Many providers assume that being out-of-network automatically means fewer patients, unpredictable reimbursements, and constant claim denials. Sound familiar? It’s a common perception—one that’s costing practices thousands, if not hundreds of thousands, in lost revenue every year.

Yet, the reality is different. When approached strategically, out-of-network claims can boost your practice's profitability, offer more flexibility, and even reduce administrative headaches compared to in-network contracts. The catch? You need to know how to work the system to your advantage.

You don’t have to play by the same old rules anymore. Our Out-of-Network Billing Services can help you simplify the process and maximize your revenue. The knowledge and strategies we’re about to share will show you how to take full advantage of out-of-network benefits, protect your bottom line, and future-proof your practice.

The Basics of Out-of-Network Benefits

When a provider isn’t part of a health plan’s contracted "network," they are considered out-of-network. Patients who visit out-of-network providers may still have some level of coverage through their insurance plan, depending on their policy type. This coverage is known as out-of-network benefits

Here’s how it works:

-

Patients pay more upfront: Since out-of-network providers haven’t negotiated lower rates with the insurer, patients often face higher out-of-pocket costs (deductibles, co-pays, etc.).

-

Insurers reimburse less: The insurer typically reimburses a portion of the bill, often based on "UCR" charges (Usual, Customary, and Reasonable amounts).

But here’s the twist: Providers who play their cards right can benefit significantly from this dynamic. By carefully navigating the rules and submitting claims properly, you can negotiate better reimbursements while providing premium care without being restricted by in-network contracts.

How Insurers Process Out-of-Network Claims

-

UCR Rates:

Insurers base their reimbursement on what they consider "Usual, Customary, and Reasonable" fees in your area. If your charge exceeds this amount, the patient may be billed for the difference (balance billing). -

Patient Responsibilities:

-

Out-of-network deductibles are often higher than in-network ones.

-

Once met, patients may still pay a percentage (e.g., 30-40%) of the UCR amount.

-

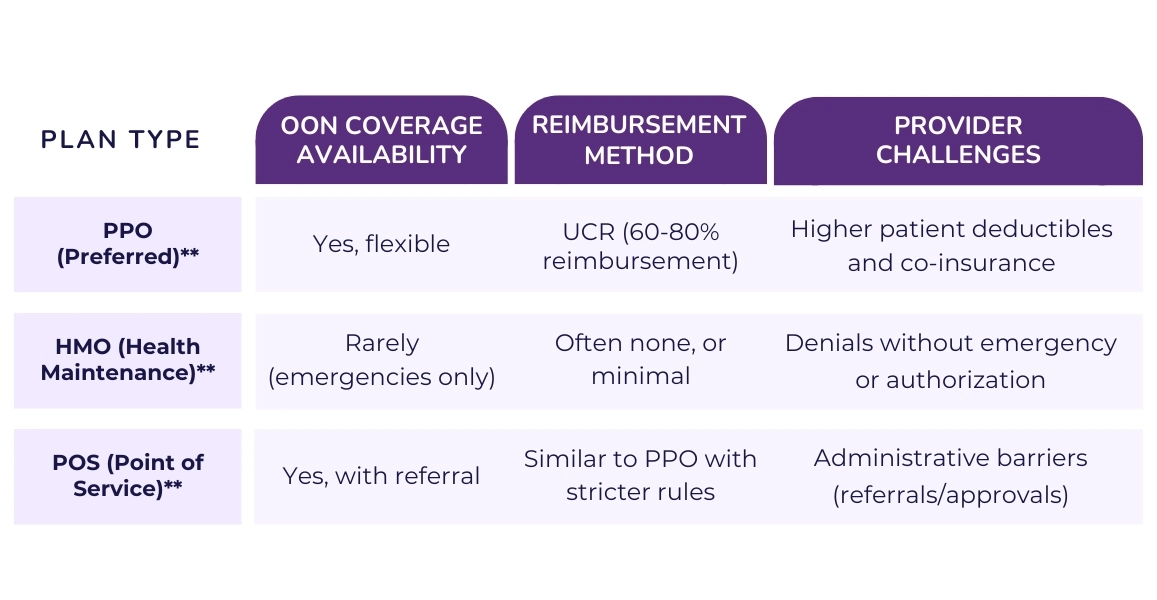

Understanding OON Coverage Tiers (PPO, HMO, POS Plans)

When dealing with out-of-network (OON) benefits, it’s crucial to understand how different insurance plans define and handle OON coverage. Not all plans are created equal—some offer more flexibility, while others severely limit reimbursements. Let’s break down the three most common plan types: PPO, HMO, and POS plans, and how they impact OON billing and claims.

1. Preferred Provider Organization (PPO) Plans – The Most Flexible Option

What it means for providers:

PPOs allow patients to see out-of-network providers with fewer restrictions compared to other plan types. Patients typically have access to both in-network and out-of-network care, though OON care will cost them more.

How OON coverage works:

- Reimbursement Rates: Based on UCR (Usual, Customary, and Reasonable) charges.

- Deductible: Patients usually have a separate, higher deductible for OON services.

- Cost-Sharing: Once the deductible is met, the insurance may cover 60-80% of the UCR amount, leaving patients responsible for the remainder.

Provider advantage:

Providers have more opportunities to collect reasonable reimbursement, especially with patients who are informed about their benefits and willing to use OON services.

2. Health Maintenance Organization (HMO) Plans – Strict and Limited

What it means for providers:

HMO plans are the least friendly to out-of-network care. Patients are often required to see in-network providers unless it’s an emergency.

How OON coverage works:

Reimbursement: Generally, no coverage is provided for OON services (except in emergencies).

Authorization: Even for emergency OON care, insurance might still require retroactive approval to reimburse claims.

Patient Responsibility: Patients are usually stuck with the full bill for non-emergency out-of-network services.

Provider challenge: OON claims are more likely to be denied unless there’s a legitimate emergency. Providers may need to work harder to help patients appeal claims.

3. Point of Service (POS) Plans – A Hybrid Option

What it means for providers:

POS plans combine features of both PPO and HMO plans. Patients have the flexibility to choose OON providers, but they need referrals and authorizations to maximize coverage.

How OON coverage works:

Authorization: Referrals from a primary care physician (PCP) are often required for OON services to be reimbursed.

Reimbursement Rates: Similar to PPOs but may include stricter guidelines for coverage amounts and network restrictions.

Cost-Sharing: Patients often pay higher deductibles and co-insurance for OON care.

Provider opportunity: If a patient secures authorization, you may still be reimbursed at a fair rate, though POS plans can be bureaucratically challenging.

Out-of-Network Claim Submission Process

Step 1: Verify Patient Benefits Before Treatment

Before providing any service, verify the patient’s out-of-network coverage to understand:

-

If their plan offers OON benefits.

-

The patient's OON deductible and co-insurance.

-

If pre-authorization is required for specific services.

Use your billing system or contact the insurer directly to get real-time benefits information.

Step 2: Collect and Submit Pre-Authorization (If Required)

Some insurers require pre-authorization for out-of-network services, especially for major procedures like surgeries or diagnostic imaging (e.g., MRIs).

Failure to obtain pre-authorization can result in automatic denials, leaving both you and the patient at risk of not getting paid.

What to Include in the Pre-Authorization Request:

-

CPT codes for services to be performed.

-

Detailed documentation of medical necessity.

-

Patient information, including their plan details.

Step 3: Submit the Claim Correctly

Providers typically have two options for submitting OON claims:

Direct submission to the insurance company (common for large practices).

Patient self-submission (common for smaller practices that don’t handle OON billing directly).

Electronic submission is preferred because it speeds up processing. Use clearinghouses or electronic health record (EHR) systems to submit claims to insurers quickly and track claim statuses.

Step 4: Track Claim Status and Follow Up

Never assume the claim will go through smoothly. Insurers may delay payment or require additional information (e.g., proof of medical necessity).

Monitor your claims regularly using your billing platform or by contacting the insurance provider.

Key things to check:

-

Has the claim been received and processed?

-

Is there a request for additional documentation?

-

Has the claim been denied or underpaid?

Step 5: Handle Denials or Underpayments

Even with perfect claims, denials and low reimbursements happen. However, you can challenge and appeal these decisions.

Common reasons for denial:

-

Missing pre-authorization.

-

Incorrect or incomplete documentation.

-

Insurer disputes the "Usual, Customary, and Reasonable" (UCR) fee amount

Steps to appeal:

Request a detailed Explanation of Benefits (EOB) to understand the denial reason.

Submit an appeal with supporting documentation, including:

-

Updated CPT/ICD codes (if necessary).

-

A letter of medical necessity.

-

Data supporting your charges (e.g., FAIR Health data showing local UCR rates).

How Providers Can Maximize Out-of-Network Reimbursement

1. Understand and Use UCR (Usual, Customary, and Reasonable) Rates to Your Advantage

Insurance companies calculate out-of-network reimbursements based on UCR (Usual, Customary, and Reasonable) charges. However, insurers often set these rates lower than what’s actually common in your area, leading to reduced payouts.

Strategies to maximize UCR-based reimbursements:

-

Use data-driven benchmarks from trusted resources like the FAIR Health database to support your charges.

-

Challenge low reimbursements by filing an appeal and providing documentation of higher local rates for similar services.

2. Obtain Pre-Authorization (Whenever Possible)

While not always required, obtaining pre-authorization for out-of-network services improves your chances of getting reimbursed. Pre-authorization shows that the insurer has acknowledged the medical necessity of the procedure, reducing the risk of later denial.

How to streamline pre-authorization:

-

Have dedicated billing staff handle all pre-authorization requests.

-

Provide detailed documentation upfront, including the patient’s diagnosis, treatment plan, and CPT/ICD codes.

-

Follow up regularly to ensure authorization is confirmed before services are rendered.

3. Submit Clean and Accurate Claims

Errors on claims—no matter how small—can lead to denials, delayed payments, or under-reimbursements. A clean, well-documented claim significantly boosts your chances of getting paid in full.

Checklist for submitting clean claims:

-

Ensure all CPT, HCPCS, and ICD-10 codes are accurate and supported by documentation.

-

Verify that the patient's insurance information is correct (policy number, group ID, etc.).

-

Attach supporting documents (e.g., medical necessity reports) if required.

Pro Tip: Invest in billing automation or claim scrubbing software to catch errors before submission.

4. Appeal Low Payments and Denials

Don’t accept low reimbursements or claim denials without a fight. Insurance companies often bank on providers not challenging their decisions.

Steps to appeal successfully:

-

Review the Explanation of Benefits (EOB): Identify the reason for denial or reduced payment.

-

Gather supporting evidence: Provide medical records, a breakdown of UCR rates, and a letter explaining why the service was medically necessary.

-

Submit your appeal: Include all relevant documentation and follow up consistently.

Many providers see significant increases in reimbursement after submitting well-supported appeals.

5. Negotiate Directly with Insurers

For high-value services or recurring procedures, you may have leverage to negotiate higher reimbursement rates with insurers—especially if you have strong evidence that your fees align with market norms.

Tips for negotiating:

-

Use billing data (e.g., average charges in your area) to justify your rates.

-

Focus on procedures where your practice offers unique expertise or better-than-average outcomes.

-

Build relationships with insurance representatives to facilitate smoother negotiations over time.

6. Balance Bill Patients Strategically

Since insurance companies often pay only a portion of out-of-network fees, the remaining balance falls to the patient. While balance billing is allowed in many cases, doing it carelessly can harm patient trust.

Best practices for balance billing:

-

Communicate upfront: Provide patients with an estimate of their financial responsibility before the service is performed.

-

Offer payment plans or discounts for prompt payment.

-

Avoid surprise bills by keeping patients informed at every stage of the claims process.

Note: Be mindful of state-specific regulations, such as those under the No Surprises Act, which limit balance billing in certain scenarios.

7. Educate and Empower Patients

Patients are often unfamiliar with their out-of-network benefits. By educating them on how to maximize their coverage, you can reduce disputes and improve collections.

What to explain to patients:

-

Their plan’s out-of-network deductible and co-insurance requirements.

-

How they can appeal low reimbursements directly with their insurer.

-

The value of your care compared to in-network alternatives, especially when specialized services are involved.

Pro Tip: Provide patients with a detailed financial responsibility breakdown and a step-by-step guide on how to file claims if needed.

8. Leverage Third-Party Billing Experts

Out-of-network billing is complex and time-consuming. If your practice lacks the internal resources to handle claims effectively, consider partnering with a medical billing service that specializes in OON reimbursement.

Benefits of outsourcing OON billing:

-

Reduced administrative burden on your staff.

-

Improved claim accuracy and faster turnaround times.

-

Higher success rates for appeals and denials.

At HMS USA LLC, we help providers optimize their out-of-network claims and maximize reimbursement with expert guidance and tailored support.

Does Medicare Have Out-of-Network Benefits?

For providers working with Medicare patients, out-of-network (OON) benefits can be a confusing and often misunderstood topic. Whether or not Medicare covers out-of-network care depends on which part of Medicare the patient is enrolled in. Let’s break it down by Medicare Part A, B, and Medicare Advantage (Part C) to provide clarity on how out-of-network coverage works.

Medicare Part A & Part B (Original Medicare)

Original Medicare, which includes Part A (hospital care) and Part B (outpatient services), generally does not have out-of-network benefits. Medicare patients are expected to receive services from providers who accept Medicare's reimbursement rates.

However, there are exceptions where out-of-network services may still be covered:

-

Emergency Situations:

-

If a patient requires emergency care and is taken to a facility that does not accept Medicare, Medicare may cover the costs, although this is rare.

-

Providers should document the emergency circumstances to avoid payment disputes.

-

-

Participating vs. Non-Participating Providers:

-

Medicare distinguishes between participating providers who accept Medicare assignment (full reimbursement rates) and non-participating providers who may still bill Medicare but can charge up to 15% above Medicare's approved rate (known as a limiting charge).

-

Non-participating providers are technically out-of-network but still eligible for partial Medicare reimbursement.

-

-

Medicare Assignment:

If a provider does not accept Medicare assignment, patients may have to pay the full cost upfront and seek reimbursement from Medicare, which usually pays a reduced amount based on Medicare's fee schedule.

Medicare Advantage (Part C) – OON Coverage May Vary

Medicare Advantage plans, also known as Part C, are provided by private insurers and often include both in-network and out-of-network options, depending on the plan type.

1. HMO Medicare Advantage Plans:

Typically, these plans have strict network restrictions and do not cover out-of-network services except in emergencies.

Patients need a referral or pre-authorization for most in-network care, and non-emergency OON services are usually denied.

2. PPO Medicare Advantage Plans:

These plans offer more flexibility by covering out-of-network services, though patients face higher co-pays, deductibles, and co-insurance for OON care.

Reimbursement rates are often based on a percentage of UCR charges.

3. POS (Point of Service) Plans:

POS Medicare Advantage plans allow some out-of-network access with pre-approval or referrals but may impose stricter reimbursement rules and lower coverage limits than PPO plans.

Tip for Providers:

Verify the specific plan details before providing OON services to Medicare Advantage patients to understand the coverage and reimbursement terms.

Medigap (Supplemental Insurance)

Patients with Medigap (Medicare Supplement Insurance) may still have significant financial responsibility for out-of-network services. Medigap policies typically only cover the patient’s share of Medicare-approved costs, meaning they won’t provide extra coverage for providers who don’t accept Medicare assignment.

Emergency and Urgent Care Exception

Both Original Medicare and Medicare Advantage plans are required to cover emergency services regardless of network status. For Medicare Advantage, this includes out-of-area or out-of-network emergencies. However, providers may still need to justify emergency care to avoid reduced payments or denials.

Words By Author

Let’s face it—insurance red tape is designed to wear providers down. But the truth is, out-of-network benefits hold untapped potential to strengthen your practice’s financial foundation. Providers who embrace this opportunity and master the process stand to gain greater flexibility, higher reimbursements, and increased independence from network limitations.

Success in OON billing isn't just about submitting claims; it’s about taking control of your practice’s narrative. By educating your patients, staying on top of insurer tactics, and pushing back against denials, you become the architect of your financial future.

Ready to stop leaving money on the table and reclaim control of your revenue? Let HMS USA LLC guide you to out-of-network billing success. Contact us today!

ABOUT AUTHOR

Pedro Collins

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.