Getting a denial on a medical billing statement can be confusing and stressful. If you are a healthcare provider and after giving care to your patient, you receive a denial, you may develop a feeling of frustration. It's like seeing a patient's vital signs flat line, and when that denial code reads CO-45, you may feel like you're stuck in a medical mystery.

Worry not this is a common case to solve, All you need to do is just stay around the corner and we will help you to crack the case of CO 45 denial code in the world of medical billing.

What Is CO 45 Denial Code?

CO 45 denial code occurs when the physical billed amount exceeds the allowed amount. This is usually because the insurance company has determined that the provider charged more than is considered reasonable and customary for that particular procedure in a given geographic area.

Claim Adjustment Reason Code

Denial CO 45 is considered a part of the Claim Adjustment Reason code (CARC).CARC codes are a critical component of the claims adjudication process in healthcare. These codes serve to inform providers of the specific rationale for payment adjustments and discrepancies between the billed amount and the actual payment made.

What Does the Term CO Means?

In medical billing, the term "CO" is an abbreviation for "Contractual Obligation." CO codes are used to identify instances where a healthcare claim has been denied or adjusted based on a contractual agreement between the healthcare provider and the insurance company or other payer.

These contractual agreements can relate to things like the maximum allowable fee for a particular service, specific coverage criteria or exclusions, and other terms and conditions that apply to the payment of healthcare claims.

CO codes are just one type of denial or adjustment code used in medical billing, and they serve as an important way for healthcare providers and insurance companies to communicate about the payment of healthcare claims and ensure that they are in compliance with their contractual obligations.

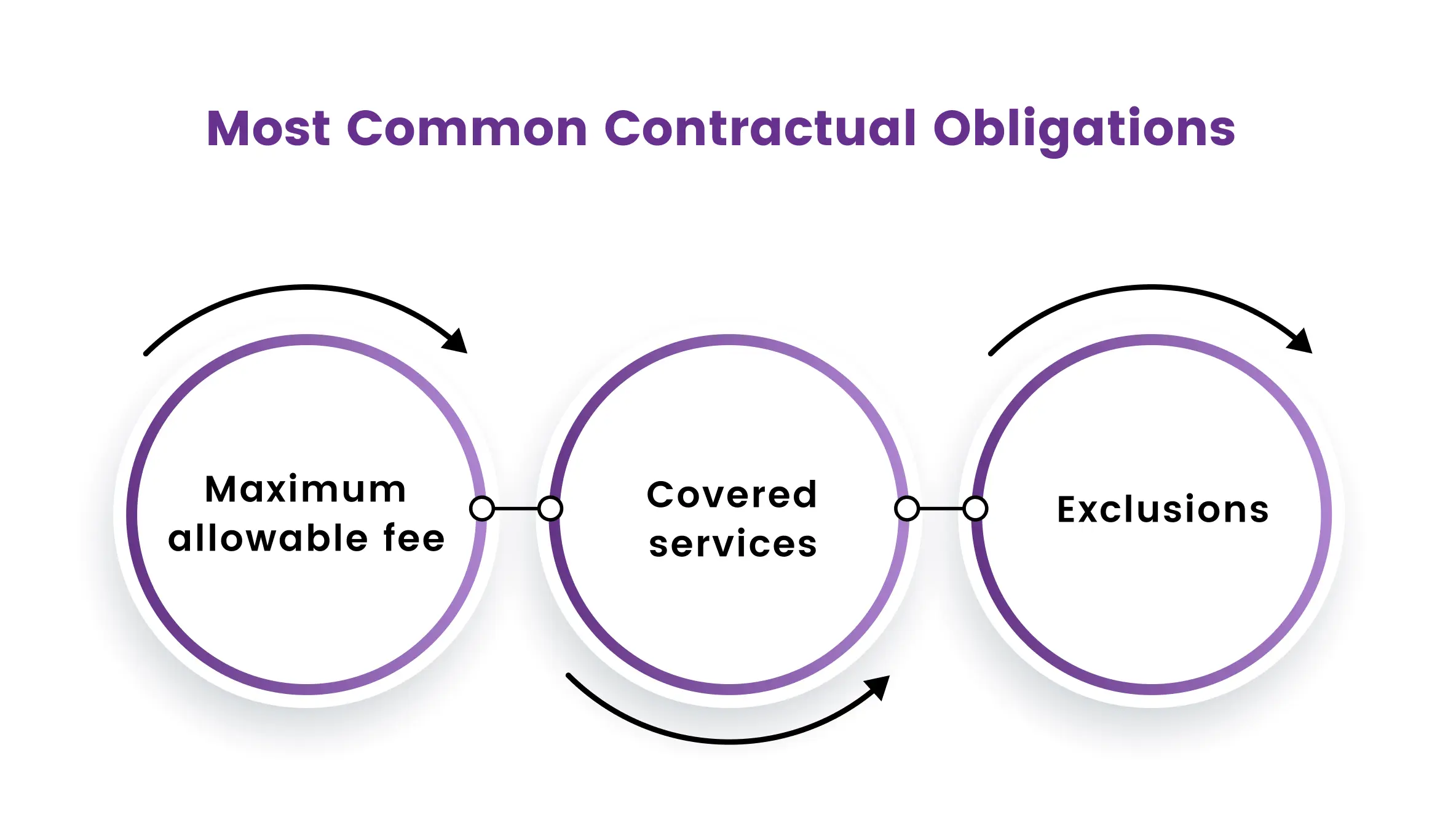

Most Common Contractual Obligations

There are several common contractual obligations that may lead to the use of CO codes in medical billing. Here are a few examples:

- Maximum allowable fee: Many insurance companies and other payers have a maximum allowable fee that they will pay for a particular service. If a healthcare provider charges more than this maximum fee, the claim may be denied or adjusted with a CO code.

- Covered services: Insurance companies often have specific criteria for which services they will cover and under what circumstances. If a service does not meet these criteria, the claim may be denied or adjusted with a CO code.

- Exclusions: Insurance companies may also have specific exclusions for certain services or conditions that are not covered under their policies. If a healthcare provider submits a claim for a service or condition that is excluded, the claim may be denied or adjusted with a CO code.

Example Cases When Co-45 Denial is Posted

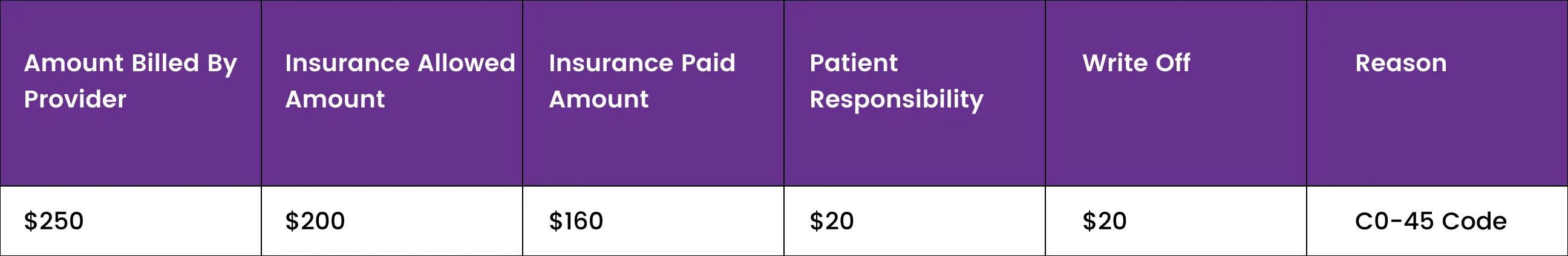

Case1

A healthcare provider bills an insurance company for a service with a fee of $250. The insurance company's maximum allowable fee for that service is $200, and they have a contracted fee arrangement with the healthcare provider for $180.

The insurance company pays $160 according to their contracted fee arrangement and $20 is sent as patient responsibility write-offs of $20 with a CO-45 code. The write-off amount is $40, and the healthcare provider bills the patient or secondary insurance for the remaining $20.

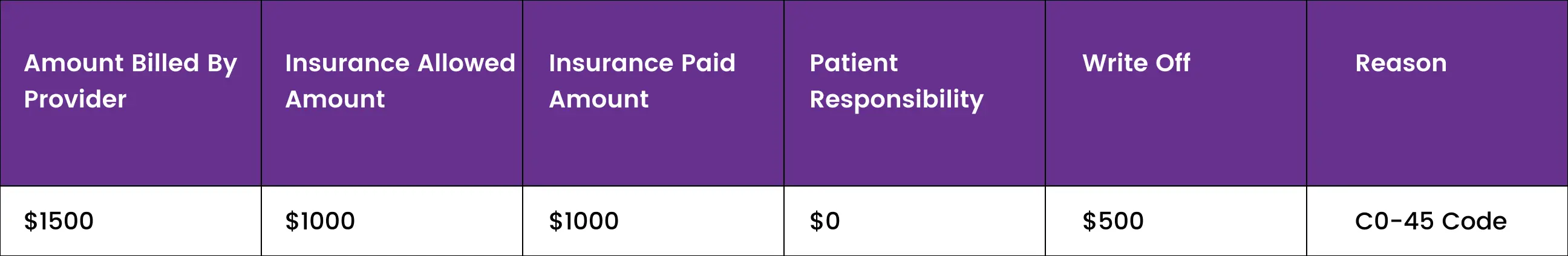

Case2

Suppose provider A and insurance company B agreed on a maximum of $1000 dollars for dental implant services but after services are rendered provider billed insurance for $1500. In this case insurance will send a C0-45 code and will write off the additional $500 would be a contractual obligation and would be written off as provider responsibility. The patient can’t be billed for this procedure.

How to Avoid CO-45 Denials

To overcome CO-45 denial, healthcare providers should take the following steps:

- Review the Explanation of Benefits (EOB) statement from the insurance company to understand the reason for the denial and the amount of the write-off.

- Check the contractual agreement with the insurance company to ensure that the billed amount is within the allowed amount.

- If the billed amount is not within the allowed amount, review the fee schedule for the particular procedure in the geographic area to ensure that the fee charged is reasonable and customary.

- If the fee charged is within the reasonable and customary range, contact the insurance company to discuss the denial and request a reconsideration of the claim.

- Provide documentation to support the fee charged, such as a fee schedule, invoice, or medical records.

- If the insurance company still denies the claim, healthcare providers can file an appeal or dispute resolution request.

Final Words

In conclusion, the CO-45 denial code is one of the most common denial codes used in medical billing. It occurs when the physical billed amount exceeds the allowed amount, usually due to a contractual obligation between the healthcare provider and the insurance company or other payer. Healthcare providers need to understand the contractual agreements and criteria for payment of healthcare claims to avoid CO-45 denial.

If you are struggling and feeling confused about what to do when you run into a CO-45 Denial Code it is better to seek help from a professional medical billing company, with our expertise and guidance, we will work with you to minimize CO-45 denials and ensure that your claims are processed accurately.

ABOUT AUTHOR

Grant Elliot

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.