Timely filing is a cornerstone in steering your healthcare practice toward efficient and prompt reimbursements. It's not uncommon for healthcare providers to encounter frequent claim denials, often stemming from delays in filing.

If you're grappling with the complexities of timely filing or in search of a comprehensive guide that unravels these guidelines and offers practical steps for timely claim submission, you're in the right place. And don't worry, we promise to keep it engaging and far from tedious!

What is Meant By Timely Filing of an Insurance Claim?

It's the specific timeframe you have to submit a claim to an insurance company for reimbursement. Each insurer sets its own deadline, typically ranging from 30 to 180 days from the date of service.

Now, you may be wondering why it is so important to file my claims in a timely manner. Well here’s the breakdown:

Financial security: Getting paid promptly ensures your practice stays afloat. Delayed claims can create cash flow issues, impacting your ability to deliver quality care and invest in your business.

Reduced workload: Timely filing minimizes the risk of claims getting lost or stuck in processing purgatory. Imagine the time and resources saved by avoiding claim resubmissions and inquiries!

Stronger relationships: By consistently meeting deadlines, you build trust and rapport with insurance companies. This can lead to smoother claim processing and potentially faster reimbursements in the future.

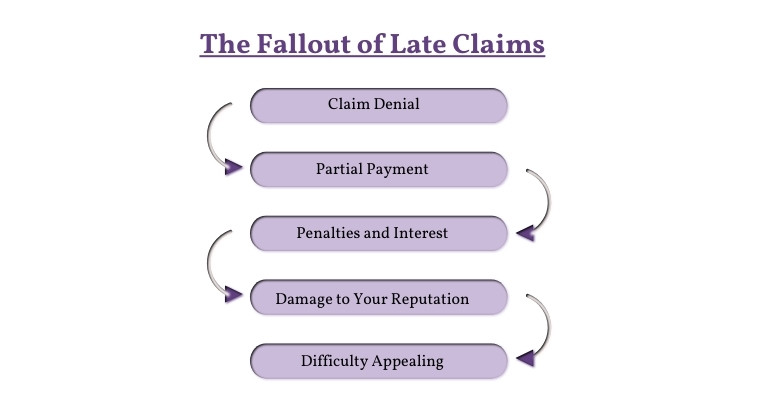

The Fallout of Late Claims

Filing your claim after the deadline can have several negative consequences:

1. Claim Denial:

This is the most significant risk. Insurance companies have strict deadlines for a reason, and missing them can lead to automatic denial. They may argue that the delay makes it difficult to verify the claim's validity or investigate potential fraud.

2. Partial Payment:

Even if your claim isn't completely denied, the insurer might only offer a partial payment. This could be due to missing information, incomplete documentation, or simply their policy for late claims.

3. Penalties and Interest:

Some insurance companies charge penalties for late filing, adding to your financial burden. Additionally, interest may accrue on the outstanding amount, further increasing your costs.

4. Damage to Your Reputation:

Consistently missing deadlines can damage your relationship with the insurance company. They may view you as unreliable or disorganized, potentially impacting future claims processing and reimbursement rates.

5. Difficulty Appealing:

If your claim is denied, appealing the decision becomes more challenging after a late filing. The insurance company may view it as an attempt to rectify your own mistake rather than a legitimate issue with the claim itself.

Timely Filing Limits of Insurance Payers

Filing claims within the correct deadline is crucial for both participating and non-participating providers.

Claim Filing Limits For Aetna

Aetna requires participating providers to submit claims electronically within 90 days from the date of service. However, exceptions exist for specific services with extended timeframes, so always double-check your contract and specific service guidelines.

For non-participating providers, Aetna's standard claim filing deadline is 180 days from the date of service.

BCBS Claim Filing Limit

Most states have a standard 1-year deadline for both participating and non-participating providers. Some states have extended timelines, ranging from 18 months to 2 years.

|

BCBS Payers |

Claim Filing Limit |

|

BCBS Alabama |

2 Years |

|

BCBS Arkansas |

180 Days |

|

BCBS Idaho |

180 Days |

|

BCBS Kansas |

12 Months |

|

Blue Cross Massachusetts |

90 Days |

|

BCBS Minnesota |

180 Days |

|

BCBS Montana |

180 Days |

|

BCBS Horizon |

180 Days |

|

BCBS Nex Mexico |

180 Days |

|

BCBS NY |

1 Year |

|

Independence BCBS |

120 Days |

|

BCBS Texas |

95 Days |

|

BCBS Tennessee |

120 Days |

|

BCBS Wyoming |

60 Days |

Cigna Timely Filing Limit

For consecutive services, such as hospital confinements, the claim filing deadline is counted from the last date of service. This means you have 90 days (participating) or 180 days (out-of-network) from the final service date to submit your claim.

Claim filing limits for EmblemHealth

Claim filing limits for EmblemHealth plans based on the plan type and provider type:

Commercial Plans:

-

Participating providers: 120 days after the date of service, unless otherwise specified in the participation agreement or self-funded plan provisions.

-

Non-participating providers: 18 months after the date of service.

Medicaid and Child Health Plus (CHPlus):

-

Participating providers: Refer to the applicable Managed Care Organization (MCO) contract for specific deadlines.

-

Non-participating providers: 15 months after the date of service.

Medicare Advantage:

-

Participating providers: Refer to the applicable Medicare Advantage contract for specific deadlines.

-

Non-participating providers: 365 days after the date of service.

Timely Claim Filing Limits for Medicare and Medicaid:

For Medicare, claims must generally be submitted within a year of the service date. Extensions are possible under certain conditions, like errors by Medicare staff or retroactive entitlements. Medicaid filing deadlines, on the other hand, are state-specific, ranging from 30 days to a year post-service. It's advisable to check with the relevant state agency for precise Medicaid deadlines.

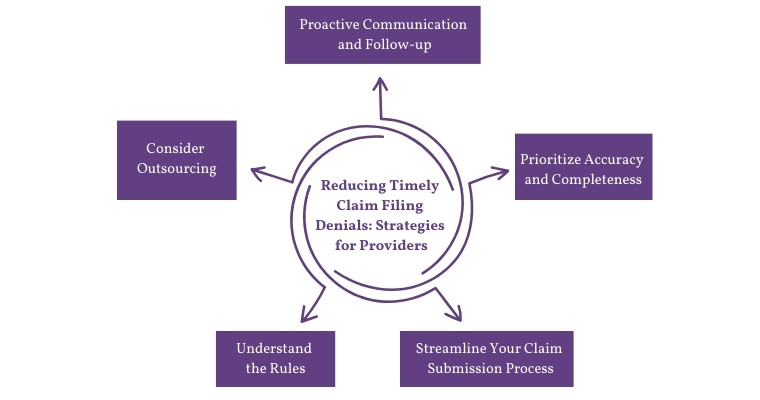

Reducing Late Claim Filing Denials: Strategies for Providers

Timely claim filing is crucial for healthcare providers to ensure reimbursement and maintain financial stability. Denials due to late submissions can be frustrating and costly, impacting both providers and patients. Here are some strategies providers can implement to reduce timely claim filing denials:

1. Understand the Rules:

-

Stay updated on payer-specific deadlines: Different insurance companies have varying filing deadlines. Regularly check and maintain a list of timeframes for different payers you cater to.

-

Know the exceptions: Understand situations where deadlines might be extended, like retroactive insurance eligibility or errors by payers.

2. Streamline Your Claim Submission Process:

-

Invest in efficient billing software: Utilize technology that automates claim creation, coding, and submission, minimizing manual errors and delays.

-

Standardize processes: Establish clear and consistent protocols for claim preparation, review, and submission across your team.

-

Implement internal deadlines: Set internal deadlines for claim submission well before external deadlines to allow buffer time for corrections or clarifications.

3. Prioritize Accuracy and Completeness:

-

Train staff on proper coding and documentation: Ensure your team adheres to accurate coding practices and thoroughly documents all services provided.

-

Double-check claims before submission: Implement a rigorous review process to catch missing information or potential errors before submitting claims.

-

Utilize electronic attachments: Use secure electronic attachments for supporting documentation instead of paper mail whenever possible to expedite processing.

4. Proactive Communication and Follow-up:

-

Verify patient insurance information: Confirm patient insurance eligibility and update information promptly to avoid delays from incorrect verification.

-

Communicate effectively with payers: Establish clear communication channels with payers to proactively address any claim rejections or inquiries.

-

Track denied claims: Monitor denied claims, identify patterns, and understand reasons for denials to implement corrective actions.

5. Consider Outsourcing:

-

Partner with a reliable billing service: Outsourcing medical billing tasks to experienced professionals can ensure timely and accurate claim submission, particularly for larger practices.

-

Seek legal assistance: If facing persistent denials with unclear reasons, consider legal counsel specializing in healthcare reimbursement to navigate complex situations.

Final words

Understanding and adhering to timely claim filing limits is essential for healthcare providers to maintain financial stability and ensure proper reimbursement from insurance companies. By following the strategies mentioned above, providers can streamline their claim submission process and reduce denials due to late submissions, ultimately improving revenue cycles and patient satisfaction.

It's crucial for providers to stay updated on payer-specific deadlines and exceptions, utilize efficient technology and standardized processes, prioritize accuracy and completeness in claims, maintain proactive communication with payers, and consider outsourcing for larger practices. By taking these measures, providers can ensure timely claim filing and avoid unnecessary delays and denials.

ABOUT AUTHOR

Neil Wagner

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.