For newly graduated physicians or those transitioning to new practices, the credentialing process presents a significant challenge. While obtaining provider credentials with insurance networks is essential for reimbursement, the process typically takes 90-180 days.

This delay creates a critical gap between a physician's start date and their ability to generate revenue through standard insurance billing channels.

This comprehensive guide explores legitimate options for new doctors to begin seeing patients while maintaining proper billing compliance during the credentialing process. With careful planning and understanding of the available alternatives, practices can navigate this transition period effectively while minimizing revenue disruption.

Understanding the Credentialing Timeline

Before diving into billing solutions, it's crucial to understand the typical credentialing timeline:

Initial Application Phase (Days 1-30):

-

Application submission to payers

-

Primary source verification begins

-

CAQH profile creation and attestation

Verification Phase (Days 31-90):

-

Payer review of credentials

-

Verification of education, licensing, malpractice history

-

Hospital privileges confirmation

Committee Review Phase (Days 91-120):

-

Credentialing committee meetings (often monthly)

-

Final approval process

-

Contract generation

Finalization Phase (Days 121-180):

-

Provider number assignment

-

Effective date determination

-

System enrollment completion

Each payer has unique timelines and requirements, with government payers like Medicare and Medicaid often taking the longest. Understanding this timeline helps practices implement appropriate billing strategies during each phase of the credentialing process.

Billing Under a Supervising Physician

One of the most common approaches for uncredentialed physicians is billing under a supervising physician who is already credentialed with the relevant insurance plans.

Key Requirements:

-

Direct Supervision: The supervising physician must be physically present in the office suite and immediately available to provide assistance and direction.

-

Documentation Standards: All patient encounters must clearly document:

-

The supervising physician's involvement

-

The uncredentialed physician's role as the treating provider

-

The supervising physician's review and approval of treatment plans

-

-

Modifier Usage: Claims typically require:

-

The supervising physician's NPI number

-

Appropriate supervision modifiers (varies by payer)

-

Billing Example:

Supervising Physician: Dr. Smith (NPI: 1234567890)

New Physician: Dr. Jones (uncredentialed)

Patient Encounter: 99213 Office Visit

Claim Format:

- Rendering Provider: Dr. Smith

- Supervising Provider: Dr. Smith

- Documentation: "Patient seen by Dr. Jones under direct supervision of Dr. Smith. Treatment plan reviewed and approved by Dr. Smith."

Compliance Warning: This arrangement requires careful attention to supervision requirements. The supervising physician assumes responsibility for the care provided and must have real-time involvement in patient care decisions.

Incident-to Billing

"Incident-to" billing offers Medicare and some commercial payers a pathway for services provided by uncredentialed physicians to be billed under a supervising physician's credentials.

Medicare Incident-to Requirements:

-

Established Patient Care: Services must be part of the patient's normal course of treatment.

-

Physician Supervision: A supervising physician must be physically present in the same office suite.

-

Established Plan of Care: The supervising physician must have initiated the patient's course of treatment.

Implementation Process:

-

Initial Evaluation: The supervising physician performs the first patient encounter and establishes a plan of care.

-

Follow-up Visits: The uncredentialed physician can provide subsequent services following the established plan.

-

Documentation Requirements:

-

Reference to the original plan of care

-

Notation of supervising physician presence

-

Any modifications to treatment plans

-

Supervising physician review and approval

-

Reimbursement Considerations:

Incident-to services are typically reimbursed at 100% of the physician fee schedule, making this approach financially advantageous compared to other options. However, the strict supervision requirements can create operational challenges.

Locum Tenens Status as a Temporary Solution

The locum tenens arrangement allows practices to temporarily bill for services provided by substitute physicians using the Q6 modifier.

Eligibility Requirements:

-

Replacement Scenario: The locum tenens arrangement typically applies when:

-

Covering for an absent physician (vacation, illness, etc.)

-

Filling a position during recruitment

-

Temporary staffing needs

-

-

Time Limitations: Medicare limits locum tenens arrangements to 60 consecutive days per physician.

-

Direct Contractual Relationship: The practice must have a direct agreement with the locum tenens physician.

Implementation Steps:

-

Contractual Agreement: Establish a written agreement specifying:

-

Compensation structure

-

Duration of service

-

Scope of practice

-

-

Billing Process:

-

Use the regular physician's NPI or provider number

-

Append the Q6 modifier (Medicare) or appropriate payer-specific modifier

-

Maintain detailed records of the arrangement

-

Documentation Example:

Claim Details:

- Provider Number: Regular physician's NPI

- Service Date: MM/DD/YYYY

- CPT Code: 99214-Q6

- Documentation: "Service provided by [Locum Physician Name] serving as locum tenens for [Regular Physician Name]"

Important Note: While Medicare recognizes locum tenens arrangements, commercial payers have varying policies. Always verify payer-specific requirements before implementing this strategy.

Cash-Pay Patient Models During Credentialing Delays

Implementing a cash-pay model provides immediate revenue during credentialing delays while avoiding insurance billing complications.

Setting Up a Compliant Cash-Pay System:

-

Fee Schedule Development:

-

Research market rates for your specialty

-

Consider setting fees at 70-80% of typical insurance reimbursement

-

Create transparent fee schedules for patients

-

-

Patient Communication Strategy:

-

Develop clear financial policies

-

Train staff on explaining the temporary cash-pay status

-

Prepare patient-friendly communication materials

-

-

Financial Workflows:

-

Implement payment collection processes

-

Consider offering payment plans

-

Evaluate credit card processing options with reasonable fees

-

Superbill Provision:

Provide patients with detailed superbills containing:

-

Accurate diagnosis codes (ICD-10)

-

Procedure codes (CPT)

-

Provider information (including NPI)

-

Practice tax ID information

This allows patients to submit for potential out-of-network reimbursement, enhancing the attractiveness of your cash-pay services.

Transitioning Back to Insurance:

When credentialing completes, implement a transition plan:

-

Notify existing patients of insurance acceptance

-

Update financial policies

-

Train staff on the verification process

-

Establish protocols for retroactive billing where allowed

Proper Physician Onboarding Protocol

Effective onboarding minimizes credentialing delays and ensures smooth practice integration for new physicians.

Pre-Employment Credentialing Checklist:

-

Documentation Collection (60-90 days before start date):

-

Medical license verification

-

DEA registration

-

Board certifications

-

Malpractice insurance documentation

-

Professional references

-

Educational verification

-

Work history verification

-

-

CAQH Profile Management:

-

Create or update CAQH ProView profile

-

Ensure quarterly attestations

-

Upload all supporting documentation

-

Grant access to relevant payers

-

-

Payer Applications:

-

Submit applications to top 5-10 payers by volume

-

Prioritize payers based on practice demographics

-

Track submission dates and follow-up requirements

-

Credentialing Tracking System:

Implement a credentialing management system that includes:

-

Application submission dates

-

Payer contact information

-

Status check schedule (bi-weekly)

-

Documentation of all communications

-

Escalation protocols for delays

A robust tracking system enables practices to identify bottlenecks and address issues proactively, potentially reducing credentialing timelines.

Compliance Considerations for Uncredentialed Physicians

Understanding compliance requirements is critical when implementing billing strategies for uncredentialed physicians.

Insurance Contract Requirements:

-

Contractual Limitations:

-

Many payer contracts prohibit billing for uncredentialed providers

-

Review specific language regarding "billing under" arrangements

-

Identify payers with explicit prohibitions

-

-

Disclosure Requirements:

-

Some payers require notification of uncredentialed providers

-

Documentation of supervision relationships

-

Transparency in patient communication

-

Regulatory Considerations:

-

Anti-Kickback and Stark Law:

-

Supervision arrangements must reflect fair market value

-

Avoid compensation tied to referral volume

-

Document business justification for arrangements

-

-

False Claims Act Risks:

-

Misrepresenting supervising physician involvement

-

Incorrect use of modifiers

-

Improper documentation of services

-

-

Medicare Enrollment Requirements:

-

Ordering and referring provider restrictions

-

Enrollment requirements for diagnostic services

-

Limitations on services provided by opt-out physicians

-

Implementing a compliance review process for all temporary billing arrangements helps mitigate these risks.

Documentation Requirements During the Credentialing Gap

Proper documentation is essential during the credentialing period to support billing integrity and ensure future audit compliance.

Key Documentation Elements:

-

Provider Identification:

-

Clear identification of both treating and supervising physicians

-

Specific notation of credentialing status

-

Documentation of physical presence for supervision

-

-

Service Delivery:

-

Comprehensive documentation of medical necessity

-

Evidence of direct supervision when required

-

Clear delineation of each provider's contribution to care

-

-

Supervision Verification:

-

Attestation statements regarding supervision

-

Timing of supervision activities

-

Evidence of case review and approval

-

Sample Documentation Template:

Date: MM/DD/YYYY

Patient: [Patient Name]

Providers Present: Dr. Smith (supervising physician), Dr. Jones (treating physician pending credentialing)

Assessment and Plan: [Clinical details]

Supervision Statement: I, Dr. Smith, was physically present in the office suite during this encounter, reviewed the findings with Dr. Jones, and approve the assessment and treatment plan outlined above.

[Supervising Physician Signature]

[Date and Time]

Maintaining consistent documentation patterns across all uncredentialed physician encounters establishes a defensible audit trail.

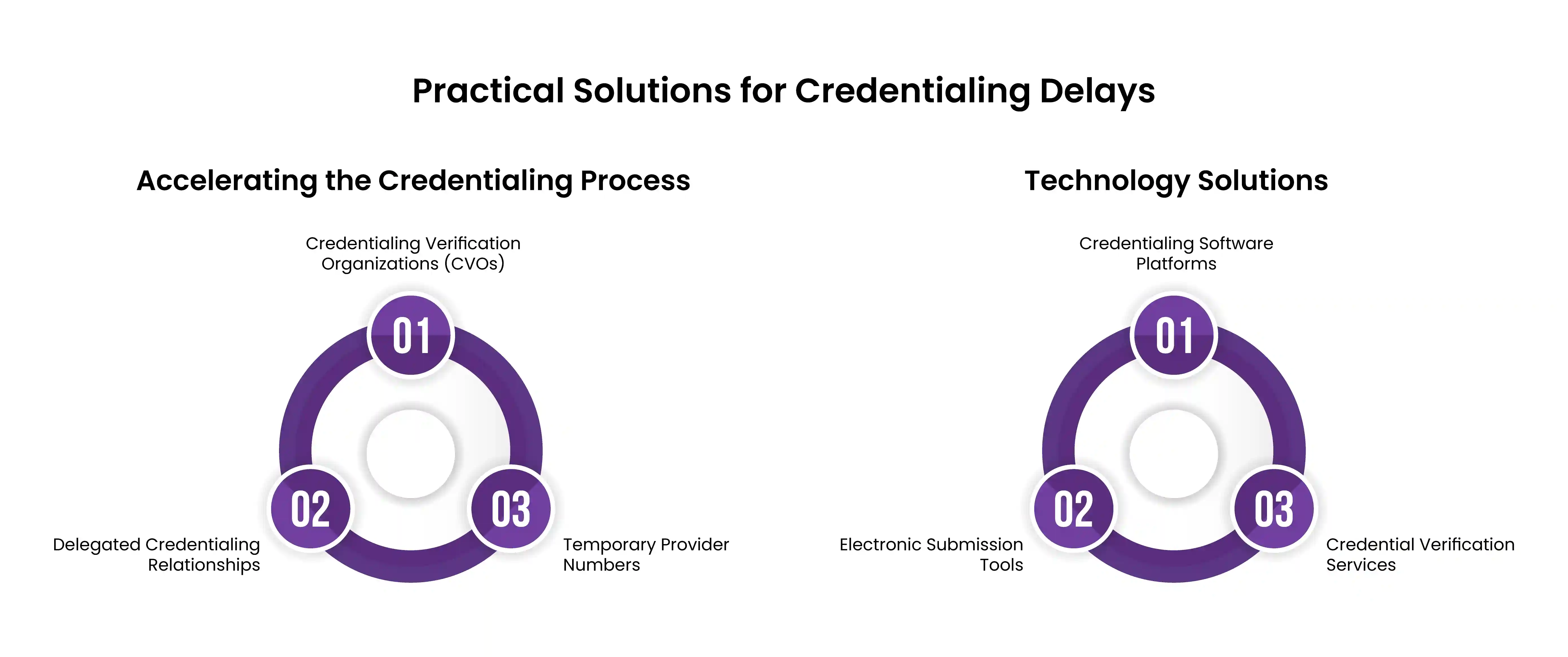

Practical Solutions for Credentialing Delays

Implementing strategic approaches can minimize credentialing delays and associated revenue impacts.

Accelerating the Credentialing Process:

-

Credentialing Verification Organizations (CVOs):

-

Engage with CVOs for centralized verification

-

Utilize CAQH ProView effectively

-

Consider payer-specific CVOs for priority insurers

-

-

Delegated Credentialing Relationships:

-

Explore delegated credentialing through IPAs

-

Leverage hospital system credentialing when applicable

-

Understand reciprocity agreements between payers

-

-

Temporary Provider Numbers:

-

Request provisional credentialing where available

-

Identify payers offering temporary billing arrangements

-

Document all provisional approvals in writing

-

Technology Solutions:

-

Credentialing Software Platforms:

-

Implement automated tracking systems

-

Use credential expiration monitoring

-

Enable real-time application status visibility

-

-

Electronic Submission Tools:

-

Utilize direct payer portals

-

Implement electronic signature capabilities

-

Maintain digital document repositories

-

-

Credential Verification Services:

-

Outsource primary source verification

-

Utilize NAMSS-certified specialists

-

Implement quality control measures

-

Strategic deployment of these solutions can reduce credentialing timelines by 15-30%, minimizing the revenue impact of delays.

FAQs: Common Questions About Practicing Before Credentialing

Can doctors see patients without credentialing?

Yes, physicians can legally see patients before completing the insurance credentialing process. However, billing for these services through insurance requires using one of the compliant approaches outlined in this article, such as billing under a supervising physician, implementing incident-to billing protocols, utilizing locum tenens arrangements, or establishing a cash-pay model.

How do I bill when not credentialed?

Uncredentialed physicians have several billing options:

-

Bill under a supervising physician with proper documentation

-

Utilize incident-to billing for established patients

-

Implement a transparent cash-pay model

-

Consider locum tenens arrangements for temporary coverage Each option has specific requirements and limitations that must be carefully followed.

What is the typical credentialing timeline?

The standard credentialing process typically takes 90-180 days from application submission to final approval. Medicare and Medicaid credentialing often takes the longest (120-180 days), while commercial payers usually range from 90-120 days. Factors affecting timeline include application completeness, payer processing volumes, and committee meeting schedules.

Can I bill retroactively once credentialing is complete?

Some payers allow retroactive billing back to the application submission date once credentialing is approved. This practice, known as "effective date retroactive billing," varies by payer:

-

Medicare typically allows 30-day retroactive billing

-

Medicaid policies vary by state (30-90 days)

-

Commercial payers have varying policies (0-90 days) Always document the initial application date and verify each payer's retroactive billing policy.

What are the compliance risks of billing under another provider?

The main compliance risks include:

-

False Claims Act violations for misrepresenting the rendering provider

-

Contractual violations of payer agreements

-

Inadequate supervision documentation

-

Improper use of modifiers

-

Potential recoupment during audits These risks can be mitigated through proper policies, documentation, and supervision protocols.

Conclusion

The credentialing gap creates headaches for new physicians eager to start seeing patients. By implementing the right strategy—whether that's supervision arrangements, incident-to billing, locum tenens work, or a transparent cash model—your practice can keep revenue flowing while jumping through the necessary hoops.

Don't wait until your new doctor's first day to think about these challenges. The smartest practices partner with experienced credentialing specialists like HMS USA LLC at least 90 days before start dates. Our dedicated credentialing team navigate these complex waters daily, often cutting weeks off standard timelines while ensuring rock-solid compliance.

By balancing proper documentation, crystal-clear policies, and transparent patient communication, you'll create a smooth transition that benefits everyone—your new physician, your practice, and most importantly, your patients

ABOUT AUTHOR

Alex White

I’m Alex White, a Senior A/R Specialist with years of experience in medical billing and coding. I specialize in revenue cycle management and reimbursement processes, with a passion for accuracy and efficiency. Through my writing, I aim to share valuable insights and be a trusted voice in the medical billing and coding industry.