria or a non-affirmative prior authorization was obtained and an Advanced Beneficiary Notice of Noncoverage (ABN) was issued, a redetermination request can be submitted with all relevant supporting documentation. This process ensures that the claim is processed accurately and promptly.

How a Provider can avoid this CO 197 Denial?

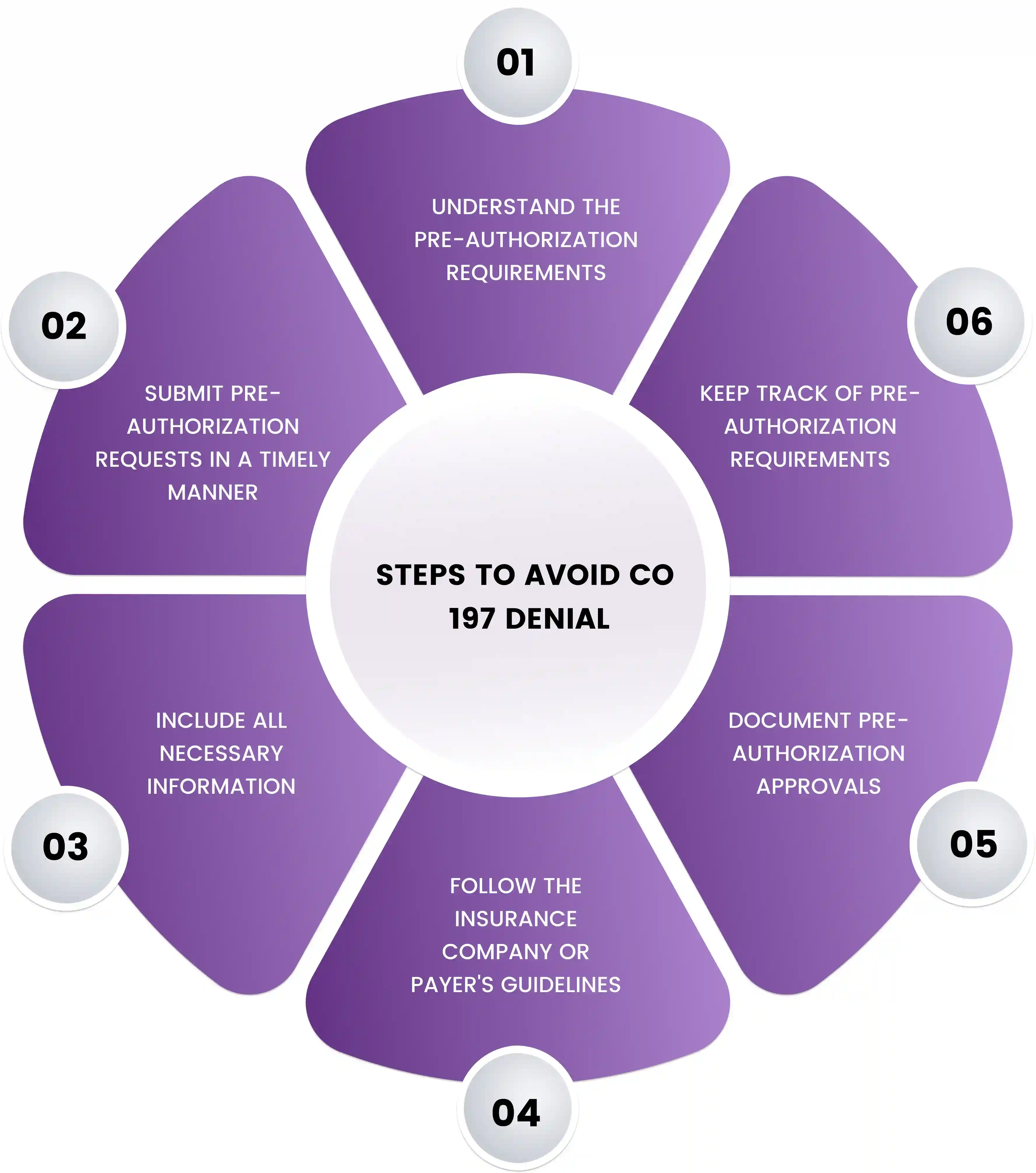

Receiving a CO 197 denial code can be frustrating for healthcare providers, as it can result in delayed or denied reimbursement for services provided to their patients. However, there are steps that providers can take to help avoid this type of denial and ensure that claims are processed and paid in a timely manner.

Understand the pre-authorization requirements: Providers should familiarize themselves with the pre-authorization requirements for each patient's insurance plan. This can typically be found in the insurance plan's policy documents or on the insurer's website.

Submit pre-authorization requests in a timely manner: Providers should submit pre-authorization requests as early as possible to allow for any necessary follow-up or appeals.

Include all necessary information: Providers should ensure that they include all necessary information in the pre-authorization request, such as the patient's medical history, the proposed service or procedure, and any supporting documentation.

Follow the insurance company or payer's guidelines: Providers should follow the insurance company or payer's guidelines for submitting pre-authorization requests. This may include using specific forms or providing certain types of information.

Document pre-authorization approvals: Providers should document pre-authorization approvals in the patient's medical record and ensure that this information is included with the claim.

Keep track of pre-authorization requirements: Providers should keep track of pre-authorization requirements for each patient's insurance plan to avoid denials or delays in the future.

Final Words

In conclusion, navigating the world of medical billing and insurance can be challenging for healthcare providers. The CO 197 denial code can be a common roadblock, but by understanding pre-authorization requirements, submitting requests in a timely manner, and ensuring that all necessary information is included, providers can avoid this pesky denial code.

By taking these steps, healthcare providers can help ensure that their claims are processed and paid in a timely manner, allowing them to focus on providing the best possible care for their patients.

FAQ! Need Help?

The CO197 denial code is a part of the contractual obligation denial ly issued when a provider has not obtained authorization from an insurance carrier before providing services or if there isn’t enough documentation to prove that the services were medically necessary.

You can receive a CO197 denail code due to absence of prior authorization. Additionally, if there is not enough documentation to prove that the services were medically necessary and/or clinically appropriate, you may also receive a CO197 denial code

Yes, is possible to appeal a CO197 denial. You can submit additional documentation that proves the services were medically necessary and clinically appropriate or try to obtain prior authorization for the services in question. Additionally, you can contact the insurance carrier and ask for reconsideration of your claim.

ABOUT AUTHOR

Grant Elliot

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.