Your practice's financial stability relies on accurate and timely reimbursement. Underpaid claims chip away at your revenue, creating a financial drain. If you suspect your practice isn't receiving full compensation for its services, it's time to take a closer look.

In this blog, we'll uncover the red flags of underpayment and provide strategies for protecting your practice's hard-earned income.

What are underpaid claims in medical billing?

An underpaid claim occurs when a healthcare provider receives less money from an insurance company than the amount they were contractually entitled to for the services they provided.

Let’s get the idea in simpler terms, Let’s say You have an agreement with the insurance company. It's like a contract that says, "If you provide this specific medical service, we'll pay you this amount of money You do your part – you provide the medical service to the patient.

It's time for the insurance company to pay up. But they sent you less money than what is in your "contract." This is an underpaid claim.

It's not that they refuse to pay anything (that would be a denied claim). They pay something, but it's not the full amount you deserve.

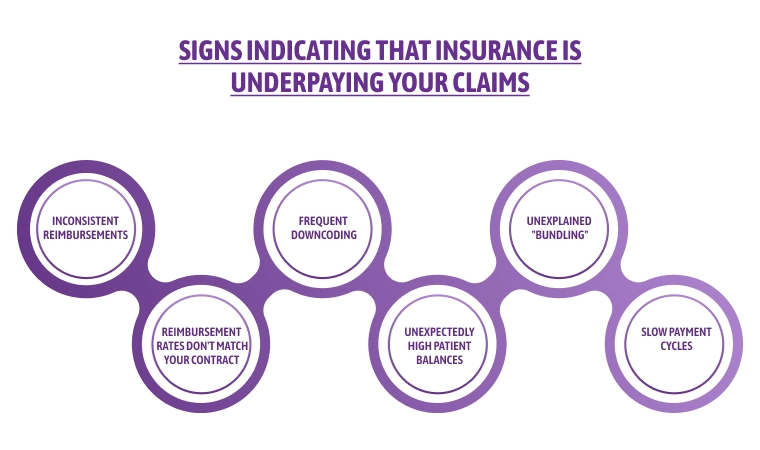

Watchful Signs Indicating that Insurance Is Underpaying Your Claims

So, you may now question yourself about what should be the red flags that are going to indicate that insurance companies are underpaying you.

Red Flags to Watch Out For

Inconsistent Reimbursements: If you notice varying payment amounts for the same procedures, even when patient insurance plans are similar, something might be amiss.his is like getting paid differently for the same amount of work.

Imagine you always charge $100 for a specific office visit. But for some patients with similar insurance plans, the insurance company reimburses you $80, while for others they pay the full $100. This inconsistency could signal errors or attempts by the insurer to downcode your services.

Frequent Downcoding: Downcoding happens when the insurance company decides your service wasn't as complex as you billed it to be. They then pay you based on a lower code, meaning less money. Keep an eye on your Explanation of Benefits (EOBs) to see if specific procedures are frequently getting downcoded.

Unexplained "Bundling": Bundling is when the insurance company groups multiple services you provided into a single payment code. This can be legitimate, but sometimes, they might bundle too many things together, resulting in a lower overall reimbursement than if billed separately.

Reimbursement Rates Don't Match Your Contract: Remember that contract you negotiated with each insurance company? It outlines the specific amount they agreed to pay for your services. If the reimbursements you're receiving consistently fall short of those contracted rates, it's a red flag.

Unexpectedly High Patient Balances: Ideally, after insurance pays its share, the remaining patient responsibility (copay, coinsurance, or deductible) should be predictable. However, if patients are consistently surprised by much higher bills than expected, it could be because your claims are being underpaid, leaving them with a bigger chunk of the cost.

Slow Payment Cycles: While some delays are normal in insurance billing, be wary of a consistent pattern of unusually slow payments. The insurer could be using this tactic to hold onto your money for longer or discourage you from following up on claims.

Are Claim Denials a Form of Insurance Underpayment?

Claim denials and insurance underpayments are both obstacles in the medical billing process, but they are distinctly different.

A claim denial means the insurance company refuses to provide any reimbursement for the service rendered. This could be due to errors in the submitted claim, the service not being covered by the patient's insurance plan or missing pre-authorization.

On the other hand, an insurance underpayment occurs when the insurance company pays some amount, but it falls short of the full contracted rate for the service provided. This can stem from issues with fee schedules, downcoding, or simply miscalculations within the insurance company's system.

|

Features |

Claim Denial |

Insurance Underpayments |

|

Payment Received |

No payment at all |

Partial payment, but less than the correct amount |

|

Common Reasons |

Billing errors, non-covered service, missing documentation |

Contractual disputes, coding issues, calculation errors |

|

Resolution |

Correct errors and resubmit the claim |

File an appeal with supporting documentation |

Impact of Underpaid Insurance Claims On Providers & Patient Care

The persistent problem of underpaid insurance claims has a ripple effect throughout the healthcare system. This hidden drain on resources creates challenges for both providers and ultimately impacts the quality of patient care.

Financial Burden of Underpaid Claims On Providers

Running a healthcare practice is a costly endeavor. Doctors, clinics, and hospitals deserve to be fairly paid for their essential services. Unfortunately, insurance underpayments are a pervasive problem that puts a heavy financial burden on providers.

Medicare and Medicaid play a huge role in healthcare reimbursement, yet studies show that 7-11% of claims from these government programs – and from commercial insurers – are underpaid. This might not seem like much, but it adds up quickly.

The numbers are staggering:

-

The American Hospital Association reports that in 2020, hospitals lost over $100 billion due to Medicare and Medicaid underpayments.

-

The American Medical Association estimates that private insurers contributed another $17 billion in unpaid or underpaid claims.

This massive loss of revenue is a major concern when healthcare costs are already sky-high. Underpaid claims squeeze the budgets of healthcare providers, making it harder for them to invest in staff, technology, and provide the best possible patient care.

Consequences of payment variance (specifically underpayments) on healthcare providers:

-

Each underpaid claim represents money that the provider is rightfully owed but doesn't receive. This directly cuts into their income.

-

Delayed or inconsistent reimbursements make it hard to plan budgets, pay staff, and cover practice expenses on time.

-

Identifying, appealing, and resubmitting underpaid claims takes time and resources. This can mean hiring more billing staff or diverting existing staff from other important tasks.

Patient Dissatisfaction Due To Underpaid Claims

Underpaid claims might seem like a problem that only impacts healthcare providers, but the consequences often trickle down to patients in the form of dissatisfaction and unexpected financial burdens. Here's how:

-

Surprise Medical Bills: When an insurance company underpays a claim, the remaining balance often gets shifted to the patient. Imagine expecting a small copay, only to receive a hefty bill months later for a service you thought was mostly covered. This leads to frustration and confusion.

-

Billing Disputes: Patients might get caught in the middle when providers and insurance companies dispute the amounts owed. Conflicting information between the provider's statement and the insurance Explanation of Benefits (EOB) can leave patients unsure of who is responsible. This adds an unnecessary layer of stress to an already complex medical billing system.

-

Strained Provider-Patient Relationship: Patients may perceive the billing issues as originating from the provider's office – even though the insurance company caused the underpayment. This can erode trust and make patients question the practice's billing practices.

-

Financial Hardship: Unexpected medical bills, especially if substantial, can create significant financial strain. This impacts patients' ability to pay for other necessities and can lead to damaging medical debt.

-

Delayed or Avoided Care: Fear of surprise bills or unresolved disputes can make patients hesitant to seek necessary follow-up care or delay getting treatment altogether. This puts their health at risk.

Proactive Steps to Prevent Insurance Underpayments

1. Know Your Contracts Inside and Out

-

Thoroughly Review: Take the time to meticulously understand the terms of each insurance contract you've signed. Pay close attention to agreed-upon reimbursement rates for different procedures and any specific billing requirements.

-

Stay Updated: Insurance contracts can change. Set up a system to ensure you're notified of updates or fee schedule revisions to avoid discrepancies.

2. Meticulous Coding and Documentation

-

Accuracy is Key: Incorrect CPT or ICD-10 codes are major contributors to underpayments and denials. Invest in ongoing training for your coding staff, and consider using coding software to minimize errors.

-

Detailed Notes: Clear and comprehensive medical records support the codes billed and justify the services provided. This helps with appeals if underpayments occur.

3. Verify Patient Insurance Eligibility and Coverage

-

Before Service: Check a patient's insurance coverage ahead of scheduled appointments. This prevents surprises and confirms what services are covered under their plan.

-

Obtain Pre-authorizations: Secure any necessary pre-authorizations required for specific procedures or treatments to avoid payment delays or denials.

4. Embrace Technology

-

Billing Software: Invest in reliable billing software that can automate many tasks, flag potential errors, and streamline the submission process.

-

Claims Scrubbing: Many systems offer "claims scrubbing" features to catch coding inconsistencies or billing mistakes before claims go out, reducing rejections and underpayments.

5. Stay Vigilant with Payment Tracking and Reconciliation

-

Scrutinize EOBs: Carefully examine each Explanation of Benefits (EOB) to match them against your submitted claims. Look for patterns in underpayments, such as specific codes or procedures.

-

Track Trends: Maintain detailed records of underpayments, noting codes, dates, amounts, and the insurer involved. This data helps you address systemic issues and negotiate better rates.

6. Advocate for Fair Reimbursement

-

Don't Be Afraid to Appeal: If you believe a claim was unfairly underpaid, file an appeal with clear documentation supporting your claim's value.

-

Negotiate: Armed with underpayment data, you may be able to renegotiate contracts with insurers who consistently underpay for your services.

Remember: Prevention is always better than trying to chase down underpayments later. By proactively implementing these strategies, you'll significantly improve your chances of receiving accurate and timely reimbursement for the care you provide.

How Can HMS USA LLC Help You Manage Your Insurance Underpaid Claims?

Dealing with underpaid insurance claims is a time-consuming and frustrating headache for any healthcare provider. HMS USA LLC can be your partner in handling this complex territory and maximizing your reimbursements.

Instead of letting underpayments drain your resources and jeopardize your practice's financial health, use our specialized expertise. Our team offers comprehensive solutions, including meticulous claim analysis to uncover underpayments, streamlined appeals processes with supporting documentation, and even contract negotiations to secure fairer reimbursement rates.

By outsourcing this complex task to HMS USA LLC, you can regain valuable time and focus on what matters most – providing excellent patient care while safeguarding your practice's financial well-being.

ABOUT AUTHOR

John Wick

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.