Have you ever received a question from a Medicare patient about an Advance Beneficiary Notice (ABN)? ABNs can be a source of confusion for both patients and providers. As a healthcare professional, understanding when and how to utilize ABNs is crucial. This blog will equip you with knowledge about ABNs. We'll explore scenarios requiring ABNs, proper form completion, and clear communication practices to ensure informed patient consent.

What is an Advance Beneficiary Notice (ABN)?

An Advance Beneficiary Notice (ABN) is a written notification from a healthcare provider to a Medicare beneficiary (patient) regarding potential coverage limitations for a specific service or item.

In simpler terms, it's a heads-up that Medicare might not pay for the service you're about to receive, and you could be on the hook for the cost.

There are a few key points to remember about ABNs:

-

They apply to Original Medicare only: If the patient has a Medicare Advantage Plan (like HMO or PPO), ABNs typically don't come into play. These plans handle coverage decisions directly with providers.

-

They inform, not guarantee: An ABN doesn't guarantee Medicare will deny coverage. It simply informs you of the possibility and your potential financial responsibility. Medicare will still review the claim.

-

They empower your decisions: By signing an ABN, the Patient acknowledges the potential lack of coverage and agrees to potentially pay for the service. This allows you to make an informed choice about whether to proceed with the service.

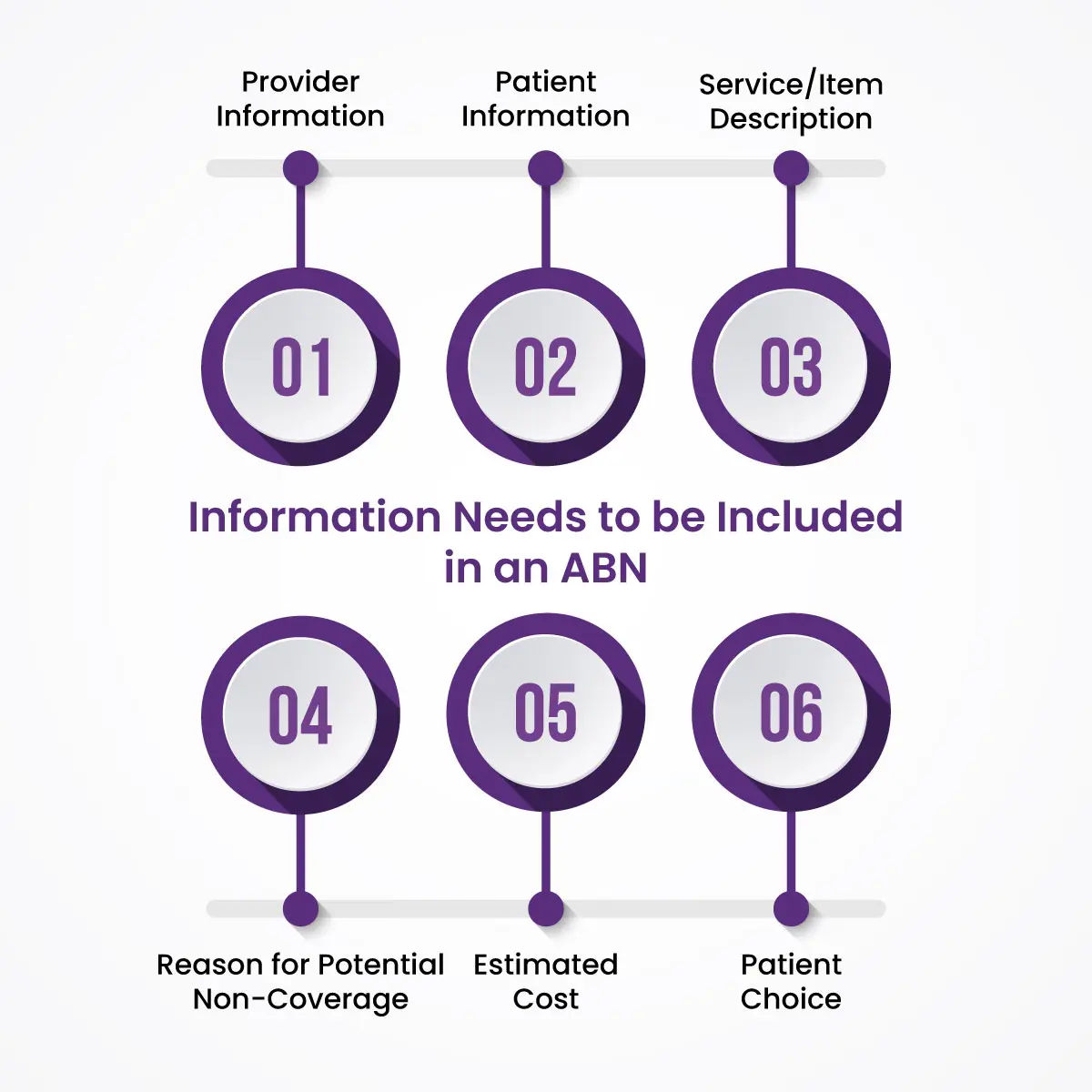

What Information Needs to be Included in an ABN?

A properly completed ABN is crucial for both patient understanding and ensuring your claim isn't denied. Here's a breakdown of the essential information an ABN should contain:

-

Provider Information: This includes your practice name, address, and phone number.

-

Patient Information: The beneficiary's full name, Medicare ID number (if available), and contact information are necessary.

-

Service/Item Description: Clearly identify the specific service or item for which coverage may be limited.

-

Reason for Potential Non-Coverage: Briefly explain why Medicare may not cover the service. This could be due to various reasons like:

-

The service being experimental or investigational.

-

The service exceeding the Medicare-approved frequency limits.

-

The service not being medically necessary.

-

-

Estimated Cost: Provide a good faith estimate of the patient's potential financial responsibility if Medicare denies coverage.

-

Patient Choice: The ABN should clearly state the patient's options:

-

Decline the service if they're unwilling to pay the potential cost.

-

Sign the ABN, acknowledging potential non-coverage and financial responsibility.

-

The Vital Role of ABNs in Medical Billing

Advance Beneficiary Notices (ABNs) play a critical role in medical billing for healthcare providers working with Medicare patients. They serve two primary purposes:

1. Protecting Your Practice from Financial Loss:

Imagine a scenario where you provide a service to a Medicare patient, only to have the claim denied later because the service wasn't covered. Without an ABN, you'd be left footing the bill. ABNs help mitigate this risk by informing the patient upfront about the potential for non-coverage and their potential financial responsibility. A signed ABN strengthens your position if Medicare denies the claim, as it demonstrates informed patient consent.

2. Promoting Patient Understanding and Informed Consent:

Transparency is key in any healthcare setting. ABNs ensure Medicare patients understand the potential cost implications of a service before they receive it. This empowers them to make informed decisions about their care. By signing the ABN, they acknowledge the potential lack of coverage and agree to pay potentially. This clear communication fosters trust and reduces the likelihood of billing disputes later.

ABNs also contribute to a smoother billing process:

-

Reduced Claim Denials: By proactively addressing potential coverage concerns, you can minimize claim denials due to lack of patient knowledge or missing information.

-

Improved Revenue Cycle: Fewer denials translate to faster reimbursements and a more efficient revenue cycle for your practice.

-

Enhanced Patient Relationships: Clear communication through ABNs builds trust and fosters positive patient relationships.

When Should An ABN Be Signed By Healthcare Providers?

Understanding the appropriate situations for using an ABN is crucial for healthcare providers. Here are some key scenarios where an ABN is recommended:

-

Services Exceeding Medicare Coverage: If a service falls outside the scope of what Medicare typically covers (e.g., cosmetic surgery, experimental treatments), an ABN is necessary.

-

Services Requiring Prior Authorization: Certain services require Medicare pre-approval before coverage is granted. An ABN informs the patient of the potential for denial even with prior authorization.

-

Services Reaching Frequency Limits: Medicare often sets limits on how often a specific service can be performed within a given timeframe. An ABN is needed if the service exceeds these limitations.

-

Voluntary ABNs: Even for services typically covered by Medicare, you can use a voluntary ABN to inform the patient about potential cost-sharing charges (e.g., co-pays, deductibles) associated with the service.

Which Patient Would Most Likely Be Asked to Sign an Advance Beneficiary Notice?

An Advance Beneficiary Notice (ABN) is most likely presented to a Medicare beneficiary (patient) in the following situations.

-

ABNs are primarily used with Original Medicare (Parts A & B), where patients directly manage their healthcare costs. Those with Medicare Advantage Plans (like HMO or PPO) typically wouldn't encounter ABNs, as these plans handle coverage directly.

-

If a service falls outside the scope of what Medicare generally covers (e.g., cosmetic surgery, experimental treatments), an ABN is likely. Similarly, services exceeding frequency limits set by Medicare (e.g., multiple physical therapy sessions in a short period) may trigger an ABN.

-

Some services require pre-approval from Medicare before coverage is granted. In these cases, an ABN informs the patient of the potential for denial even with prior authorization.

How To Explain ABN To Patient?

Explaining an ABN to a patient requires clear and concise communication. Start by introducing the ABN. Briefly explain it's a document informing them about a service or item that Medicare might not cover.

Focus on the reason. Explain why Medicare might not cover the service. This could be because it's not typically covered (like cosmetic surgery), exceeds frequency limits (like multiple physical therapy sessions in a short time), or requires prior authorization that could be denied.

Clearly outline the patient's choices. They can either decline the service if they're not comfortable potentially paying for it, or they can sign the ABN acknowledging the potential lack of coverage and their financial responsibility if Medicare denies the claim.

Provide a good faith estimate of the potential cost they might incur if Medicare doesn't cover the service. Encourage the patient to ask any questions they may have about the ABN or the service itself.

ABNs and the Appeals

While signing an ABN acknowledges the patient's understanding of this possibility, it doesn't necessarily mean you have no recourse if the claim is denied. Even after signing an ABN, patients have the right to appeal a Medicare coverage denial. The ABN simply informs them of the potential for non-coverage, but the final decision rests with Medicare.

Understanding why Medicare denied your claim is crucial for a successful appeal. The reason for denial should be documented on the Medicare Explanation of Benefits (EOB) they receive. This could be due to various factors like:

-

Service deemed not medically necessary.

-

Service exceeding frequency limitations.

-

Procedural errors in billing.

To strengthen their appeal, patients should gather any documentation that supports the medical necessity of the service. This could include doctor's notes, test results, or referral letters. Medicare outlines a specific timeframe and process for filing appeals. Patients can typically initiate an appeal online, by mail, or by phone with Medicare.

Final words

In conclusion, understanding Advance Beneficiary Notices (ABNs) empowers both patients and healthcare providers. By utilizing ABNs effectively, healthcare providers can protect their practice from financial surprises and ensure patients are informed about potential cost implications. Patients, in turn, gain valuable transparency into their healthcare costs and can make informed decisions about their care. Remember, ABNs are a communication tool, not a barrier to care

ABOUT AUTHOR

John Whick

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.