If you've ever received a medical bill, you may have noticed a small deduction marked "sequestration." This often confusing term refers to automatic government budget cuts that directly affect how much your doctor gets paid by Medicare. But what exactly is sequestration, and is it still happening? In this blog, we'll break it all down.

What is Sequestration In Medical Billing?

The word "sequestration" generally means to isolate or set apart. In the world of government spending, sequestration refers to automatic, across-the-board budget cuts. In the case of medical billing, sequestration specifically targets Medicare payments.

Sequestration in Medicare stems from the Budget Control Act of 2011. This law aimed to reduce the United States' national deficit. The law mandated that if Congress couldn't agree on a budget plan, automatic spending cuts would go into effect. This included a 2% reduction in Medicare payments to healthcare providers.

Which Medicare Claims Face Sequestration?

The sequestration reduction applies to the vast majority of claims submitted to Medicare Fee-For-Service (FFS). This includes physician services, hospital visits, outpatient care, medical equipment, and more.

There are a few very specific situations where sequestration might not apply. These include some Medicare Advantage plans and cases related to critical care hospitals. Even if you pay a deductible or coinsurance, these patient responsibility amounts are not subject to sequestration. The reduction only applies to the amount Medicare pays the provider.

How to Identify Sequestration on a Claim

Providers need to be vigilant in identifying the impact of sequestration on their Medicare reimbursements When submitting claims for services subject to sequestration; providers must include Claim Adjustment Reason Code (CARC) 253. This code specifically designates sequestration reduction in federal payment.

Using CARC 253 and verifying it on the RA ensures the reduction is attributed to the correct reason. This maintains transparency in billing and accounting for both Medicare and the provider.

How to Calculate Sequestration Reductions In Medical Billing

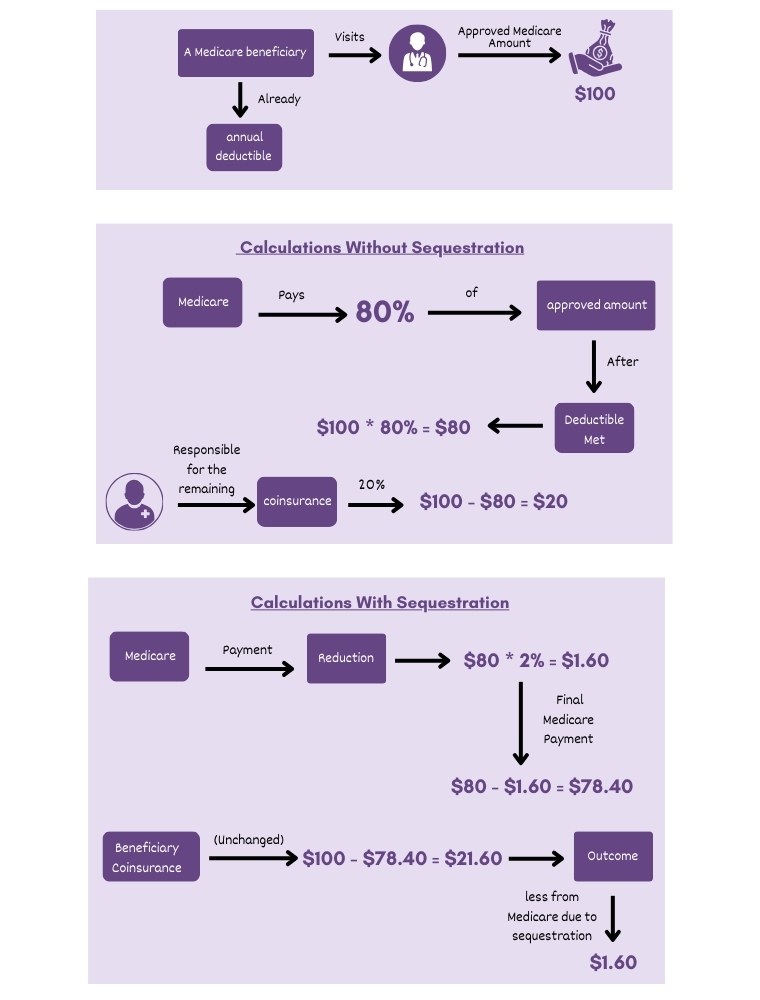

Start with the Medicare-approved amount for the specific service provided. This is the amount Medicare has determined appropriate reimbursement before any reductions or coinsurance are applied. The current sequestration rate is 2%. Multiply the Medicare-approved amount by the sequestration percentage (as a decimal).

Let’s have a better understanding of how sequestration reduction is calculated

Example:

-

Service: Office visit with a Medicare-approved amount of $120.

-

Sequestration Rate: 2% (or 0.02 as a decimal).

Calculation

-

$120 (approved amount) * 0.02 (sequestration rate) = $2.40 (sequestration reduction)

Effect on Reimbursement

-

Original Medicare Payment (without sequestration): $120 * 80% = $96 (assuming the patient's deductible has been met)

-

Medicare Payment After Sequestration: $96 - $2.40 = $93.60.

-

The provider receives $2.40 less due to sequestration.

Current Status of Sequestration?

The 2% Medicare sequestration reduction is currently in effect. It resumed on July 1st, 2022, after several temporary suspensions due to the COVID-19 pandemic. Medicare Fee-for-Service claims continue to be reduced by 2% after any other payment calculations, impacting both provider reimbursement and potentially increasing patient out-of-pocket costs.

Organizations like the American Hospital Association (AHA) and others are actively lobbying Congress to provide further relief from sequestration cuts or eliminate them entirely.

There are two key pieces of legislation that could change the future status of sequestration:

Potential Sequestration from PAYGO: The Statutory Pay-As-You-Go (PAYGO) Act of 2010 requires automatic spending cuts if certain budget thresholds are exceeded. This could trigger sequestration for some mandatory spending programs. It's uncertain if these cuts will occur and what that would mean specifically for Medicare.

Possible Legislative Changes: Congress could pass new laws to modify, suspend, or eliminate sequestration. It's a complex political issue.

ABOUT AUTHOR

John Wick

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.