Missed deadlines, claims crossing fiscal years, or misunderstood filing limits can lead to claim rejections, disrupting cash flow and adding unnecessary complexity to an already challenging revenue cycle. One of the most common denials that many healthcare providers often encounter, even after submitting the claim within the deadline, is the CO-29 denial code.

Whether it’s a single day past the deadline or claims spanning multiple fiscal years, the impact of these denials can ripple through your entire practice, often catching providers off guard when it’s too late to act. And yet, these rejections are more preventable than many realize.

In this blog, we’ll take a fresh look at what CO 29 denials mean, exploring how time-sensitive claims are processed, why they matter, and how to avoid the costly pitfalls of missed filing deadlines. Ready to break the cycle? Let’s dive in.

What is the CO 29 Denial Code?

The CO 29 denial code is triggered when a healthcare claim is submitted after the allowed filing timeframe. Practically, it means that the claim was filed too late, beyond the insurance payer's specified limits for submission.

For most payers, this timeframe is typically 365 days from the date of service for original claims and up to 720 days for replacement claims. However, the code can also surface if there are fiscal year overlaps in the services billed or if filing limits are misunderstood.

Despite the service being rendered, the claim is denied simply because the submission fell outside of the acceptable window.

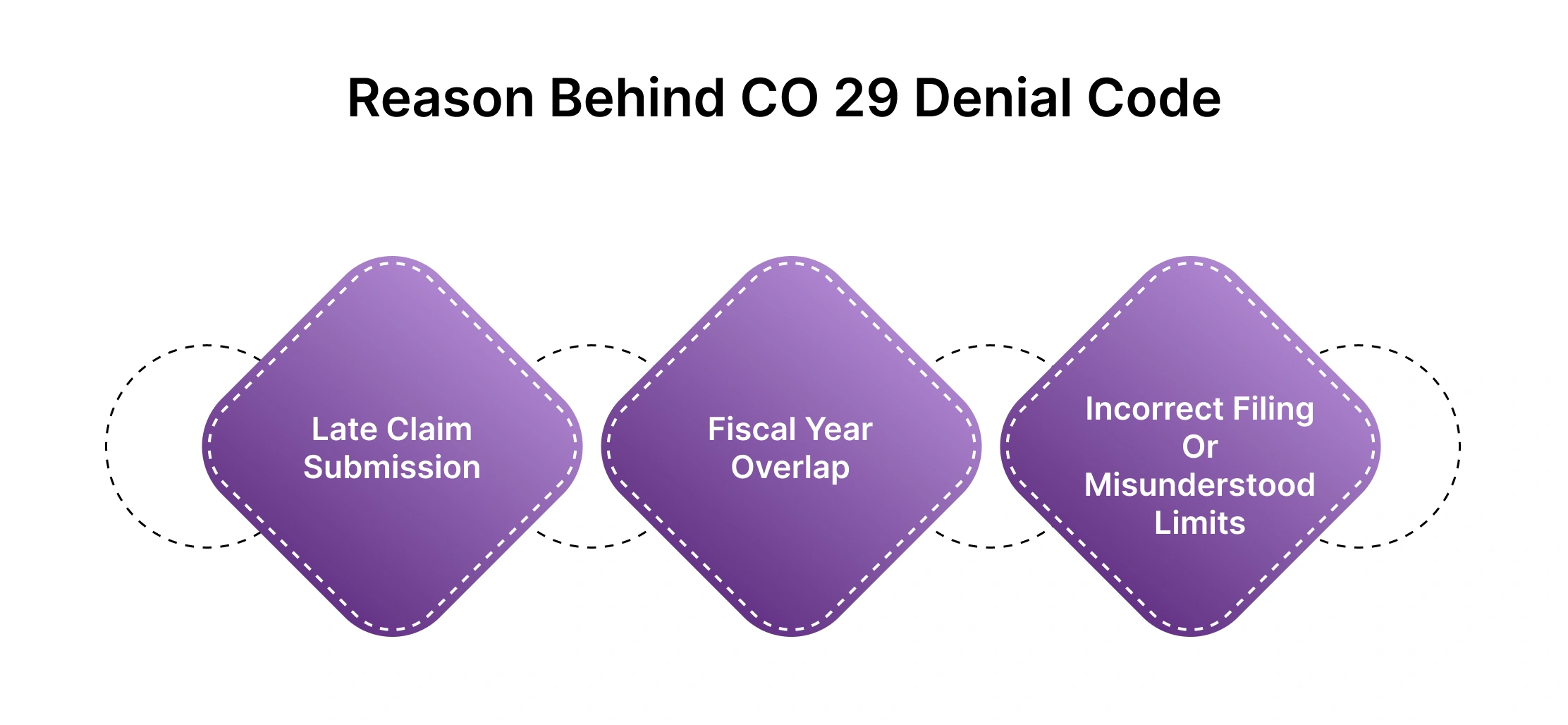

Reason Behind CO 29 Denial Code

The CO 29 denial code arises primarily due to timing issues in claim submissions. Below are the common reasons behind this denial:

-

Late Claim Submission: The most frequent cause is submitting a claim after the payer’s allowed time limit, which is typically 365 days from the date of service for an original claim. For replacement or corrected claims, this limit extends to 720 days. If the claim is submitted beyond these deadlines, it’s automatically denied.

-

Fiscal Year Overlap: If the services provided in the claim span two different fiscal years (e.g., July 1st to June 30th), the payer may deny the claim. Most systems only allow claims for one fiscal year to be processed at a time.

-

Incorrect Filing or Misunderstood Limits: Providers may submit claims with an incorrect service date or overlook the payer's specific timeframes for filing, leading to a CO 29 denial. Misunderstanding the filing limits can also result in claims being rejected, even if the service was properly rendered.

Also Read: [https://hcmsus.com/blog/timely-insurance-claim-filing]

In all these cases, the underlying issue is that the claim wasn’t submitted according to the payer’s strict guidelines, resulting in denial despite the legitimacy of the services provided.

Don't let timely filing issues and confusing fee schedules slow you down. Let HMS take the burden off your shoulders. Talk to us today to see how we can help!

Fiscal Overlap Scenario

A fiscal year is a 12-month period used for accounting purposes, and it typically runs from July 1st to June 30th. In healthcare billing, a claim should be submitted for services that took place within the same fiscal year.

When a claim contains services from different fiscal years (e.g., some services provided before June 30th and others after July 1st), the claim will be denied or flagged.Only the services that fall within the current fiscal year will be processed. The services from the previous fiscal year will be separated out and denied.

Let’s Understand through an example

-

Let’s say you submit a claim on July 10, 2024, that includes services provided on both June 25, 2024 (last fiscal year) and July 5, 2024 (current fiscal year).

-

The services provided on June 25, 2024, are from the previous fiscal year (July 1, 2023 - June 30, 2024), while the services on July 5, 2024, are from the current fiscal year (July 1, 2024 - June 30, 2025).

-

Because the claim spans two fiscal years, the system will pend (hold) or deny the part of the claim related to the previous fiscal year (June 25) for manual review or denial.

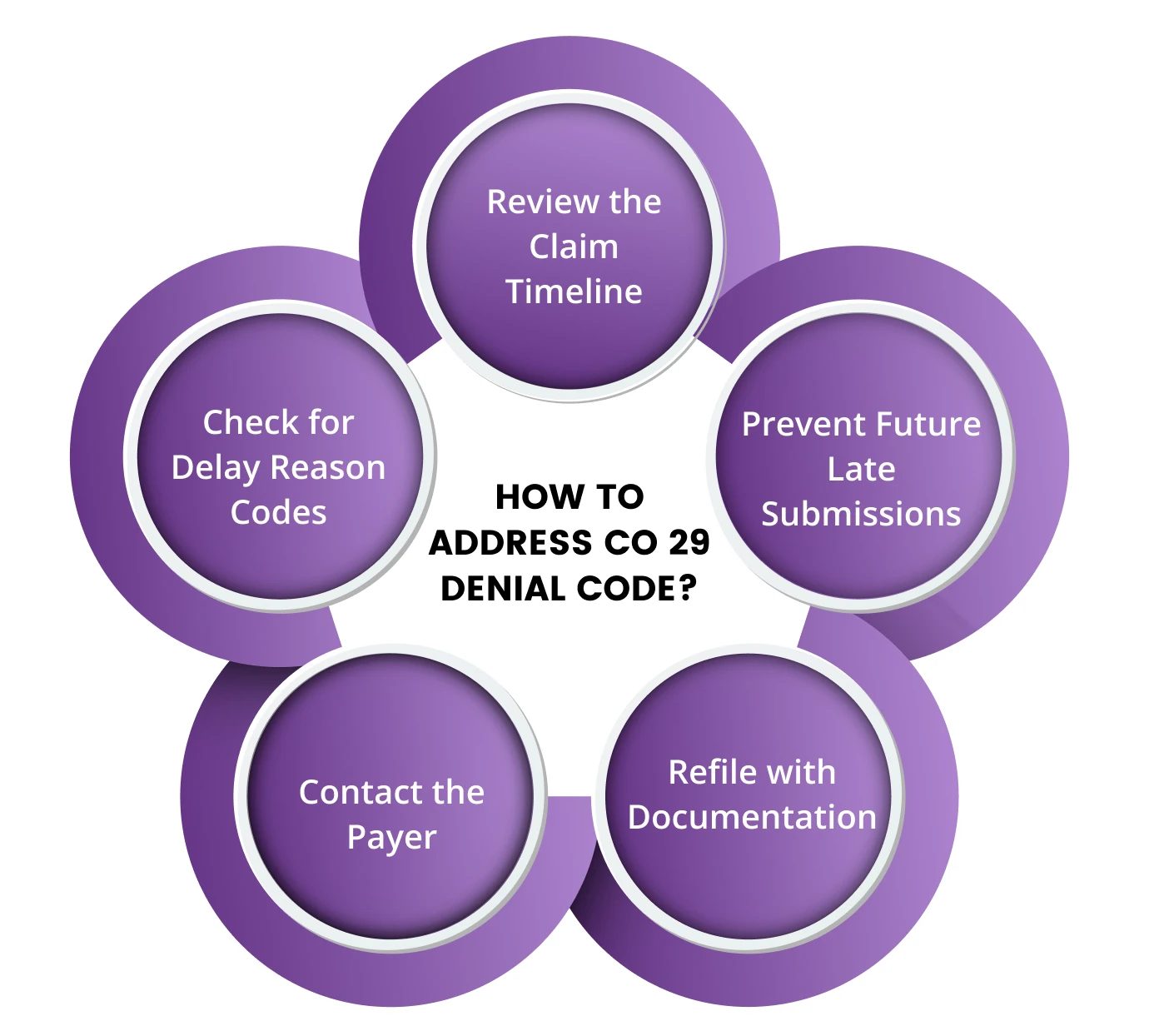

How to Address CO 29 Denial Code?

Dealing with a CO 29 denial code can be frustrating, but by understanding its causes and taking a systematic approach, providers can effectively resolve or even prevent these denials. Below are the best strategies for addressing CO 29 denials across different scenarios:

1. Missed Claim Submission Deadline

-

Cause: The claim was submitted after the payer’s time limit (typically 365 days for original claims or 720 days for replacement claims).

Solution:

-

Review the Claim Timeline: The first step is to verify the actual date of service and the date the claim was submitted. Check if it falls outside the payer’s filing window.

-

Check for Delay Reason Codes: Some payers allow claims beyond the deadline if a valid delay reason code is provided (e.g., system outage, natural disaster, etc.). If applicable, resubmit the claim with the appropriate delay reason.

-

Contact the Payer: If the delay was due to circumstances beyond your control (like an issue with the payer's portal or internal system failures), contact the payer’s customer service or provider relations team to request an exception.

-

Refile with Documentation: If a valid reason for the delay exists, resubmit the claim with supporting documentation showing why it was delayed. For example, correspondence with the payer, technical issues, or state/federal emergencies can be used to explain delays.

-

Prevent Future Late Submissions: To avoid future CO 29 denials, establish an internal tracking system that ensures claims are submitted well within the payer’s allowed time frame. Automated billing systems with alerts for upcoming deadlines can be helpful.

2. Fiscal Year Overlap

-

Cause: The claim contains services that span two different fiscal years, leading to a denial.

Solution:

-

Split the Claim by Fiscal Year: If the services in the claim cross from one fiscal year into another (e.g., some services rendered before June 30 and others after July 1), the claim must be separated into two parts. Submit each part in its respective fiscal year.

-

Resubmit the Denied Claim: Once the claim is split, resubmit the part that was denied under the appropriate fiscal year. This ensures that the payer processes each fiscal year's portion separately.

-

Avoid Future Overlaps: To prevent this issue from recurring, ensure that your claims submission process is configured to recognize fiscal year cut-offs. This may involve updating your billing software to automatically detect and warn you when a claim spans fiscal years.

3. Incorrect Date of Service or Data Entry Error

-

Cause: The date of service was entered incorrectly, causing the system to flag the claim as being outside of the allowed submission window.

Solution:

-

Verify the Date of Service: Double-check the date of service on the claim and compare it with the patient's records to ensure accuracy.

-

Correct and Resubmit: If you identify a typo or data entry error, correct the date of service and resubmit the claim. Make sure to add notes or documentation explaining the correction, if required by the payer.

-

Audit Claims Before Submission: Implement internal auditing procedures to review claims before they are submitted. Catching data entry errors early can save time and prevent unnecessary denials.

4. Replacement Claim Denied for Late Submission

-

Cause: A replacement or corrected claim was submitted beyond the allowable 720-day window from the original date of service.

Solution:

-

Confirm the Submission Timeframe: Verify whether the replacement claim was filed within the extended deadline of 720 days from the original date of service. If not, the claim will not be processed.

-

Appeal with Justification: If the late submission was caused by payer-related issues or delays in processing the original claim, you can submit an appeal. Include evidence of any communication with the payer, explanations for the delay, or proof of extenuating circumstances that led to the delay.

-

Expedite Future Replacement Claims: Ensure replacement claims are filed as soon as errors are identified. Don’t wait until the 720-day window is nearing expiration. This can be accomplished by creating a system to flag claims that need corrections early.

5. Payer Processing Delays

-

Cause: Sometimes, a claim might be denied due to delays in processing on the payer’s side, even though it was submitted on time.

Solution:

-

Monitor Submission and Receipt Dates: Always obtain and save electronic receipts or confirmations when submitting claims. If you have proof that the claim was submitted on time, use this documentation to appeal the denial.

-

Contact the Payer: Reach out to the payer if there is a delay in processing on their end. Provide proof of submission and ask for a re-evaluation of the claim.

-

Escalate When Necessary: If the payer doesn’t respond or doesn’t resolve the issue, escalate the case by contacting higher-level management at the payer or even your state insurance commissioner, if necessary.

6. Appeal Process for CO 29 Denials

-

Cause: The claim has been denied, but you believe it should be reimbursed.

Solution:

-

File an Appeal: Most payers allow for appeals when claims are denied. Prepare a formal appeal letter that includes all necessary documentation, including proof of timely submission, delay reason codes (if applicable), and any communication with the payer.

-

Submit Documentation: Include supporting documents such as the claim submission receipt, delay reason code, any payer correspondence, and a summary of the circumstances that led to the denial.

-

Follow Up: After submitting the appeal, follow up regularly to track its status. Appeals can take time, but regular follow-up can help keep the process moving.

Words by Author

CO 29 denials can disrupt your revenue cycle, but with the right approach, they are manageable and often preventable. By understanding the various causes of these denials and taking proactive steps—such as timely submission, splitting claims across fiscal years, or appealing with the proper documentation—you can minimize their impact. Implementing strong internal processes and staying up-to-date on payer rules will help your practice avoid future CO 29 denials and keep your claims flowing smoothly.

ABOUT AUTHOR

Khabib Makhachev

As a blog writer with years of experience in the healthcare industry, I have got what it takes to write well-researched content that adds value for the audience. I am a curious individual by nature, driven by passion and I translate that into my writings. I aspire to be among the leading content writers in the world.