Navigating the world of healthcare can be a daunting task, especially when it comes to understanding the difference between in network and out of network providers. These terms refer to the relationship between healthcare providers and insurance companies, and their impact on the cost of medical care for patients.

Understanding the difference between in network and out of network providers is crucial for anyone looking to make informed decisions about their healthcare. This Guide will give you the insights of the difference between these two terminologies. So just stick around with us till the very end and we will give you get a better understanding.

Table of Content:

1- What is in Network vs Out of Network: Where the difference lies

2- Break Down Of Network Healthcare Plans

3- Comparing in Network vs Out of Network Cost

4- Revealing the best possible ways to get insurance cover your out-of-network charges

5- How Do You Check the Provider Network Status

6- Final Words

What is in Network vs Out of Network: Where the difference lies

In network and out of network are terms used to describe the level of care provided by an insurance provider or health plan, depending on which provider you choose.

While it is not always easy to determine the difference between in network and out of network providers, some important distinctions should be considered.

What does the term In Network Means?

In-network providers have contracts with the insurance company, which means they agree to accept the rates paid by insurances for their services. This might include co-pays and deductibles (those usually remains less) when using an in-network provider.

What does the term Out of Network Mean?

Out-of-network providers do not have a contract with the insurance company/s, so they can set their rates, which means you could be charged more than you are expecting. In addition, out-of-network providers may not accept insurance at all, meaning you would have to pay the total amount of the bill if you choose Out of Network provider for your services

If you opt for a provider who is contracted with your healthcare plan, then insurance will pay them as per her contracted rates and you will only be responsible for your co-insurances and deductibles (As per the limits of your annual criteria).

Likewise, choose not to stay with an in network provider and want to move with a provider that is not in contract with your health plan (Out of network). You might be responsible for a large portion of the copay or the total bill of the service or your health insurance will pay a certain amount depending on your health plan.

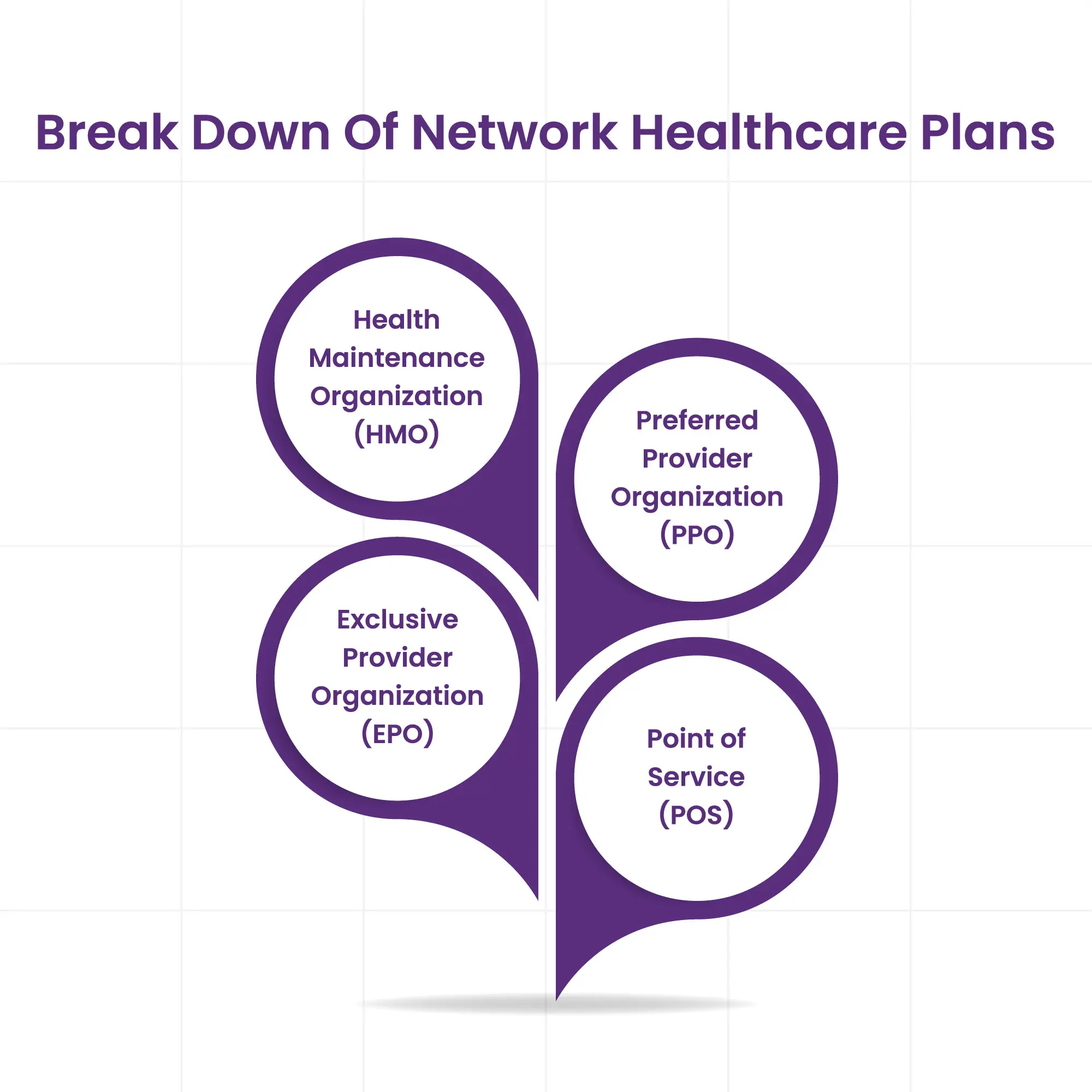

Break Down Of Network Healthcare Plans

Healthcare plan type is an essential factor when considering out-of-network costs. Different types of plans, such as HMOs, PPOs, EPOs and POS plans, vary in how they deal with reimbursement for out of network care.

Health Maintenance Organization (HMO)

Generally speaking, HMO insurance plans are most likely to restrict or not cover any out-of-network care. As they have no out of network benefits to offer to patients, if a patient tries to go out of network, he might be considered as responsible for the all out of pocket cost.

Preferred Provider Organization (PPO)

PPO Plans offer more flexibility with out-of-network care but usually require higher premiums and co-pays. They are not considered as worthy as HMOs but offer some out-of-network coverage.

Exclusive Provider Organization (EPO)

EPOs are similar to HMOs in that they generally do not provide coverage for out-of-network care and require patients to stay within the network. However, unlike HMOs, they may allow some exceptions and provide limited coverage for out-of-network care in certain (emergency and other) circumstances.

Point of Service (POS)

POS plans are a hybrid of HMOs and PPOs, meaning they offer some out-of-network benefits as long as the patient obtains prior authorization from their primary care doctor before receiving any care outside the network. However, these plans are often more expensive than HMOs and PPOs due to higher premiums and co-pays.

Ultimately, patients need to understand the different healthcare plans available when shopping for coverage to get an informed decision about their out-of-network costs.

Comparing in Network vs Out of Network Cost

When choosing a doctor or other healthcare provider, it is essential to consider if they are in or out of your insurance network. In-network providers have an agreement with your health plan that allows them to provide services at a discounted rate.

Generally, these contracted rates will be lower than what you would pay for the same service from an out-of-network provider.

In-network providers are typically more cost-efficient than out-of-network providers because they have agreed to accept a lower fee for their services in exchange for a higher volume of patients and stability of payments from the insurance company.

This means that you, as the patient, will likely pay less out of pocket even if you have to meet a deductible.

On the other hand, out of network providers might disagree with your health plan and thus can charge whatever they deem necessary for their services. So you might have to pay more than if you had seen an in-network provider since your health plan won't be able to negotiate a lower rate.

It is important to understand the cost comparison between in network and out of network so that you can make an informed choice about where you go for healthcare services.

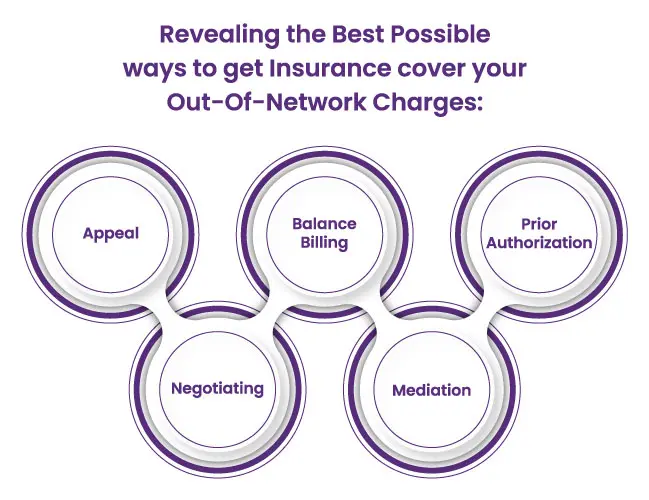

Revealing the best possible ways to get insurance cover your out-of-network charges:

If you have seen a therapist that doesn't fall in your network's radar and you still want your health plan to cover the coverage as you want to get care from the same doctor or therapist, there are some ways to make your unexpected bill get covered.

Appeal: You can appeal the decision. If you can find a way to prove that using any other doctor is not feasible for you and your health plan denies your coverage, then you can ask them to reconsider their decision.

Balance Billing: You should also be aware of balance billing, which means if you have found a provider outside of your network, tell the doctor that you will pay him the amount your insurance company pays.

Prior Authorization: You should also check if prior authorization is required for specific treatments, surgeries or procedures with out of network providers before you opt for any treatment.

Negotiating: You can also negotiate with out of network providers and try to get a discount. Many providers offer discounts if you pay them in cash or upfront.

Mediation: You can also seek help from a professional mediator specializing in resolving healthcare disputes. The mediator will know the ins and outs of the health insurance industry and can help you find a resolution that works for all parties.

How Do You Check the Provider Network Status

When selecting a healthcare provider, it's essential to know whether they are in-network or out of network. To check if a provider is in-network or out of network, you can:

1. Contact the health plan provider directly. You will need to provide your insurance policy number when calling and ask if they have a contract with the provider you are considering.

2. Use the provider directory on your health plan’s website. Many plans have provider directories that list the providers in-network for their plan.

3. Ask your provider what insurance plans they accept. Most providers will be able to tell you which health plans they are contracted with and if they are in-network or out of network with yours specifically.

4. Use an online search engine such as Zocdoc. Zocdoc is an online search engine that helps you find doctors and reviews and other information to help you decide which doctor is best for you. It also lets you know if the provider is in-network or out of network for your health plan.

Following these steps, you can quickly determine whether a provider is in-network or out of network with your health plan.

Ending Notes

In conclusion, knowing if a provider is in-network or out-of-network can save you money. It is essential to do your research before selecting a healthcare provider and to be aware of the cost differences between them.

Take charge of your health and financial future by taking the time to understand in network vs out of network before deciding on your care.

FAQ! Need Help?

An out-of-network provider in healthcare refers to a healthcare provider who is not contracted with an individual's insurance plan. As a result, utilizing the services of an out-of-network provider may result in increased financial responsibility for the patient, including higher out-of-pocket costs.

There are a few potential advantages to utilizing the services of an out-of-network provider. Some of these may include:

- Greater flexibility in choosing a provider

- Access to specialized services

- Avoiding long wait times

- Higher quality care

It depends on your specific insurance plan and the availability of in-network providers in your area. Some insurance plans may cover out-of-network providers if no in-network providers are available in your area. However, other insurance plans may not cover out-of-network providers in this situation or only cover them at a reduced rate.

HMOs have a smaller network of providers and lower out-of-pocket costs, while PPOs offer greater flexibility in choosing providers and usually include out-of-network coverage. The best option depends on one's budget, medical needs and preferences.

Insurance plans can have a combined deductible for in-network and out-of-network providers or separate deductibles. A combined deductible counts expenses towards it regardless of provider network status, while separate deductibles only count expenses towards the corresponding network's deductible.

ABOUT AUTHOR

Tammy Carol

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.