When a denial code 19 shows up on a claim, it signals that the insurance company believes the service relates to a workplace injury and should be covered by Worker’s Compensation—not traditional health insurance. This denial isn’t just frustrating; it can slow down your revenue cycle and keep your payment tied up until you address it.

So, what’s the best way to handle it? In this guide, we’ll unpack exactly what the denial code 19 means, why it pops up, and the steps you can take to respond effectively. By the end, you’ll know how to prevent these denials from hitting your claims and ensure smoother, faster payments.

What Does Denial Code 19 Entail?

When a claim comes back with a denial code 19, it means that the insurance company has determined that the billed service or treatment is related to a workplace injury or illness. As a result, they believe the claim should be processed under Worker’s Compensation rather than standard health insurance.

In simpler terms, the denial code 19 isn’t saying there’s something wrong with the service you provided; instead, it’s about who the insurer thinks should be responsible for paying. Worker’s Compensation policies are designed to handle work-related injuries and illnesses, so if an insurance company suspects a treatment is work-related, they will deny the claim under standard health coverage and indicate that Worker’s Compensation should be billed instead.

Common Reasons Why Denial Code 19 Occurs

Denial 19 often comes down to a mix-up over who should be responsible for paying the claim: the patient’s health insurance or Worker’s Compensation. Here are some common reasons why this denial code pops up:

-

Incomplete or Incorrect Injury Documentation

If there’s missing or unclear information on the claim regarding the injury or illness, the insurance company may default to assuming it’s work-related. Detailed and accurate documentation is key to ensuring the claim is processed under the right coverage. -

Patient Reported the Injury as Work-Related

Sometimes, patients may mention to their health provider or insurance company that their injury occurred at work, even if they later seek treatment under their regular insurance. This information can trigger an automatic 19 denial, with the insurance company deciding that the claim belongs with Worker’s Compensation. -

Coding or Billing Errors Indicating a Work-Related Injury

Certain codes used in billing, particularly diagnosis or treatment codes, can be flagged as work-related by insurance algorithms. If any information on the claim suggests an injury type commonly associated with workplace accidents, it may be sent back with a 19 denial. -

Claim Filed with the Wrong Insurer

If the patient has an active Worker’s Compensation case but the claim is submitted under their standard health insurance, it will almost always result in a 19 denial. This happens most often when the patient is unsure about their coverage or doesn’t inform the provider about their Worker’s Compensation status. -

Previous Claims Linked to Worker’s Compensation

Insurance companies keep track of previous claims. If the patient has a history of Worker’s Compensation claims, especially for a similar injury, a new claim might be flagged as potentially related, resulting in a 19 denial.

Best Ways to Mitigate Denial Code 19

Dealing with denial code 19 can be time-consuming and disruptive to your billing workflow, but there are effective strategies to minimize the chances of this denial happening. Here are some of the best ways to mitigate denial code 19 and keep your claims on track:

-

Verify Injury Details with Patients

At intake, ask patients directly if their injury or condition occurred at work. If there’s any indication that the treatment might be related to a workplace incident, follow up to confirm whether it should be billed to Worker’s Compensation. This step can prevent unnecessary denials from the start. -

Document Thoroughly and Accurately

Ensure that all relevant details about the patient’s condition, including the location, cause, and nature of the injury, are documented in the claim. Precise and complete documentation makes it easier for the insurance company to process the claim under the correct coverage. -

Use Clear and Specific Diagnosis Codes

Be cautious with diagnosis codes that are frequently associated with workplace injuries (like fractures or sprains), as these may trigger denial code 19. Double-check coding guidelines to ensure that your codes accurately reflect the patient’s treatment and do not inadvertently signal a work-related injury. -

Confirm Insurance Eligibility and Coverage

Before submitting a claim, verify that the patient’s health insurance policy is the appropriate payer for the treatment. If there’s any indication that Worker’s Compensation might be involved, confirm this with the patient and adjust the claim submission as necessary to avoid denials. -

Monitor for Repeated Denials and Address Root Causes

If you notice that denial code 19 appears frequently for certain types of cases or specific patients, it’s a good idea to conduct a deeper review. Understanding the root causes of repeated denials can help you adjust your processes, avoid similar issues in the future, and submit claims with confidence. -

Submit Additional Documentation When Needed

In cases where an insurer may need reassurance that an injury is not work-related, consider including any relevant documentation or notes that support your claim. A brief statement from the provider explaining that the injury occurred outside of work can sometimes make the difference in preventing a denial. -

Educate Your Team on Denial Trends

Billing and front-office staff should be well-informed about denial code 19 and the common triggers for this issue. With proper training, your team can spot potential problems early and take preventive steps to submit clean claims that won’t get flagged unnecessarily.

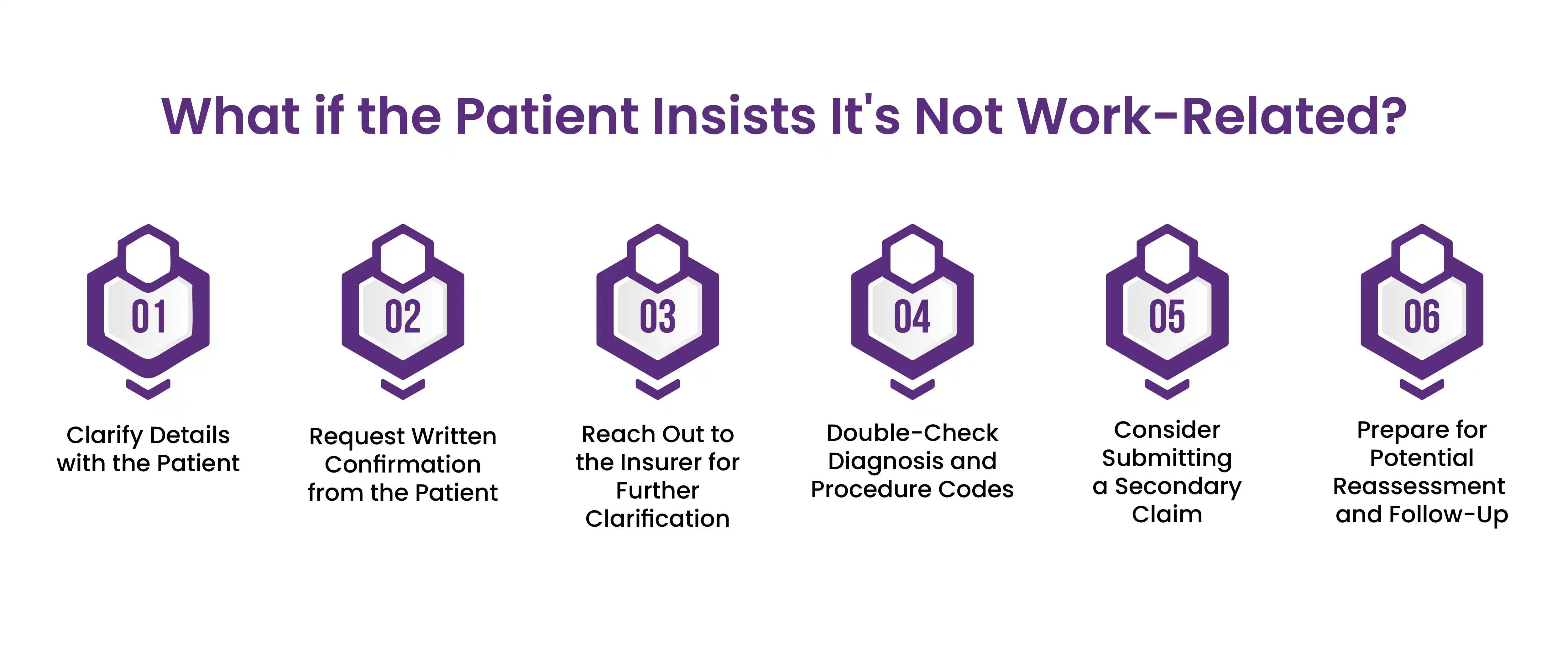

What if the Patient Insists It's Not Work-Related?

When a patient insists that their injury or illness isn’t work-related, yet you receive a denial under code 19 suggesting otherwise, it can put you in a tricky situation. Here’s how to approach this scenario effectively:

1. Clarify Details with the Patient

-

Politely ask the patient for more context about when and where the injury occurred. Avoid leading questions and instead focus on getting a clear timeline and location, as this information can help solidify whether it’s work-related or not.

-

Let the patient know that the insurer flagged the claim as potentially work-related, which means it would typically be billed through Worker’s Compensation. Sometimes, a patient may have mentioned something during their initial visit or intake that suggested a workplace connection without realizing its billing impact.

2. Request Written Confirmation from the Patient

-

If the patient firmly states it’s not a workplace issue, consider asking them to provide a brief written statement. This can include a simple explanation confirming that the injury or condition did not occur at work and why they believe it should be processed through standard health insurance.

-

A written statement can be useful when appealing the denial, as it serves as additional evidence that the injury wasn’t related to the patient’s job.

3. Reach Out to the Insurer for Further Clarification

-

Contact the insurance company directly to explain that the patient denies a workplace connection. Offer any additional documentation, like patient notes or the patient’s statement, to clarify the injury’s context.

-

Ask if there’s any specific documentation or information they need to reassess the denial. Sometimes, insurers may require specific forms or information that weren’t initially included in the claim.

4. Double-Check Diagnosis and Procedure Codes

-

Certain diagnosis or treatment codes can sometimes automatically flag a claim as work-related. Double-check your coding to ensure that no details suggest a workplace injury or condition, as even minor code changes can make a difference.

5. Consider Submitting a Secondary Claim (If Applicable)

-

In rare cases, a patient may be unaware of an open Worker’s Compensation case on their behalf. If you suspect this may be the issue, you can work with the patient or their employer to confirm.

-

If you confirm that Worker’s Compensation isn’t involved, submit an appeal along with the relevant documentation to try and push the claim through under regular health insurance.

6. Prepare for Potential Reassessment and Follow-Up

-

Insurers may ask for further information to substantiate that the injury isn’t work-related. Staying in touch with both the patient and the insurer can help expedite this process.

-

Sometimes, patients may need clarification about why these steps are necessary to ensure a smooth billing process. Keeping the patient informed can help reduce confusion and encourage cooperation if further documentation is needed.

Final Words

By understanding denial code 19 and implementing these preventive steps, you can reduce your practice’s exposure to these denials, ensuring that claims are processed quickly and accurately. Take the time to educate your team, review denial patterns, and stay proactive—these strategies will streamline your revenue cycle, minimize interruptions, and improve overall billing efficiency.

ABOUT AUTHOR

John Doe

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.